Banco Santander (BME:SAN): What the Latest Share Momentum Means for Its Valuation

Reviewed by Kshitija Bhandaru

Banco Santander (BME:SAN) shares have been on the move lately, catching the eye of many investors following a series of recent performance updates. Over the past month, the stock has gained 8%, adding to a solid track record for the year.

See our latest analysis for Banco Santander.

Momentum has picked up for Banco Santander, with its latest 1-month share price return of 8% building on a strong performance so far this year. Looking longer term, total shareholder returns over the past three and five years show steady gains. This suggests that investors continue to see growth potential even as short-term trading remains lively.

If you’re interested in what other stocks may be showing similar momentum, now is an ideal time to broaden your search and discover fast growing stocks with high insider ownership

But with such a strong run behind it, is Banco Santander still trading below its intrinsic value? Alternatively, have recent gains already factored in all future growth, leaving little room for a potential bargain for buyers?

Most Popular Narrative: 5.6% Overvalued

Banco Santander’s latest close of €8.66 sits notably above the narrative’s fair value of €8.20, reflecting analyst caution about its recent run. The following insight highlights a core driver behind this viewpoint.

Accelerated deployment of digital banking platforms (e.g., Openbank expansion, PagoNxt payments, AI-driven CRM), alongside cloud migration and automation, positions Santander to benefit from global digitization trends. This lowers operating costs and improves net margins as digital usage and process efficiencies scale further.

Curious why analysts aren’t getting swept up by the recent momentum? Hidden in this narrative are assumptions about profit margins, ambitious digital growth, and future earnings power. These details could change the valuation landscape entirely for Santander. See which future projections might make or break this consensus.

Result: Fair Value of €8.20 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent challenges in key markets like Brazil and potential setbacks in Santander's technology transformation could dampen the outlook if these issues are not carefully managed.

Find out about the key risks to this Banco Santander narrative.

Another View: SWS DCF Model Suggests Undervaluation

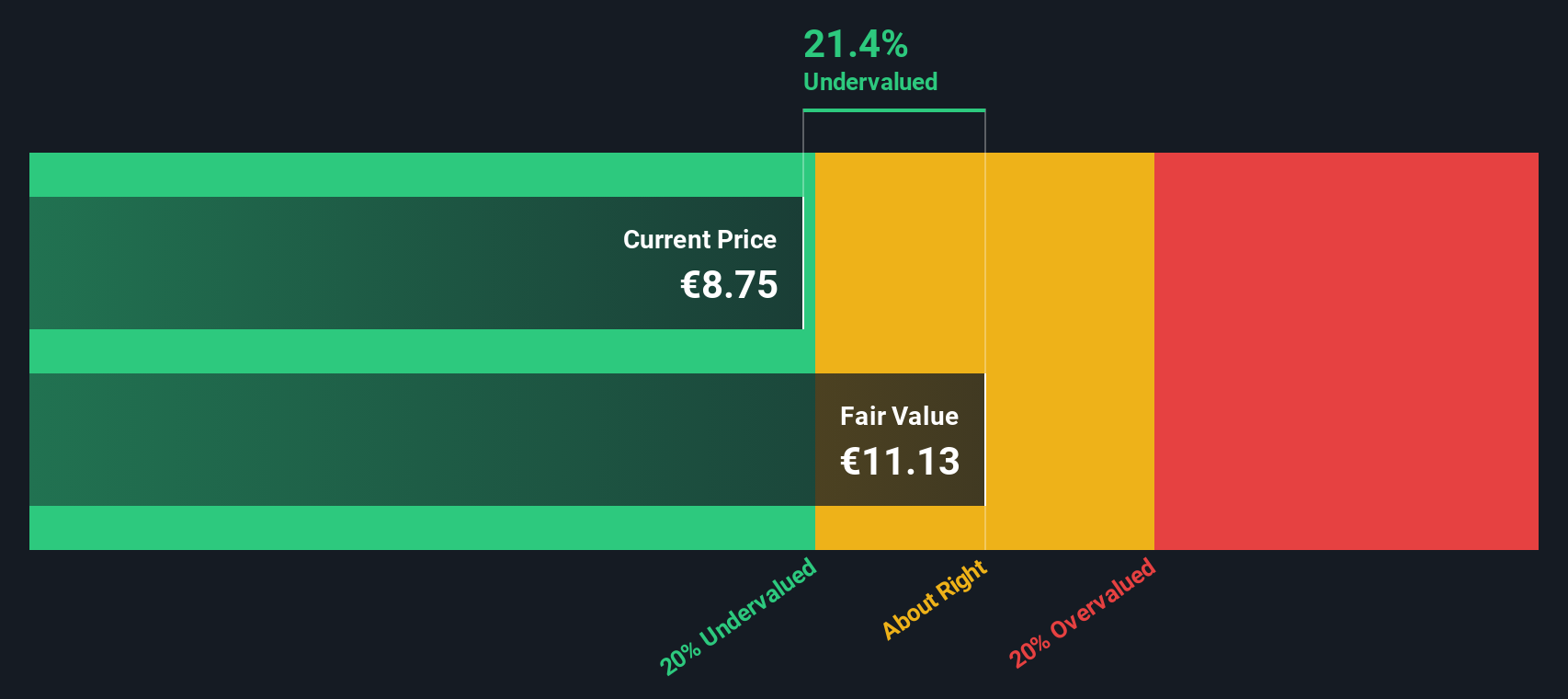

While analyst price targets put Banco Santander’s fair value below its current share price, our SWS DCF model offers a very different story. Using forward-looking cash flow estimates, this method values the stock at €11.13, which is about 22% higher than the market. Does this mean the recent rally still leaves plenty of upside?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Banco Santander Narrative

If you think your perspective differs or you prefer hands-on research, you can develop your own view in just a few minutes, and Do it your way.

A great starting point for your Banco Santander research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors know the next big opportunity rarely waits. Expand your horizons right now and uncover unique stocks driving growth, innovation, and reliable income.

- Tap into future technology trends by checking out these 23 AI penny stocks which are set to transform major industries with artificial intelligence innovation.

- Enhance your portfolio with stable cash flows and resilience by exploring these 916 undervalued stocks based on cash flows that offer strong potential at attractive prices.

- Maximize your yield potential with these 19 dividend stocks with yields > 3% designed for consistent returns through superior dividend performance and healthy fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Banco Santander might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:SAN

Banco Santander

Provides various financial products and services to individuals, small and medium-sized enterprises, large corporations, and public entities worldwide.

Good value with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives