The Bull Case For Banco Sabadell (BME:SAB) Could Change Following Analyst Downgrade After TSB Divestment

Reviewed by Sasha Jovanovic

- Banco Sabadell reported its Q3 2025 results, highlighting a recurrent return on tangible equity of 14.1%, confirmed guidance across all profit and loss lines, announced a second interim dividend payable in December, and outlined plans for an extraordinary dividend from the TSB divestment.

- An analyst downgrade followed, citing concerns about Sabadell’s growing reliance on the Spanish market after the TSB sale and questioning future revenue diversification.

- We'll examine how Sabadell's reaffirmation of 2027 targets, alongside new market concentration concerns, could affect the company's investment outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Banco de Sabadell Investment Narrative Recap

To be a shareholder in Banco de Sabadell, you need to believe in its core Spanish banking franchise, disciplined capital return, and ability to sustain earnings in a concentrated market. The recent Q3 results, with robust capital generation and a reaffirmation of 2027 targets, do not materially alter the key short-term catalyst, distribution of capital from the sale of TSB, but do reinforce the near-term risk: increased reliance on Spain after TSB’s divestment.

Announcing a second interim dividend and plans for an extraordinary payout from the TSB sale, Sabadell underscores its commitment to returning capital to shareholders. This remains highly relevant to the catalyst of near-term total shareholder returns, even as some analysts voice concern over emerging market concentration risks following the TSB exit.

However, against these positives, it is worth highlighting that when a bank’s income becomes tied to a single market ...

Read the full narrative on Banco de Sabadell (it's free!)

Banco de Sabadell's outlook forecasts €7.0 billion in revenue and €1.8 billion in earnings by 2028. This is based on an expected annual revenue growth rate of 5.2% and an earnings decrease of €0.1 billion from current earnings of €1.9 billion.

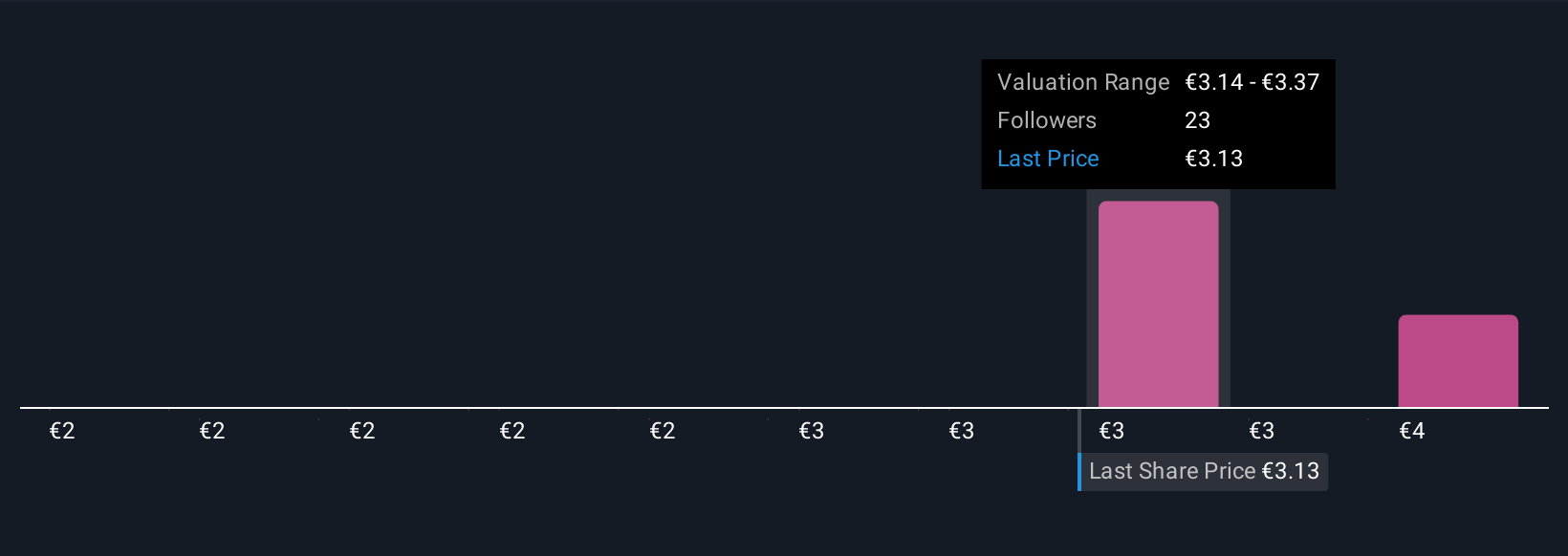

Uncover how Banco de Sabadell's forecasts yield a €3.34 fair value, a 5% upside to its current price.

Exploring Other Perspectives

Seven members of the Simply Wall St Community place Sabadell’s fair value in a wide band from €2.15 to €3.82 per share. While this shows the breadth of opinion, the big question remains whether Sabadell’s growing reliance on the Spanish market could affect the company’s future earnings stability, explore how others are weighing the trade-offs.

Explore 7 other fair value estimates on Banco de Sabadell - why the stock might be worth 32% less than the current price!

Build Your Own Banco de Sabadell Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Banco de Sabadell research is our analysis highlighting 3 key rewards and 5 important warning signs that could impact your investment decision.

- Our free Banco de Sabadell research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Banco de Sabadell's overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Banco de Sabadell might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:SAB

Banco de Sabadell

Provides banking products and services to personal, business, and private customers in Spain and internationally.

Good value with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives