Santander (BME:SAN) Net Margin Improves to 25.3%, Challenging Expectations of Slowing Growth

Reviewed by Simply Wall St

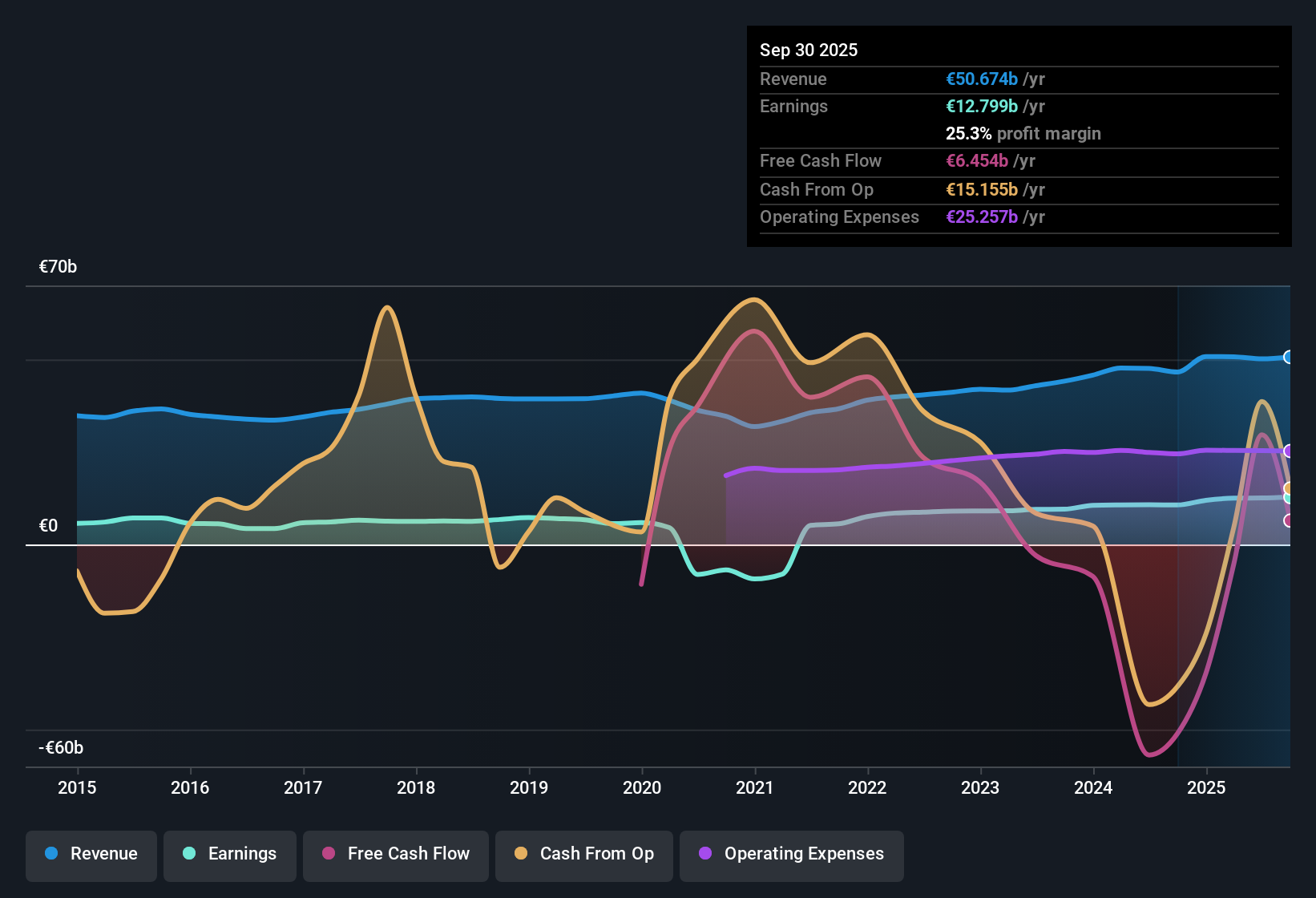

Banco Santander (BME:SAN) delivered another year of profitability growth, posting a 19.8% rise in annual earnings, which brings its five-year earnings increase to an impressive 36.7%. Net profit margins also ticked higher to 25.3%, gaining from last year's 22.9%, and the shares are now trading at €8.75, notably below the estimated fair value of €11.5. With future earnings projected to grow at 3.8% per year, which is slower than the broader Spanish market but with revenue expected to outpace sector averages, investors face a mix of steady results and moderate growth potential as they reassess valuation sentiment.

See our full analysis for Banco Santander.Next, let’s see how Santander’s figures match up to the current market narrative and where expectations might need recalibrating.

See what the community is saying about Banco Santander

Digital Expansion Drives Revenue Outperformance

- Revenue is forecast to grow 5.7% per year, beating the broader Spanish market’s 4.2% annual rate over the same period.

- Analysts’ consensus view credits the bank’s digital banking expansion and operational efficiency. Initiatives like Openbank and PagoNxt are identified as key levers enabling above-market revenue growth, even while net margin compression is on the horizon.

- The consensus narrative notes that technology investments and digital platform rollouts have helped reduce costs and improve fee growth.

- However, despite digital tailwinds, the expected margin reduction from 25.1% to 20.7% by 2028 presents a challenge to sustaining outperformance at the bottom line.

- Curious how digital transformation is shaping the broader Santander story? See both sides in the full Consensus Narrative. 📊 Read the full Banco Santander Consensus Narrative.

Profit Margins Face Near-Term Squeeze

- Profit margins, after reaching 25.3% this year, are anticipated to shrink to 20.7% within three years, according to analyst forecasts.

- Consensus narrative highlights that while diversified global operations and efficiency programs buffer against global pressures,

- Persistent headwinds in key markets like Brazil, including high interest rates and currency pressures, threaten loan quality and may drive up costs, forcing margins lower.

- Greater digitization and the “ONE Transformation” cost cutting are expected to help but may not fully offset external pressures on profitability.

Valuation Holds Steady Against Peers

- Banco Santander’s price-to-earnings ratio is 10.1x, nearly matching peer averages and modestly above the broader European banking sector’s 9.6x.

- The analysts’ consensus view interprets this as fair value. The current share price of €8.75 sits close to the consensus price target of €9.14, suggesting the market recognizes the shift from rapid historical growth to a steadier outlook, without attributing a valuation premium for its technology led initiatives.

- Despite earnings momentum and growth in higher-yielding segments, the small gap between share price and analyst target signals little near-term rerating potential.

- Risks related to dividend sustainability and exposure to volatile emerging markets may cap further upside in multiples relative to peers.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Banco Santander on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a fresh take on the data? Share your insights and shape a personal narrative quickly and easily. Your unique angle awaits. Do it your way

A great starting point for your Banco Santander research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite digital growth, Banco Santander faces near-term pressure as profit margins are forecast to decline and risks could limit further valuation upside.

If steadier results appeal to you, focus on companies that deliver consistent performance through cycles by using our stable growth stocks screener (2108 results) for your next investment search.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Banco Santander might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:SAN

Banco Santander

Provides various financial products and services to individuals, small and medium-sized enterprises, large corporations, and public entities worldwide.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion