- Spain

- /

- Electrical

- /

- BME:ART

Arteche Lantegi Elkartea And 2 Other Undiscovered European Gems For Your Portfolio

Reviewed by Simply Wall St

As European markets experience a positive shift, with the pan-European STOXX Europe 600 Index climbing 2.10% amid improved sentiment following a de-escalation in U.S.-China trade tensions, investors are increasingly looking toward small-cap opportunities that may benefit from these broader economic dynamics. In this environment, identifying stocks with strong fundamentals and growth potential can be particularly rewarding; Arteche Lantegi Elkartea and two other lesser-known European companies stand out as intriguing options for those seeking to diversify their portfolios.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| AB Traction | NA | 5.39% | 5.24% | ★★★★★★ |

| Martifer SGPS | 102.88% | -0.23% | 7.16% | ★★★★★★ |

| Linc | NA | 101.28% | 29.81% | ★★★★★★ |

| La Forestière Equatoriale | NA | -65.30% | 37.55% | ★★★★★★ |

| Intellego Technologies | 11.59% | 68.05% | 72.76% | ★★★★★★ |

| Flügger group | 20.98% | 3.24% | -29.82% | ★★★★★☆ |

| Dekpol | 70.15% | 14.02% | 14.57% | ★★★★★☆ |

| Alantra Partners | 3.79% | -3.99% | -23.83% | ★★★★★☆ |

| Evergent Investments | 5.59% | 5.88% | 16.36% | ★★★★☆☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Arteche Lantegi Elkartea (BME:ART)

Simply Wall St Value Rating: ★★★★★★

Overview: Arteche Lantegi Elkartea, S.A. specializes in the design, manufacture, integration, and supply of electrical equipment and solutions with a focus on renewable energies and smart grids both in Spain and internationally, with a market capitalization of approximately €518.55 million.

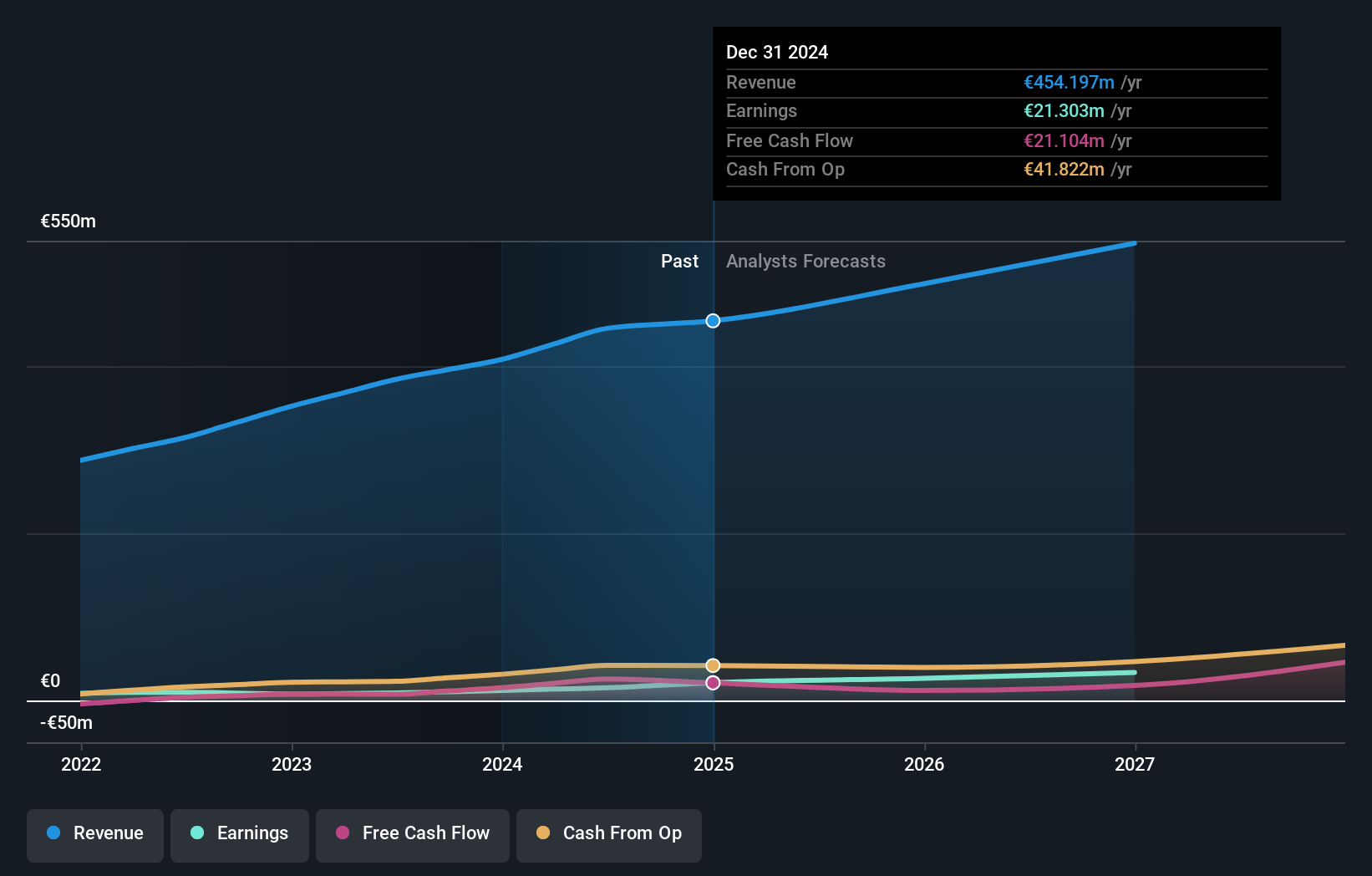

Operations: Arteche Lantegi Elkartea generates revenue primarily from three segments: Systems Measurement and Monitoring (€321.55 million), Automation of Transmission and Distribution Networks (€79.94 million), and Network Reliability (€45.92 million).

Arteche Lantegi Elkartea has demonstrated robust financial health, reducing its debt to equity ratio from 289.3% to 137.9% over five years, while the net debt to equity stands at a satisfactory 29.9%. Earnings surged by 76.6% last year, outpacing the electrical industry average of 7.4%, and are forecasted to grow at an annual rate of 22.62%. Trading at a discount of about 25% below estimated fair value, Arteche is well-positioned with high-quality earnings and strong interest coverage at 5.6x EBIT, suggesting solid future prospects in the electrical sector landscape.

Caisse Régionale de Crédit Agricole Mutuel Alpes Provence Société coopérative (ENXTPA:CRAP)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Caisse Régionale de Crédit Agricole Mutuel Alpes Provence Société coopérative operates as a provider of banking products and services in France, with a market capitalization of €692.10 million.

Operations: The company generates revenue primarily from its retail banking segment, amounting to €442.53 million.

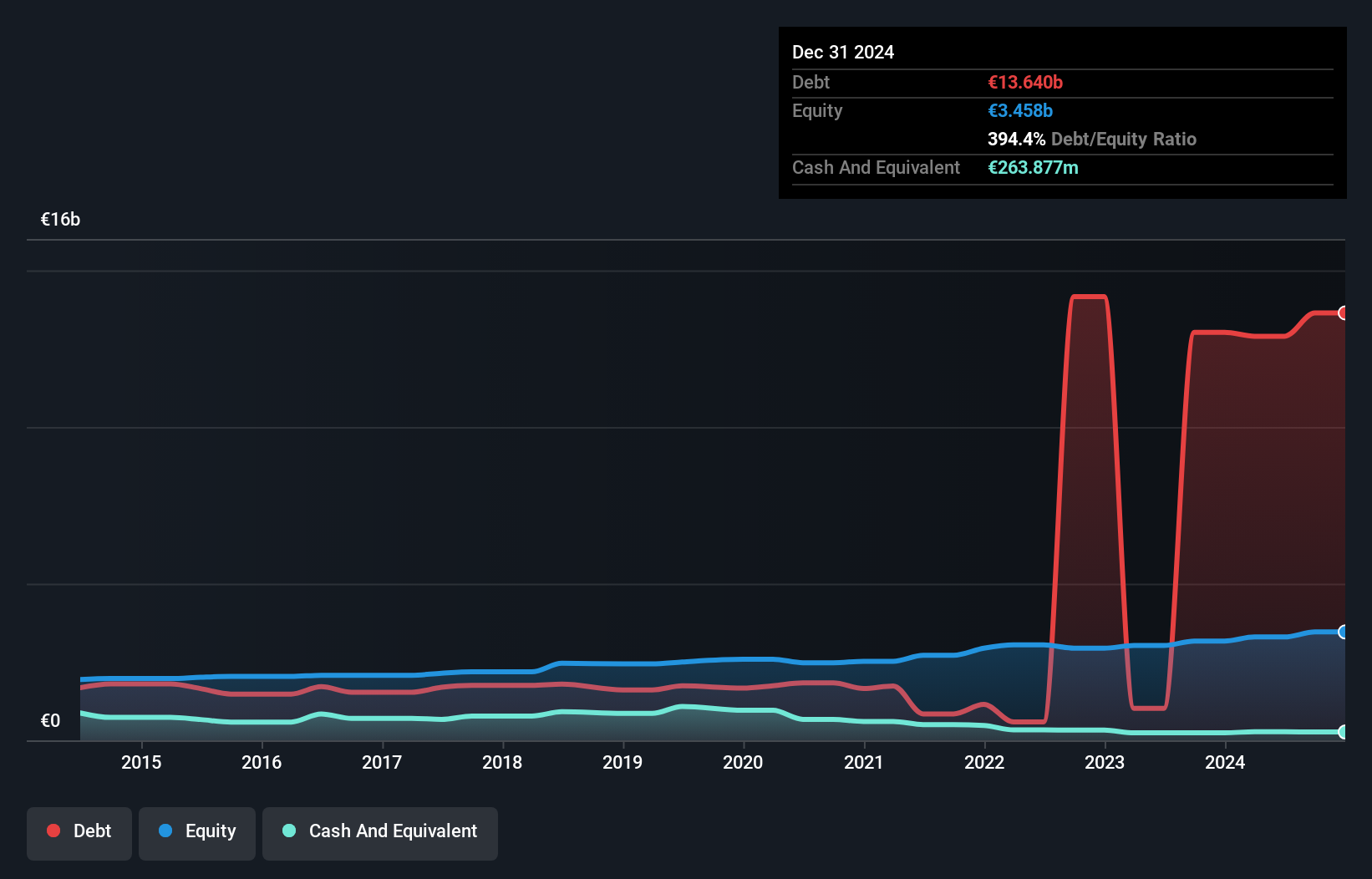

Caisse Régionale de Crédit Agricole Mutuel Alpes Provence, with total assets of €26.9 billion and equity of €3.5 billion, is trading at a significant discount to its estimated fair value by 54.9%. The bank has an appropriate level of bad loans at 1.5% and a sufficient allowance for these loans at 124%, indicating prudent risk management. Its earnings grew by 15.1% last year, outpacing the industry average of 3.2%. However, it's notable that 61% of its liabilities are sourced from higher-risk funding avenues, which could impact stability in volatile markets.

V-ZUG Holding (SWX:VZUG)

Simply Wall St Value Rating: ★★★★★★

Overview: V-ZUG Holding AG is a company that develops, manufactures, sells, and services kitchen and laundry appliances for private households across Switzerland and internationally, with a market capitalization of CHF476.99 million.

Operations: V-ZUG Holding AG generates revenue primarily from its Household Appliances segment, which reported CHF591.72 million. The company's financial performance is influenced by its operational efficiency, as reflected in the net profit margin trends over recent periods.

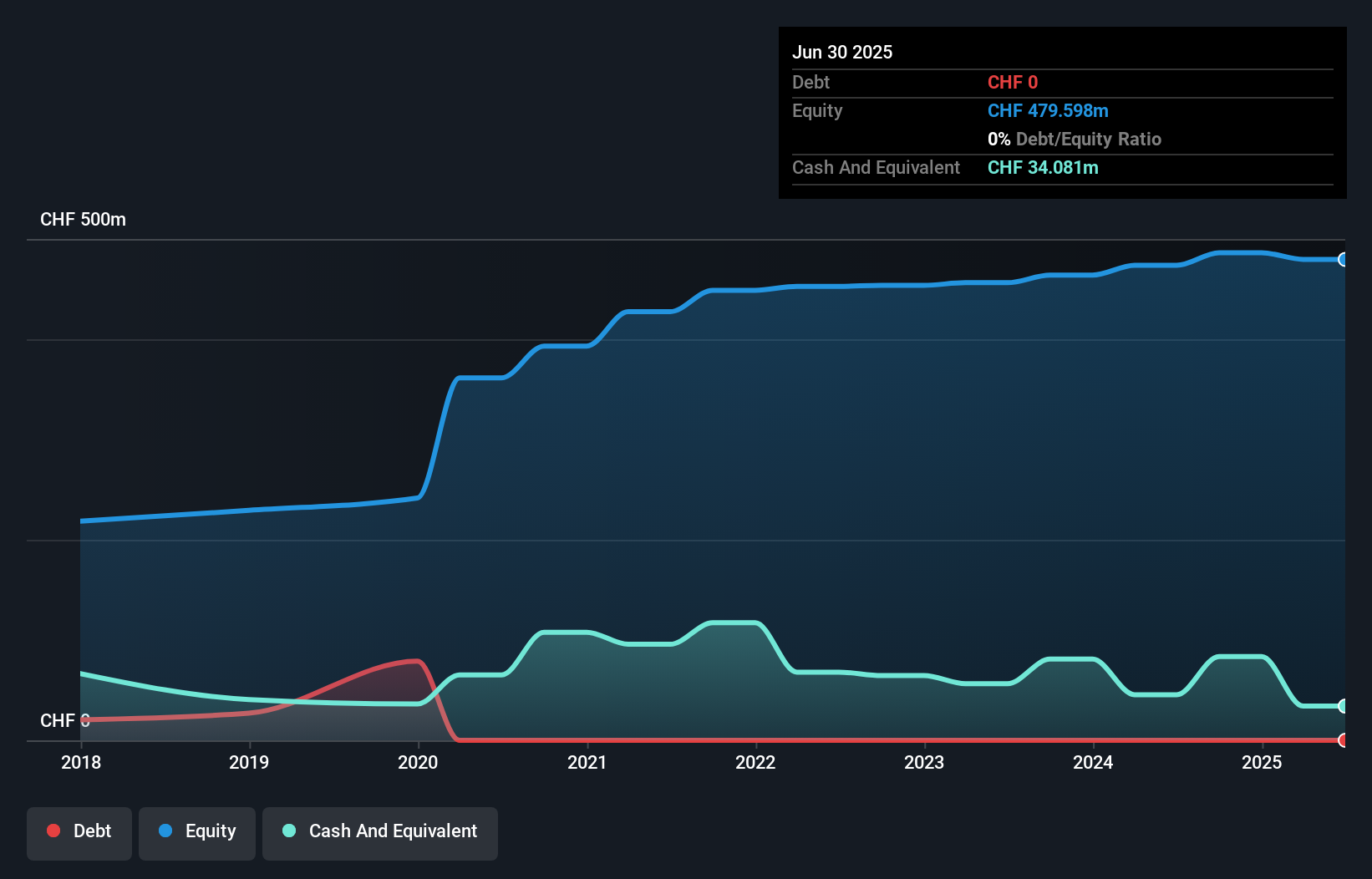

V-ZUG Holding, a niche player in the European market, showcases impressive growth with earnings surging 83% last year, outpacing its industry peers. The company is debt-free now, a significant shift from five years ago when its debt to equity ratio was 32.7%. Recent initiatives like the new V-ZUG Studio in Zurich highlight its commitment to innovation and customer engagement. With net income climbing to CHF 21 million from CHF 12 million and basic earnings per share rising to CHF 3.33 from CHF 1.82, V-ZUG's financial health appears robust as it anticipates continued sales and profitability improvements in 2025.

- Navigate through the intricacies of V-ZUG Holding with our comprehensive health report here.

Evaluate V-ZUG Holding's historical performance by accessing our past performance report.

Summing It All Up

- Embark on your investment journey to our 330 European Undiscovered Gems With Strong Fundamentals selection here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:ART

Arteche Lantegi Elkartea

Engages in the design, manufacture, integration, and supply of electrical equipment and solutions focusing on renewable energies and smart grids in Spain and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives