Generally speaking long term investing is the way to go. But along the way some stocks are going to perform badly. Zooming in on an example, the Bankia, S.A. (BME:BKIA) share price dropped 67% in the last half decade. We certainly feel for shareholders who bought near the top. And some of the more recent buyers are probably worried, too, with the stock falling 40% in the last year. Shareholders have had an even rougher run lately, with the share price down 18% in the last 90 days.

See our latest analysis for Bankia

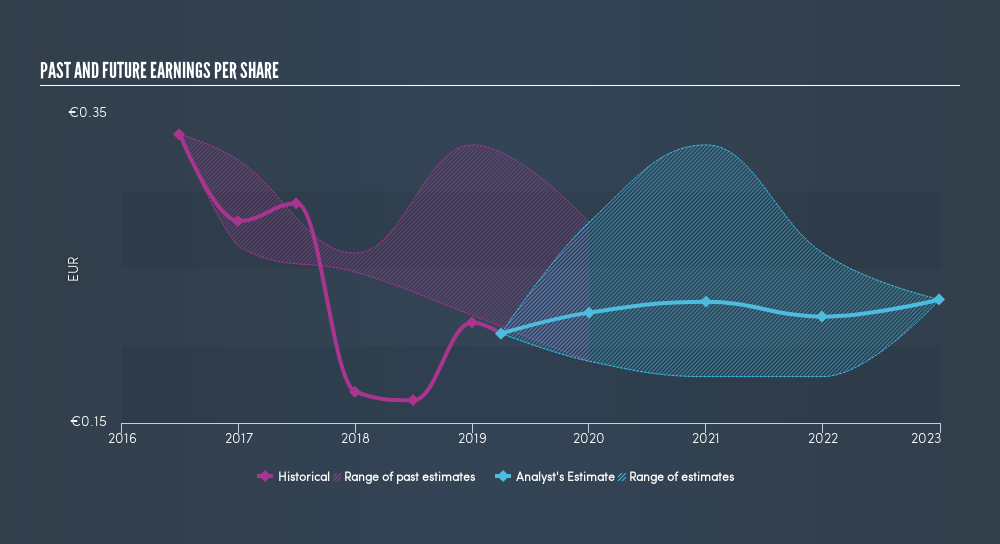

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the five years over which the share price declined, Bankia's earnings per share (EPS) dropped by 17% each year. Notably, the share price has fallen at 20% per year, fairly close to the change in the EPS. This implies that the market has had a fairly steady view of the stock. Rather, the share price has approximately tracked EPS growth.

We know that Bankia has improved its bottom line over the last three years, but what does the future have in store? You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Bankia's TSR for the last 5 years was -63%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

While the broader market lost about 0.5% in the twelve months, Bankia shareholders did even worse, losing 37% (even including dividends). Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 18% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. If you would like to research Bankia in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

We will like Bankia better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on ES exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Market Insights

Community Narratives