Can Santander’s Rally Continue After Surging Over 100% in 2024?

Reviewed by Bailey Pemberton

Thinking about what to do with Banco Santander stock? You are not alone. With shares closing recently at €8.85, investors are weighing its remarkable rise against questions of value and potential. If you have been watching the bank’s performance, you have seen a year of eye-popping numbers: the stock has climbed 101.0% year-to-date, and an incredible 307.6% over the last three years. Even in the short run, there is notable momentum, up 2.3% this past week and 9.8% over the past month. The story gets even more interesting with that five-year return, an impressive 569.4%, which is proof of serious long-term deliverance for shareholders. In recent months, positive sentiment around European banks, improvements in economic outlook, and shifting risk perceptions have all played their part in fueling Banco Santander’s rally. Now, as everyone asks, “Is there more room to run, or is this as good as it gets?” a closer look at valuation feels more urgent than ever.

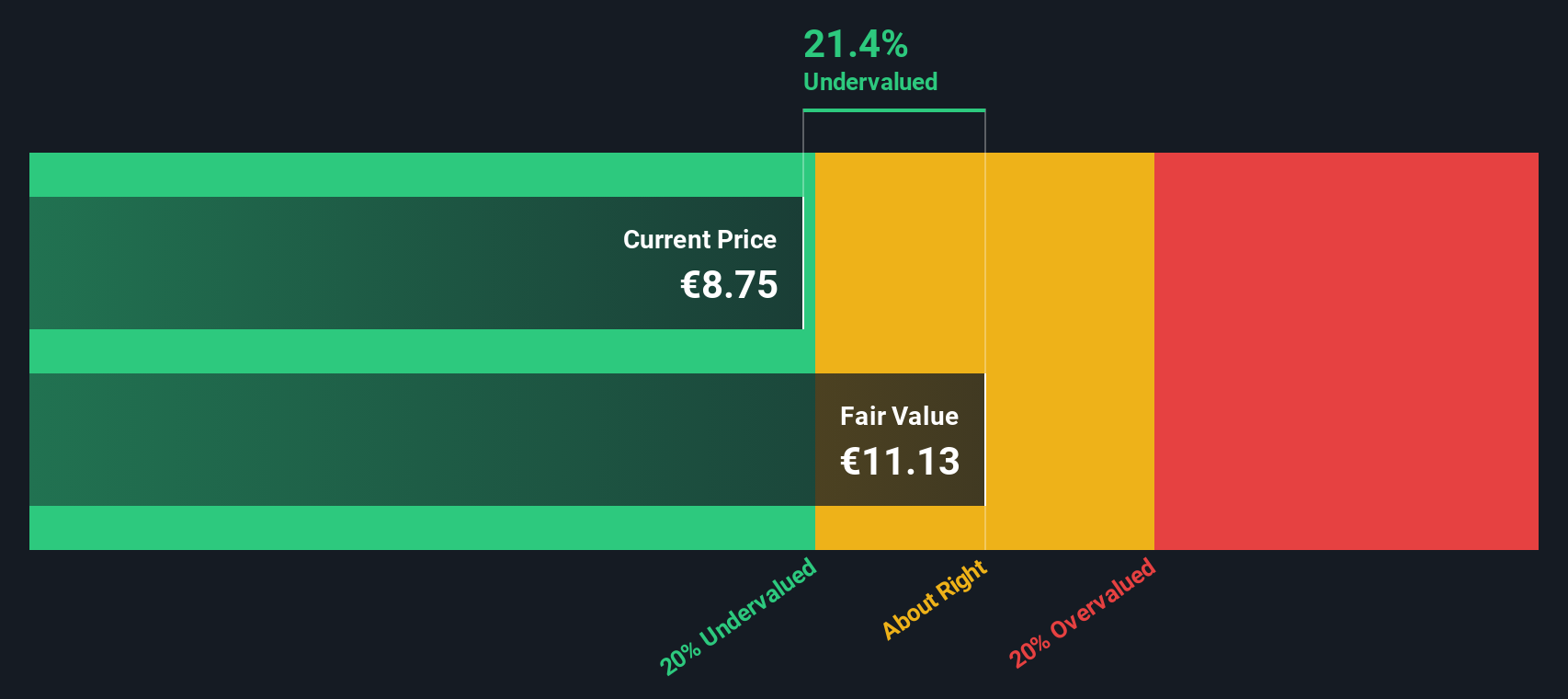

When stacking Banco Santander up against six classic valuation checks, the company only scores 1 out of 6, suggesting it is undervalued by just one key metric. This low score hints that the stock might not be the deep bargain some had hoped, yet headline numbers never tell the whole story. Let’s break down each valuation approach to see what is really driving that score, and stick around for a perspective on valuation that digs even deeper than traditional methods.

Banco Santander scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.Approach 1: Banco Santander Excess Returns Analysis

The Excess Returns model assesses a company’s ability to generate returns above its cost of equity. This can signal sustainable value creation for shareholders. By focusing on how much Banco Santander earns from its investments compared to what those investments cost, this model offers insight into whether the bank is truly adding value over time.

For Banco Santander, the average Return on Equity stands at 12.63%, based on estimates from 14 analysts. The current Book Value per share is €6.63, with forecasts pointing to a stable Book Value of €7.81 in the future, as projected by 9 analysts. Stable Earnings Per Share are estimated at €0.99, while the Cost of Equity is €0.93 per share. This results in an excess return of just €0.05 per share, indicating that the bank is generating only a small surplus above its required return.

Based on the Excess Returns approach, Banco Santander’s intrinsic value calculation suggests the shares are about 5.8% above their fair worth at the recent closing price of €8.85. This means the stock is modestly overvalued according to this method, but not by a wide margin.

Result: ABOUT RIGHT

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Banco Santander.

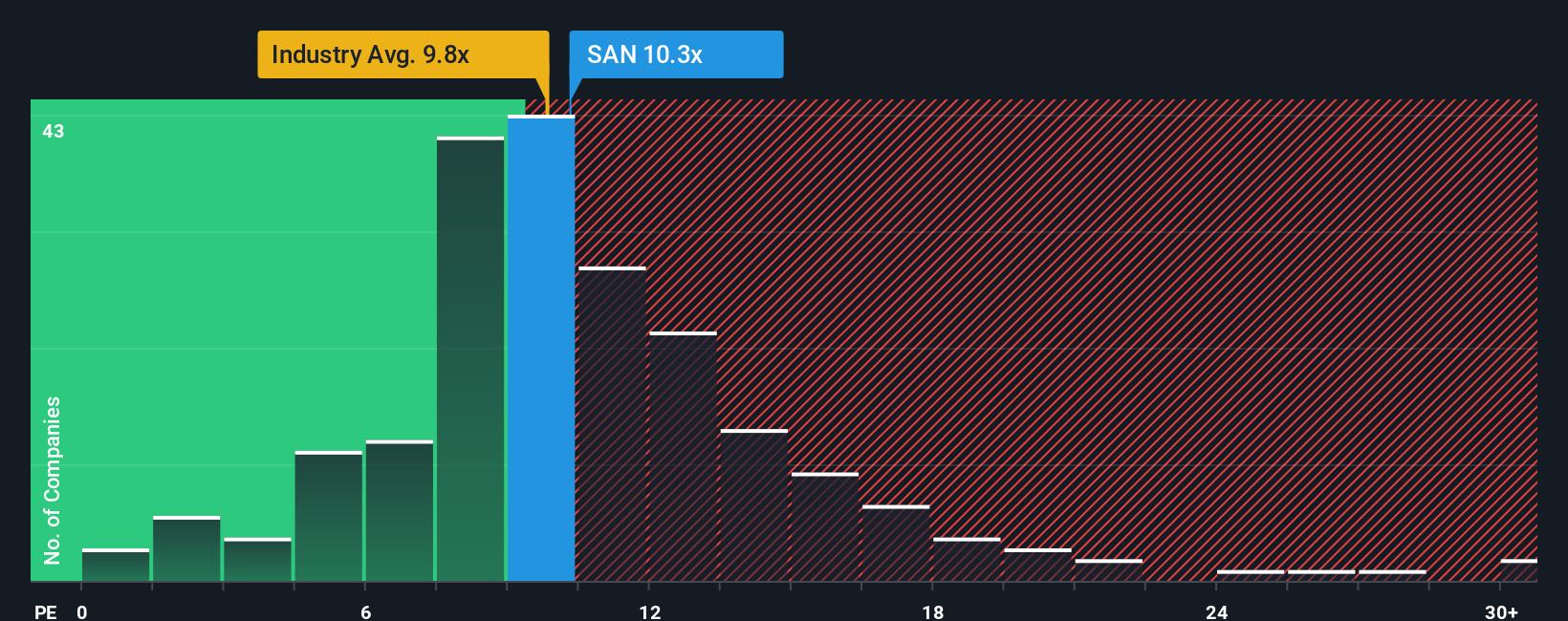

Approach 2: Banco Santander Price vs Earnings

The Price-to-Earnings (PE) ratio is a classic yardstick for valuing profitable companies like Banco Santander. It relates the current share price to the company's earnings per share, making it a useful snapshot of how much investors are willing to pay for each euro of profit the bank generates. This connects valuation directly to current profitability.

What constitutes a “fair” PE ratio is shaped by several factors, most notably expectations for future earnings growth and the level of risk in the business or industry. Higher growth prospects or lower perceived risk generally justify a higher PE, while slower growth or higher risk should be reflected in a lower multiple.

Currently, Banco Santander trades at a PE of 10.4x. This sits very close to both the peer average of 10.3x and the broader banking sector's average of 10.5x. This suggests that the market is valuing Santander in line with other banks. Simply Wall St’s proprietary Fair Ratio takes the analysis a step further by factoring in not just market comparisons, but also the company’s own growth, profitability, risk level, industry positioning, and market cap. For Banco Santander, the Fair Ratio is 11.1x.

Because Simply Wall St’s Fair Ratio closely matches the current PE ratio, with a difference of less than 0.1x, it signals that the market is pricing Santander’s shares about right from both a traditional and a more nuanced perspective.

Result: ABOUT RIGHT

Upgrade Your Decision Making: Choose your Banco Santander Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. Narratives are a powerful and straightforward tool that allow you to express your own outlook on a company by connecting its story, future potential, and real-world events to concrete financial assumptions, such as what you believe is a fair value, future revenues, earnings, and profit margins.

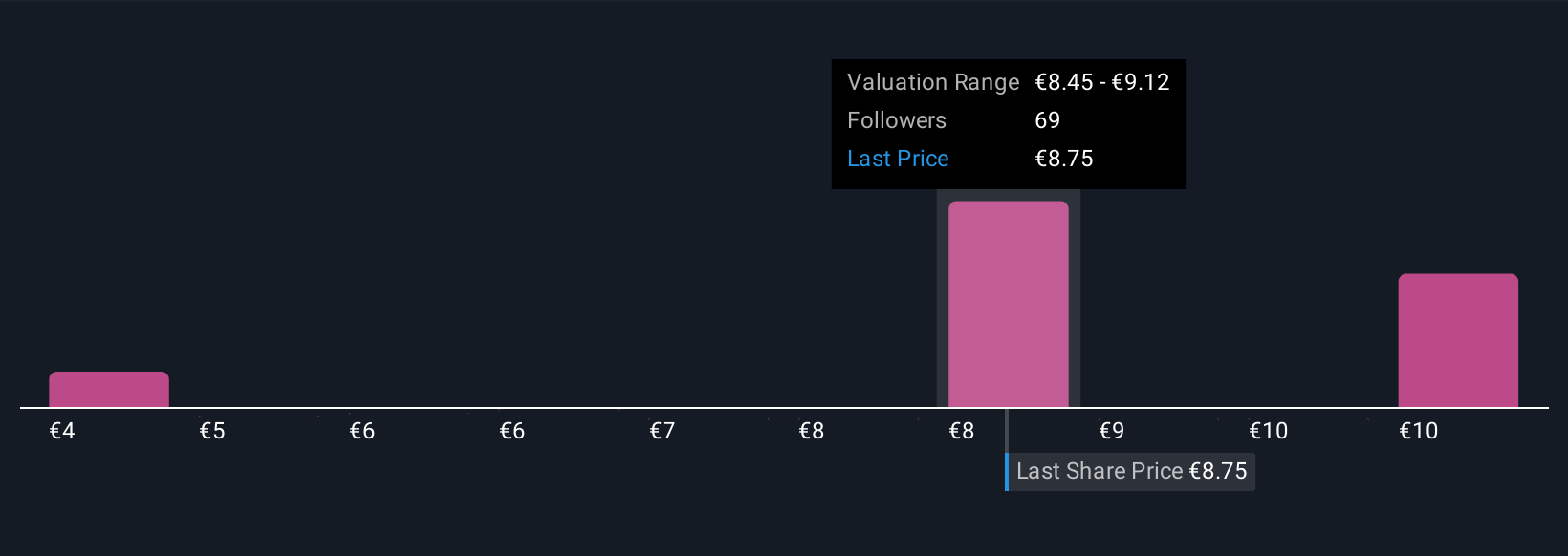

Unlike traditional models that just crunch numbers, a Narrative lets you spell out the “why” behind your view. It links the context of Banco Santander’s business, such as expansion in digital banking or ongoing regulatory risks, to your own forecast and ultimately, to a calculated fair value. Narratives are accessible to everyone on Simply Wall St’s Community page and are used by millions of investors globally, making it easy to see a range of perspectives and shape your own.

With Narratives, you can make smarter “buy or sell” choices by comparing what you think Santander is worth to its latest share price, all in light of your expectations. In addition, Narratives update automatically as new information or news comes in, keeping your investment thesis up to date with the facts. For example, one investor may see Santander’s fair value as low as €4.43, focusing on cautious digital growth, while another may project it as high as €8.20, inspired by bullish digital banking and expansion in Latin America.

Do you think there's more to the story for Banco Santander? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Banco Santander might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:SAN

Banco Santander

Provides various financial products and services to individuals, small and medium-sized enterprises, large corporations, and public entities worldwide.

Good value with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives