- Spain

- /

- Construction

- /

- BME:ACS

Top European Dividend Stocks To Watch In March 2025

Reviewed by Simply Wall St

As the European market continues to show resilience with the STOXX Europe 600 Index posting its longest streak of weekly gains since 2012, investors are increasingly looking at dividend stocks as a reliable source of income amidst mixed economic signals. In this environment, identifying strong dividend stocks involves focusing on companies with stable earnings and robust cash flows that can sustain payouts even when broader market conditions fluctuate.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.23% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 4.22% | ★★★★★★ |

| Mapfre (BME:MAP) | 5.82% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 4.84% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.49% | ★★★★★★ |

| Vaudoise Assurances Holding (SWX:VAHN) | 4.33% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.36% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.53% | ★★★★★★ |

| Credito Emiliano (BIT:CE) | 6.02% | ★★★★★☆ |

| Piscines Desjoyaux (ENXTPA:ALPDX) | 6.47% | ★★★★★☆ |

Click here to see the full list of 221 stocks from our Top European Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

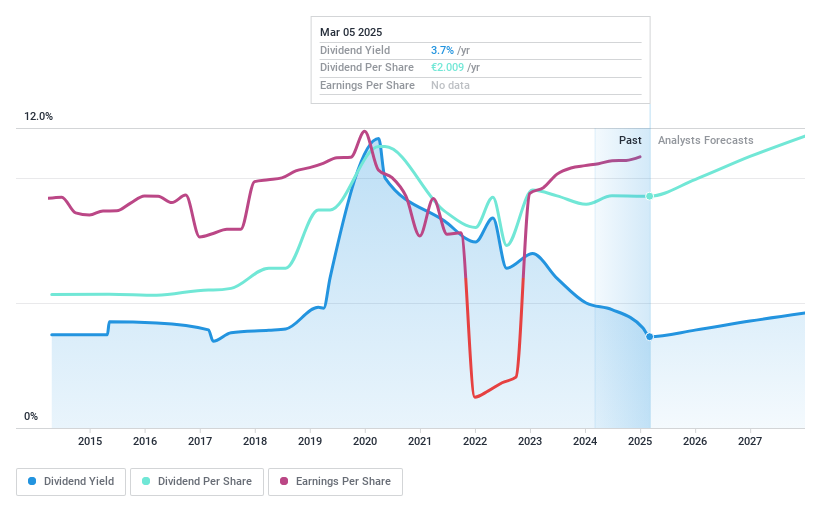

ACS Actividades de Construcción y Servicios (BME:ACS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ACS Actividades de Construcción y Servicios (BME:ACS) is a global construction and services company with a market capitalization of €13.38 billion.

Operations: ACS Actividades de Construcción y Servicios generates its revenue from several key segments, including Cimic (€10.21 billion), Turner (€19.26 billion), Infrastructure (€172.67 million), and Engineering and Construction (€9.51 billion).

Dividend Yield: 3.8%

ACS Actividades de Construcción y Servicios offers a mixed dividend profile. Its 3.83% yield is lower than the Spanish market's top quartile, but dividends are well-covered by earnings (64% payout ratio) and cash flows (24% cash payout ratio). Despite recent earnings growth, ACS has an unstable dividend history with volatility over the past decade. Recent financials show improved sales (€41.64 billion) and net income (€827.58 million), suggesting potential for future stability in payouts.

- Navigate through the intricacies of ACS Actividades de Construcción y Servicios with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential overvaluation of ACS Actividades de Construcción y Servicios shares in the market.

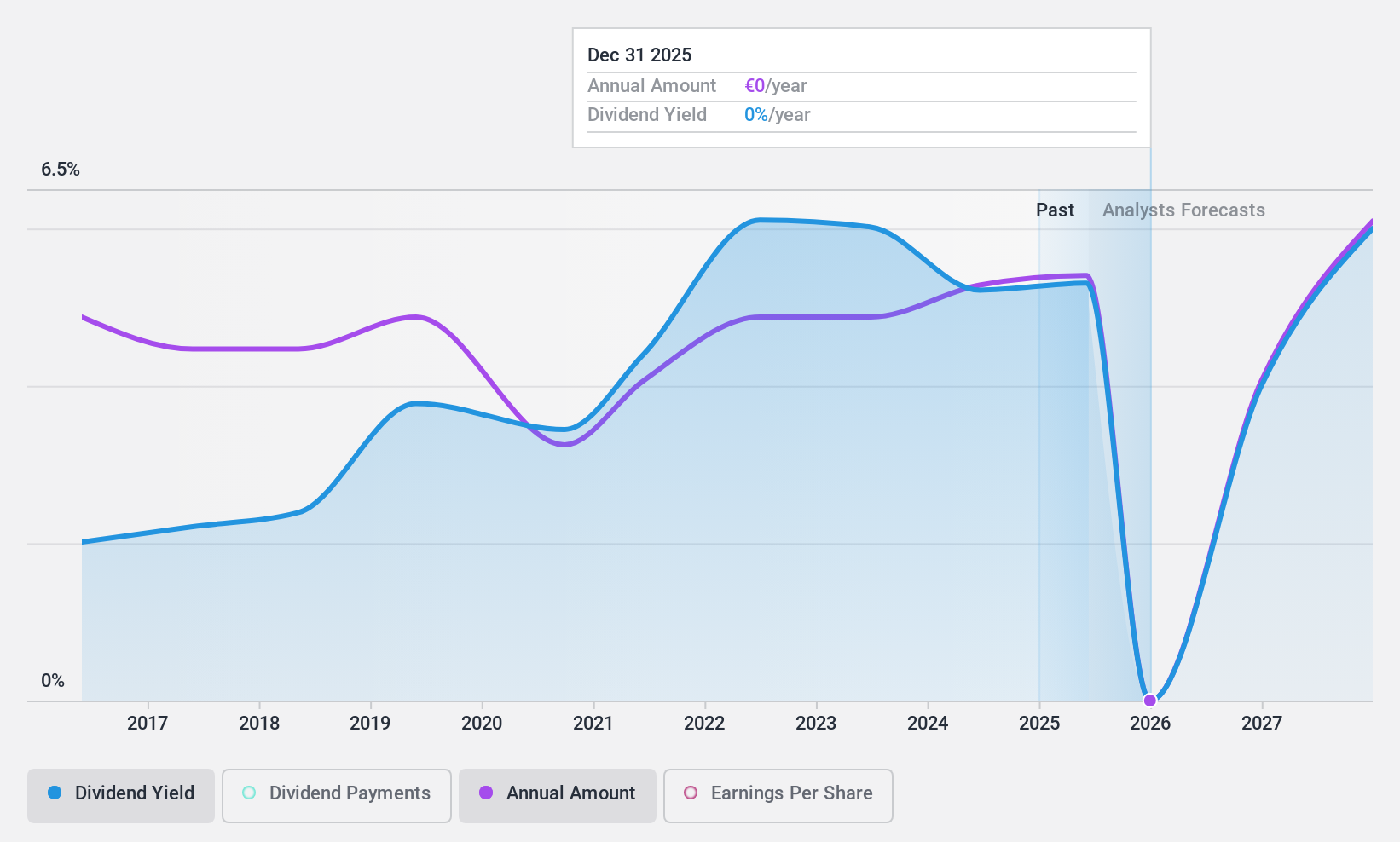

Fleury Michon (ENXTPA:ALFLE)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Fleury Michon SA is a company that produces and sells food products both in France and internationally, with a market cap of €96.78 million.

Operations: Fleury Michon's revenue is primarily derived from its Division GMS France segment, which accounts for €679.59 million, and its International Division, contributing €91.20 million.

Dividend Yield: 5.6%

Fleury Michon offers a compelling dividend profile with its 5.6% yield, ranking in the top 25% of French dividend payers. The dividends are well-supported by earnings and cash flows, with payout ratios of 34.1% and 12.6%, respectively. Despite these strengths, the company's dividends have been volatile over the past decade, lacking reliability in growth or stability. Trading significantly below estimated fair value suggests potential for capital appreciation alongside income generation.

- Delve into the full analysis dividend report here for a deeper understanding of Fleury Michon.

- Our comprehensive valuation report raises the possibility that Fleury Michon is priced lower than what may be justified by its financials.

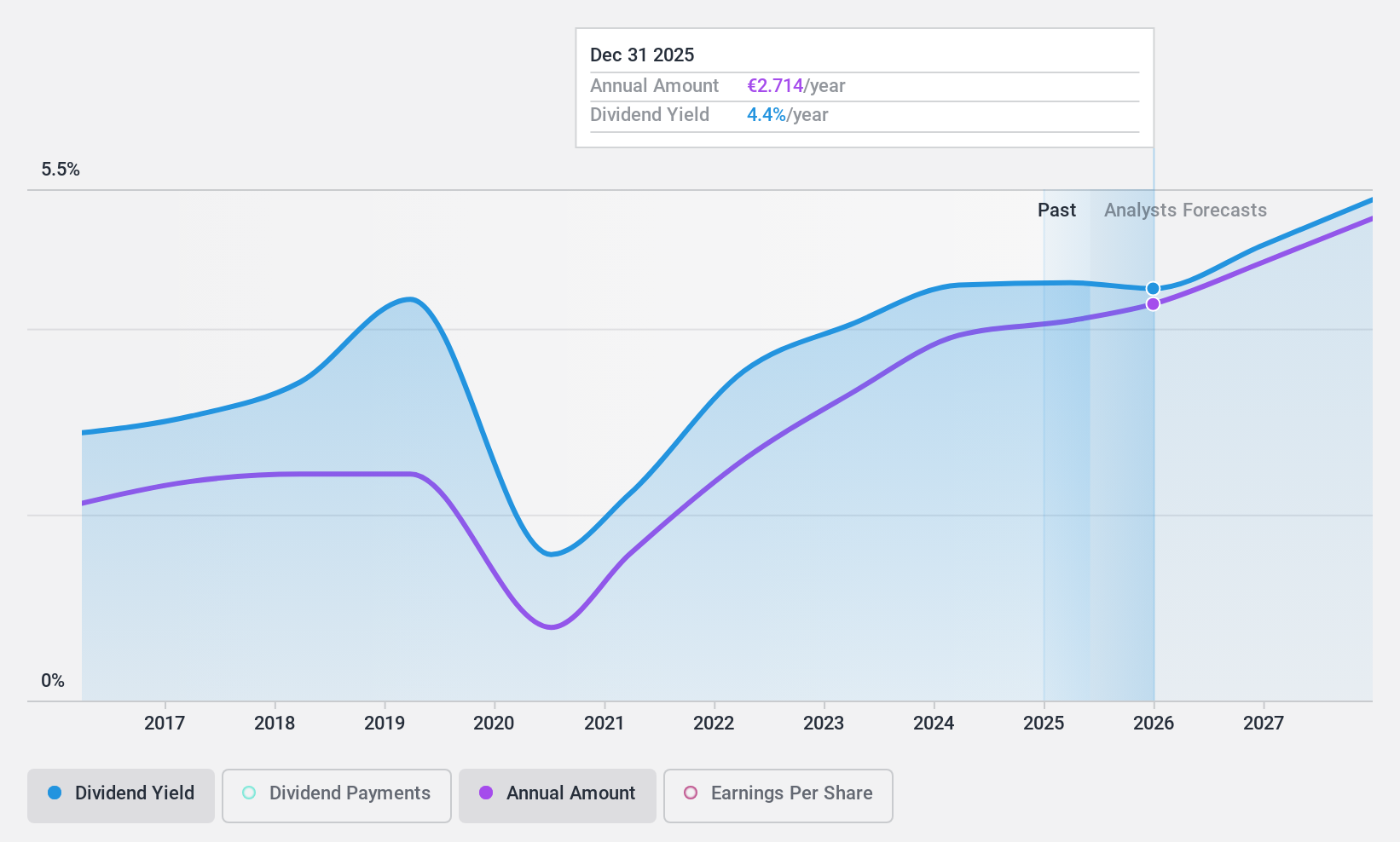

Andritz (WBAG:ANDR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Andritz AG operates globally, offering plants, equipment, and services for the pulp and paper industry, metalworking and steel industries, hydropower stations, and solid/liquid separation sectors with a market cap of approximately €5.75 billion.

Operations: Andritz AG generates its revenue from four main segments: Metals (€1.84 billion), Hydro Power (€1.48 billion), Pulp & Paper (€3.83 billion), and Environment & Energy (€1.33 billion).

Dividend Yield: 4.3%

Andritz offers a dividend yield of 4.31%, which is below the top tier in Austria, but its dividends are well-covered by earnings and cash flows with payout ratios of 49.5% and 47.1%, respectively. Despite an increase over the past decade, its dividend track record has been volatile and unreliable, experiencing significant annual drops. Trading at a discount to fair value may offer potential for capital appreciation, though dividend stability remains a concern.

- Get an in-depth perspective on Andritz's performance by reading our dividend report here.

- The valuation report we've compiled suggests that Andritz's current price could be quite moderate.

Summing It All Up

- Click here to access our complete index of 221 Top European Dividend Stocks.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade ACS Actividades de Construcción y Servicios, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:ACS

ACS Actividades de Construcción y Servicios

ACS, Actividades de Construcción y Servicios, S.A.

Adequate balance sheet average dividend payer.