With EPS Growth And More, Banco Santander (BME:SAN) Makes An Interesting Case

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Banco Santander (BME:SAN). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for Banco Santander

Banco Santander's Earnings Per Share Are Growing

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Recognition must be given to the that Banco Santander has grown EPS by 38% per year, over the last three years. Growth that fast may well be fleeting, but it should be more than enough to pique the interest of the wary stock pickers.

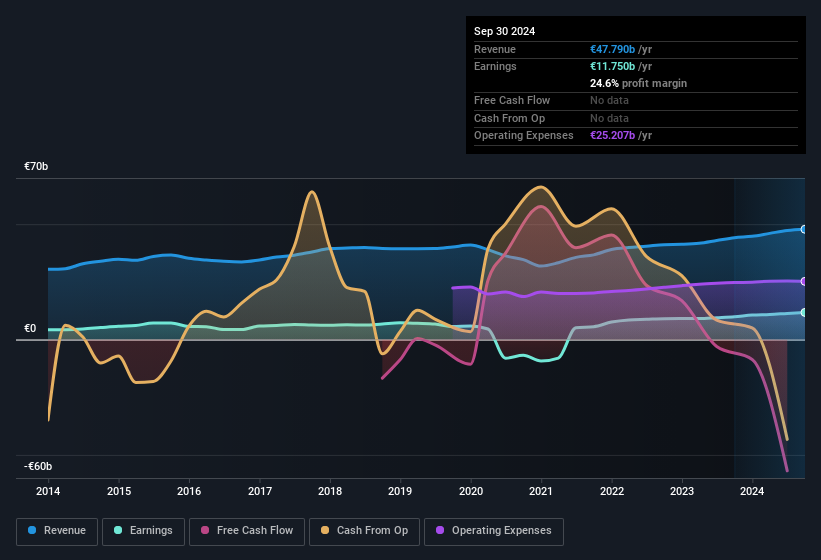

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Not all of Banco Santander's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. Banco Santander maintained stable EBIT margins over the last year, all while growing revenue 8.3% to €48b. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Fortunately, we've got access to analyst forecasts of Banco Santander's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Banco Santander Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Banco Santander top brass are certainly in sync, not having sold any shares, over the last year. But the bigger deal is that the company insider, Luis Isasi Fernandez de Bobadilla, paid €170k to buy shares at an average price of €3.78. It seems at least one insider has seen potential in the company's future - and they're willing to put money on the line.

On top of the insider buying, it's good to see that Banco Santander insiders have a valuable investment in the business. Indeed, they have a considerable amount of wealth invested in it, currently valued at €636m. This comes in at 1.0% of shares in the company, which is a fair amount of a business of this size. So despite their percentage holding being low, company management still have plenty of reasons to deliver the best outcomes for investors.

Does Banco Santander Deserve A Spot On Your Watchlist?

Banco Santander's earnings per share have been soaring, with growth rates sky high. The cherry on top is that insiders own a bunch of shares, and one has been buying more. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest Banco Santander belongs near the top of your watchlist. What about risks? Every company has them, and we've spotted 2 warning signs for Banco Santander (of which 1 doesn't sit too well with us!) you should know about.

The good news is that Banco Santander is not the only stock with insider buying. Here's a list of small cap, undervalued companies in ES with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Banco Santander might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BME:SAN

Banco Santander

Provides various financial products and services to individuals, small and medium-sized enterprises, large corporations, and public entities worldwide.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives