Taking Stock of Santander (BME:SAN): Assessing Valuation After a Strong Multi‑Month Share Price Rally

Reviewed by Simply Wall St

Banco Santander (BME:SAN) has quietly delivered a strong run, with the share price up about 8% over the past month and roughly 17% in the past 3 months, drawing fresh investor attention.

See our latest analysis for Banco Santander.

Zooming out, the stock’s momentum looks firmly intact, with a year to date share price return of around 115% and a five year total shareholder return of more than 300%. This signals that investors are re rating Banco Santander’s earnings power and risk profile.

If Santander’s run has you rethinking your portfolio, this could be a good moment to explore fast growing stocks with high insider ownership for other compelling growth stories backed by committed insiders.

Still, with the share price now sitting almost exactly at the average analyst target while trading at a notable discount to some intrinsic value estimates, is there genuine upside left here or is the market already baking in Banco Santander’s next leg of growth?

Most Popular Narrative Narrative: 20% Overvalued

Compared with the last close of €9.48, the most followed narrative sees Banco Santander’s fair value closer to €9.46, implying modest downside from here.

Ongoing transformation and cost reduction programs (ONE Transformation) are delivering structural operational leverage, with significant potential remaining as legacy systems are phased out. This supports a sustainable improvement in cost/income ratio and operating profits even in more muted economic environments.

Curious how steady, rather than spectacular, growth in revenue, margins and earnings can still justify a richer future earnings multiple for a global bank? The full narrative unpacks the exact assumptions behind those projections and how they connect to that fair value estimate.

Result: Fair Value of €9.46 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent macro and regulatory pressures, particularly in Brazil and Spain, could raise loan losses and compliance costs, which may undermine the expected earnings stability.

Find out about the key risks to this Banco Santander narrative.

Another Angle on Value

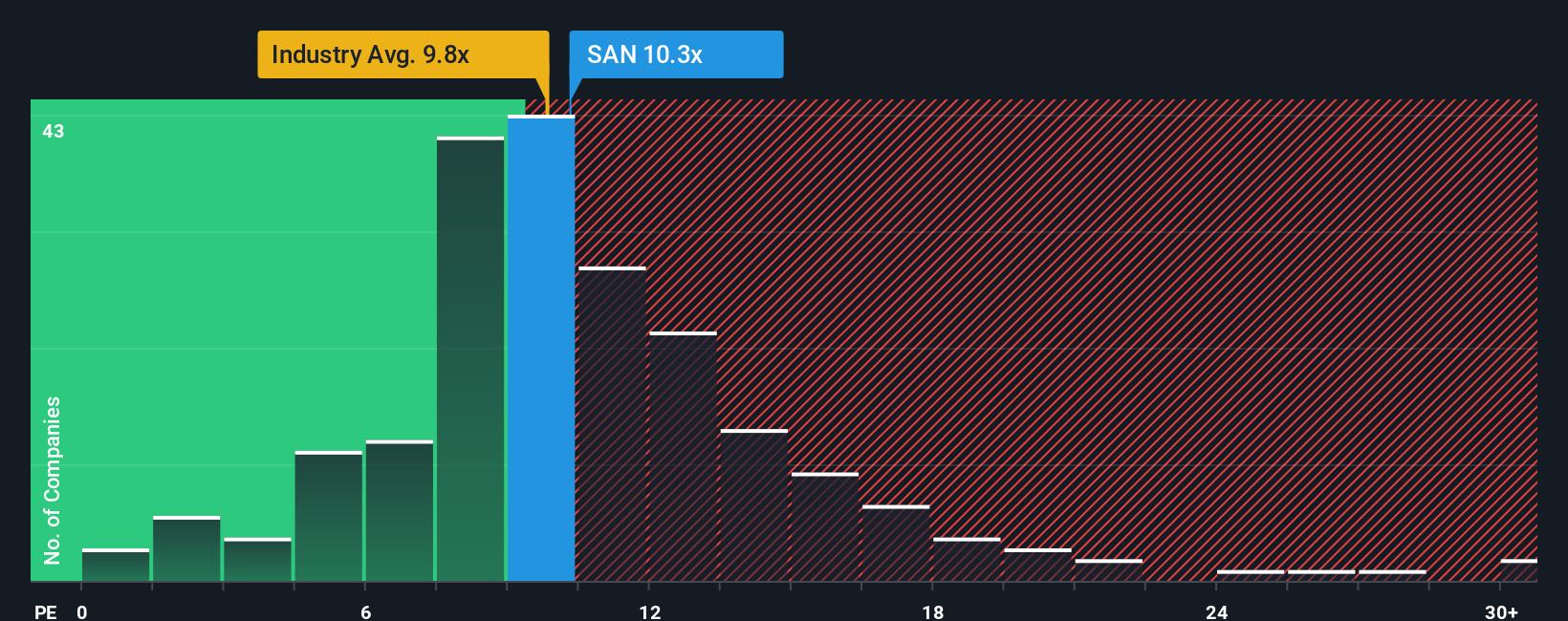

While the narrative suggests Banco Santander is about 20% overvalued, a simple earnings based lens tells a different story. The shares trade on a price to earnings ratio of 10.9x versus a fair ratio of 12.3x, hinting at upside if sentiment keeps improving.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Banco Santander Narrative

If you see the story differently, or simply prefer to rely on your own analysis, you can build a fresh narrative in just minutes: Do it your way.

A great starting point for your Banco Santander research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Ready for your next investing move?

Do not stop at one opportunity. Use the Simply Wall St screener to uncover focused shortlists of stocks that could reshape your portfolio’s potential.

- Secure stronger potential income streams by targeting companies with reliable payouts through these 15 dividend stocks with yields > 3% that may help anchor your returns when markets turn.

- Position yourself early in transformative medical breakthroughs with these 30 healthcare AI stocks where advanced data and diagnostics are changing how healthcare leaders grow and defend margins.

- Capitalize on powerful cash generation by zeroing in on these 913 undervalued stocks based on cash flows that the market may be mispricing relative to their future cash flows and growth prospects.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Banco Santander might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:SAN

Banco Santander

Provides various financial products and services to individuals, small and medium-sized enterprises, large corporations, and public entities worldwide.

Good value with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026