Does Bankinter’s Recent 88% Price Surge Signal Limited Upside in 2025?

Reviewed by Bailey Pemberton

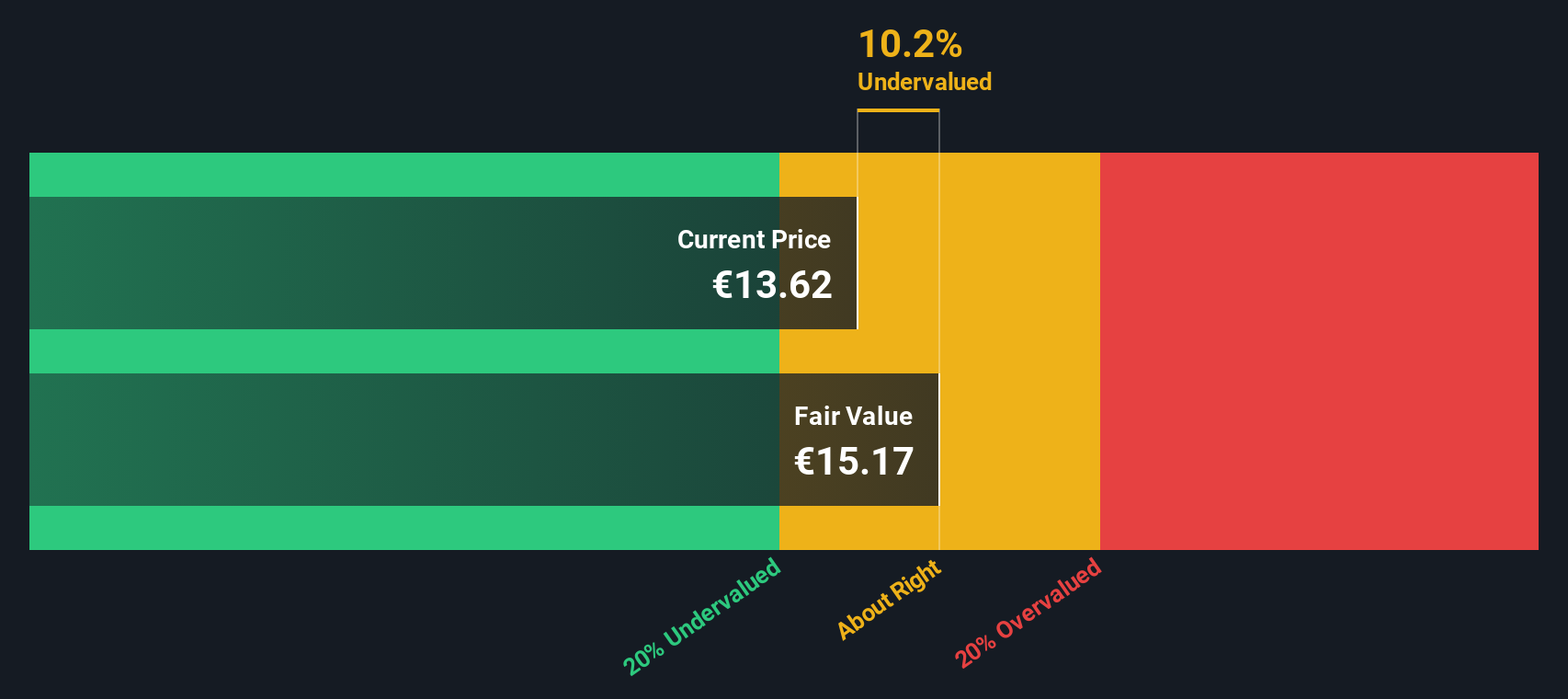

Trying to figure out what to do with Bankinter stock? You are not alone. After a strong run over the past few years, with shares up 10.2% in the past month and a striking 88.3% in the last year, interest in this Spanish banking player is at a high. This is even more notable when you look at the longer term. Bankinter’s stock has soared an impressive 553.9% over the last five years, outpacing most of its sector peers.

Some of these big moves have been linked to positive shifts in the European banking landscape and renewed confidence from investors after a period of uncertainty. As financial markets recalibrate risk and growth potential, it seems Bankinter has managed to land on the right side of sentiment, at least for now. But with all these gains, the question naturally follows: does the stock still offer value, or is it getting ahead of itself?

When we dig into pure valuation, Bankinter clocks a score of 1 out of 6 possible checks indicating undervaluation. That may not sound overly compelling. Most metrics right now suggest the stock is closer to fairly valued, or even a little stretched, versus historical norms. But of course, headline numbers can sometimes miss hidden strengths or future upside.

Let’s break down those valuation approaches, one by one, and see what they really tell us about where Bankinter stands today. And just as importantly, we will look for a smarter path to understanding whether the price truly matches the potential.

Bankinter scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Bankinter Excess Returns Analysis

The Excess Returns valuation approach estimates intrinsic value by looking at how much return Bankinter generates over and above its cost of equity. Instead of focusing solely on profits or dividends, this model zeroes in on whether the bank is making its equity capital work harder than simply returning it to shareholders.

For Bankinter, the details are telling. The Book Value per share currently stands at €7.25, while future projections suggest a stable Book Value of €7.82 per share. The bank’s anticipated Stable EPS is €1.28 per share, based on future Return on Equity estimates from 16 analysts. Its Cost of Equity is €0.74 per share, with the Excess Return on that capital calculated at €0.54 per share. This indicates Bankinter is actively creating value from what it invests. Over the long term, the average Return on Equity comes in at a robust 16.36%, further reinforcing investor confidence.

Factoring these elements together, the Excess Returns model suggests Bankinter’s shares are intrinsically worth about 9.1% more than their current price. Since the estimated discount is just below the 10% mark, this points to Bankinter being very close to fairly valued in the current market.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Bankinter's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: Bankinter Price vs Earnings

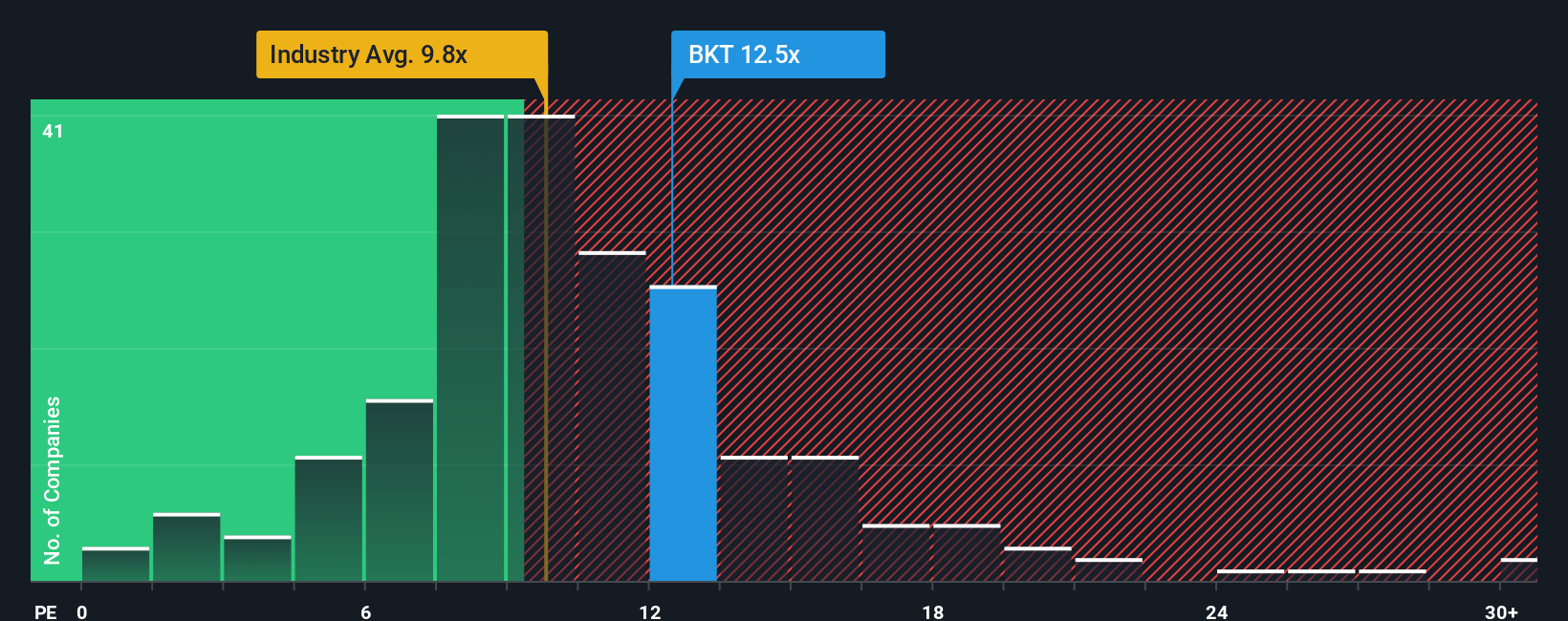

The Price-to-Earnings (PE) ratio is a favored valuation tool for profitable companies like Bankinter because it directly links a company's share price with its earnings power. For businesses that consistently generate profits, the PE ratio offers a straightforward way of assessing how much investors are willing to pay for each euro of earnings.

Market expectations for earnings growth, risk, and overall profitability all influence what counts as a “normal” or “fair” PE multiple. Companies with stronger growth prospects and safer earnings streams generally command higher PE ratios, while riskier or slower-growing firms trade at lower multiples.

Currently, Bankinter trades at a PE of 12.6x. This is higher than the banking industry average of 10.3x and its peer group average of 9.7x, suggesting that the market is attaching a premium to Bankinter’s shares relative to those benchmarks. However, Simply Wall St's proprietary "Fair Ratio" for Bankinter is 10.1x. This Fair Ratio reflects not just earnings, but also factors like growth outlook, profit margins, competitive risks, the size of the business, and its market dynamics.

Using the Fair Ratio is more insightful than a simple peer or industry comparison. It considers specific characteristics that can make a company deserve a higher or lower multiple, rather than relying on broad averages that may not tell the whole story.

With Bankinter’s actual PE at 12.6x and its Fair Ratio at 10.1x, the shares look a bit expensive on this measure. The gap is just above the threshold for a neutral call.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Bankinter Narrative

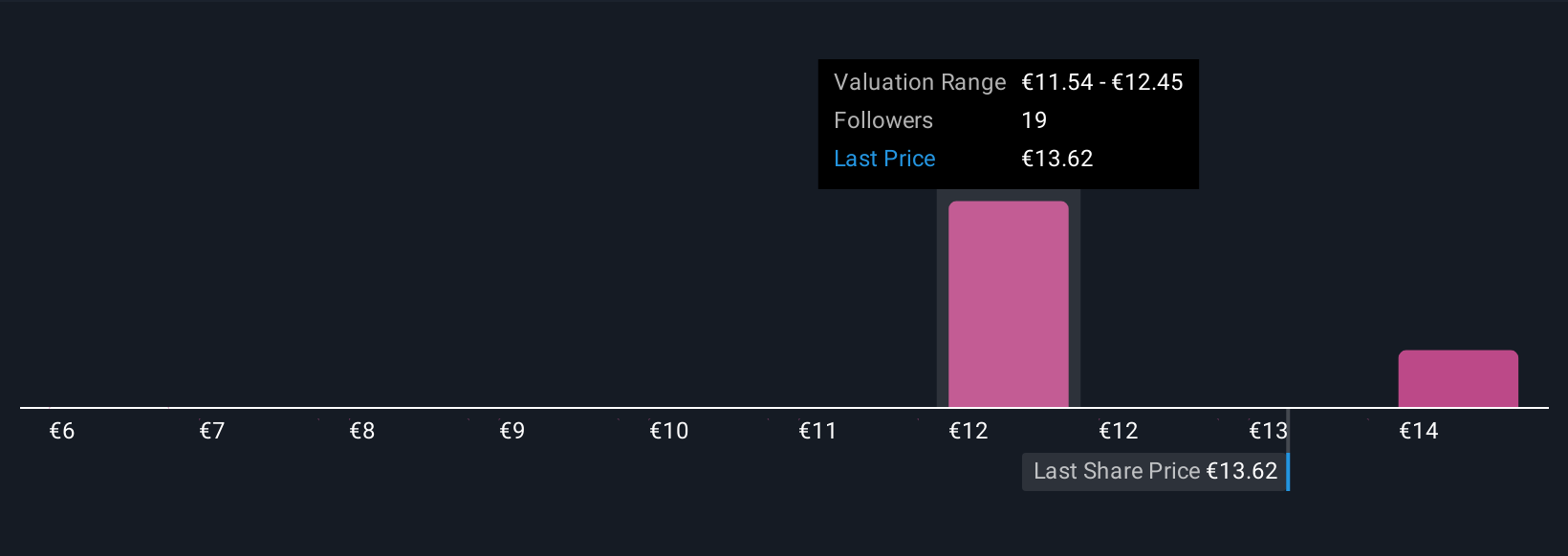

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your story about a company, combining your beliefs about its future revenue, earnings, and margins into a single picture that links the business’s journey to its financial numbers and ultimately to your own estimate of fair value. Narratives make investing personal and powerful because they let you factor in the latest news, your outlook on strategy, and your forecasts, moving past simple ratios to a more nuanced approach.

On Simply Wall St's platform, millions of investors already use Narratives through the Community page, making it easy for anyone to see, write, and share different perspectives on a company's future. Narratives are updated automatically as new data or events (like earnings or news) come in, so your insights always reflect the most recent information. By comparing the Fair Value from your Narrative against today’s Price, you get a clear, actionable view on whether to buy, hold, or sell.

For Bankinter, for instance, some investors see digital transformation and international growth driving a fair value as high as €14, while others, focusing on domestic risks and market challenges, land closer to €10.1. Your own Narrative matters more than ever.

Do you think there's more to the story for Bankinter? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bankinter might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:BKT

Bankinter

Provides various banking products and services to individuals and corporate customers, and small- and medium-sized enterprises in Spain.

Average dividend payer with moderate growth potential.

Similar Companies

Market Insights

Community Narratives