Has Santander’s 127% Rally in 2025 Already Priced In Its Improving Returns?

Reviewed by Bailey Pemberton

- If you are wondering whether Banco Santander still offers good value after such a substantial run, or if you might be late to the party, this breakdown will walk through what the current share price is really implying.

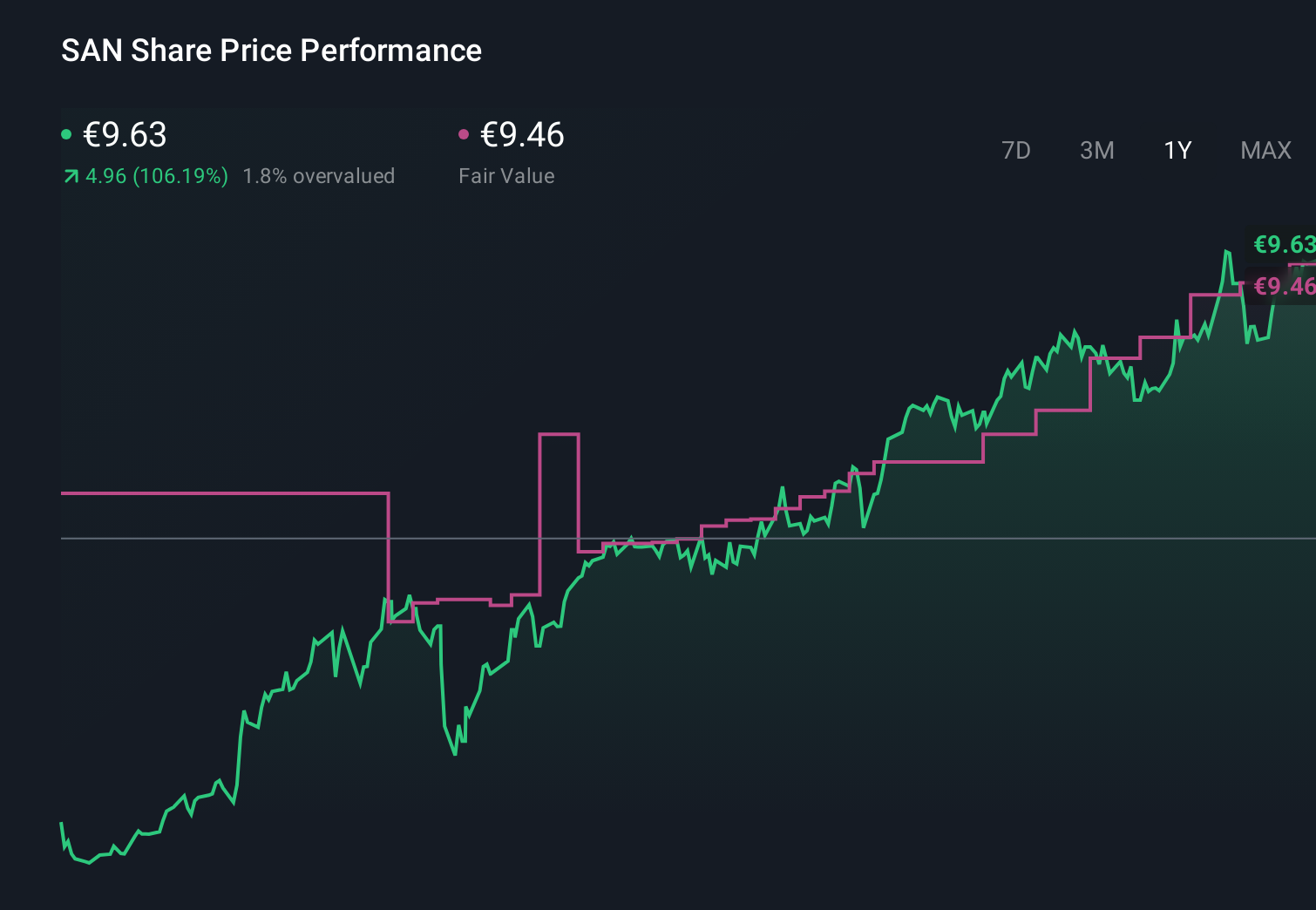

- The stock has climbed 2.2% over the last week, 13.9% in the last month, and 127.0% year to date, with a 132.8% gain over the past year and 332.8% over five years pointing to a major rerating by the market.

- Recent headlines have focused on Santander doubling down on its core European and Latin American banking franchises, along with ongoing cost discipline and strategic capital allocation moves that investors see as supporting higher returns. At the same time, shifting interest rate expectations and renewed confidence in European banks have helped fuel sentiment toward large diversified lenders such as Santander.

- Despite all that momentum, Santander only scores 2 out of 6 on our valuation checks. In this breakdown, we will unpack what different valuation approaches are saying about the stock, before finishing with a more powerful way to think about its long-term value story.

Banco Santander scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Banco Santander Excess Returns Analysis

The Excess Returns model looks at how much value Banco Santander creates over and above the minimum return that shareholders require. Instead of focusing on cash flows, it starts from the bank’s equity base and asks whether its returns on that equity are high enough, and durable enough, to justify a premium over book value.

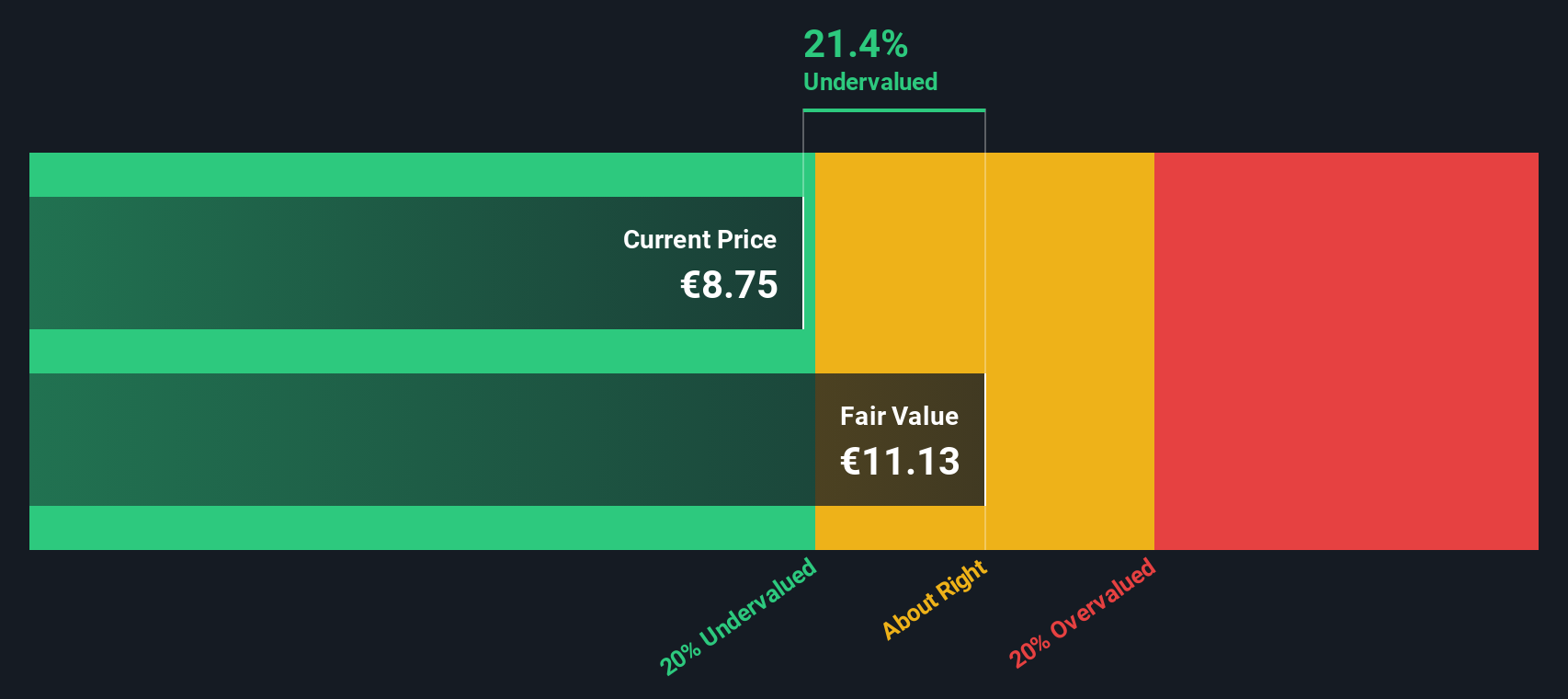

For Santander, the model assumes a Book Value of €6.82 per share and a Stable EPS of €1.03 per share, based on weighted future Return on Equity estimates from 14 analysts. With an Average Return on Equity of 13.21% compared with a Cost of Equity of €0.73 per share, the bank is expected to generate an Excess Return of €0.30 per share on a Stable Book Value rising to €7.79 per share, using book value forecasts from 9 analysts.

When these excess returns are projected forward and discounted back, the model arrives at an intrinsic value of about €11.99 per share, suggesting the stock is trading at a 16.6% discount to its current price. In other words, the market is not fully pricing in Santander’s ability to earn returns above its cost of equity.

Result: UNDERVALUED

Our Excess Returns analysis suggests Banco Santander is undervalued by 16.6%. Track this in your watchlist or portfolio, or discover 916 more undervalued stocks based on cash flows.

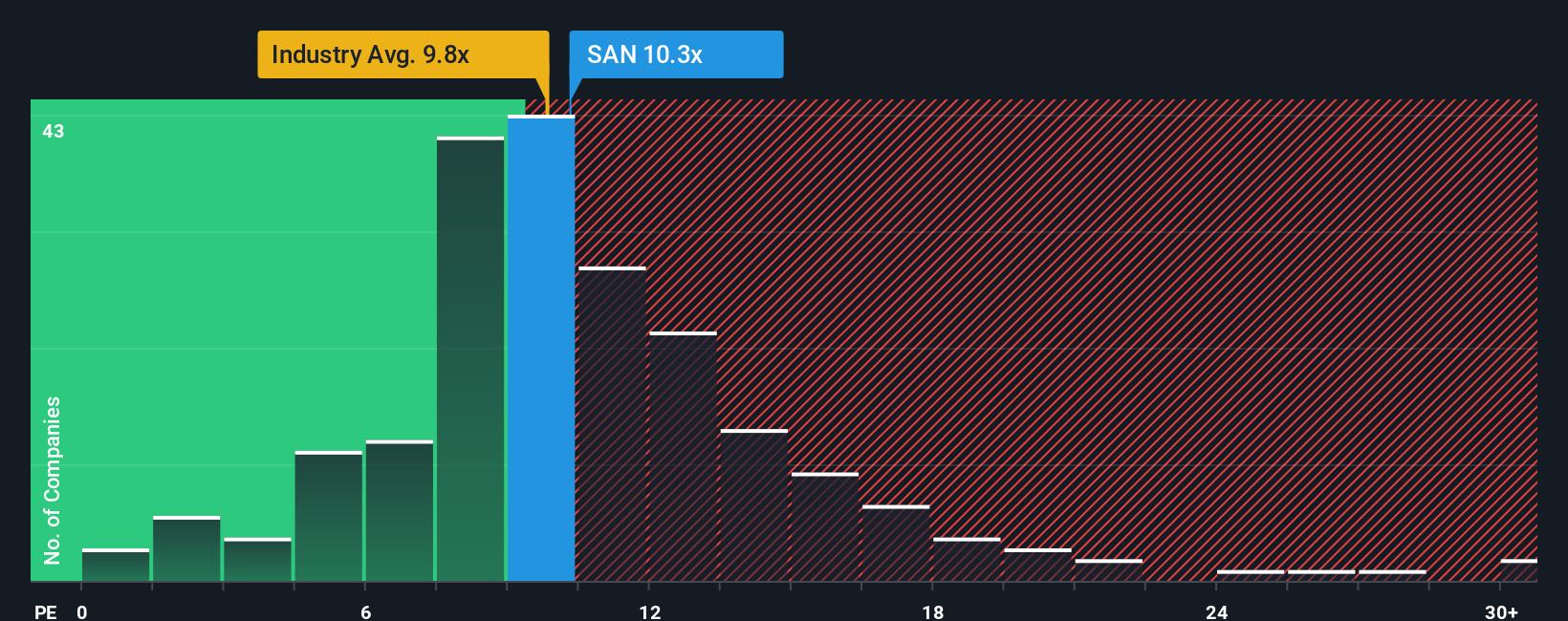

Approach 2: Banco Santander Price vs Earnings

For a consistently profitable bank like Banco Santander, the price to earnings, or PE, ratio is a practical way to gauge what investors are willing to pay for each euro of earnings today. In general, stronger and more reliable earnings growth, combined with lower perceived risk, justify a higher PE multiple, while slower growth or higher risk usually warrant a lower one.

Santander currently trades on a PE of 11.48x, which is slightly above the global Banks industry average of about 10.84x and very close to its peer group average of 11.43x. Simply Wall St also estimates a Fair Ratio for Santander of 12.32x, which reflects what investors might reasonably pay given its earnings growth outlook, profitability, size, industry positioning and risk profile.

This Fair Ratio is more informative than a simple comparison to peers or the sector, because it adjusts for Santander specific characteristics, rather than assuming all banks deserve the same multiple. Comparing the Fair Ratio of 12.32x with the current PE of 11.48x suggests the market is applying a modest discount to what would be considered reasonable, which indicates that the shares still look slightly undervalued on earnings.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1456 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Banco Santander Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, which are simply your story about a company expressed as numbers like your fair value, and your expectations for future revenue, earnings and margins, all linked together. A Narrative connects what you believe about Santander’s strategy, risks and opportunities to a concrete financial forecast and then to an implied fair value, so you can directly compare that fair value with today’s share price to decide whether it looks like a buy, hold or sell. On Simply Wall St, millions of investors build and share these Narratives on the Community page, and they update dynamically as new information, such as earnings or major news, comes in. For example, one Santander Narrative might lean bullish, assuming revenue growth closer to the top end of analyst expectations and a fair value near €9.5 per share, while a more cautious Narrative might assume slower growth, lower margins and a fair value closer to €5.8, giving you a clear, numbers based view of how different perspectives translate into different investment decisions.

Do you think there's more to the story for Banco Santander? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Banco Santander might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:SAN

Banco Santander

Provides various financial products and services to individuals, small and medium-sized enterprises, large corporations, and public entities worldwide.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion