How Investors May Respond To Banco Bilbao Vizcaya Argentaria (BME:BBVA) Q3 Results and Share Buyback Initiative

Reviewed by Sasha Jovanovic

- Banco Bilbao Vizcaya Argentaria, S.A. has reported its third-quarter 2025 results, recording €6.64 billion in net interest income and €2.53 billion in net income, alongside the announcement of a share buyback program aimed at enhancing shareholder value.

- While net interest income rose compared to the previous year, net profit saw a slight decline, pointing to shifting operational dynamics within the bank’s core markets.

- We'll look at how BBVA’s higher net interest income and new share buyback shape its investment narrative and future expectations.

Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

Banco Bilbao Vizcaya Argentaria Investment Narrative Recap

To be a shareholder of Banco Bilbao Vizcaya Argentaria today, you need confidence in the bank’s ability to drive growth through expanding financial inclusion and digital transformation across emerging markets like Mexico and Turkey, while recognizing that short-term earnings may fluctuate with macroeconomic volatility. The recent Q3 earnings report, showing higher net interest income but a slight net profit dip, does not materially alter the major catalysts or most pressing risks: BBVA’s exposure to political and currency instability in emerging markets remains significant, and core earnings growth is still shaped by interest rate trends.

Among the recent announcements, BBVA’s new share buyback program is particularly relevant to the current investment discussion. Share buybacks can directly impact shareholder returns and market perception, especially at a time when net profit is under modest pressure, even as the bank continues to focus on balance sheet strength and returning value.

However, investors should pay close attention to how fluctuations in emerging market currencies could still...

Read the full narrative on Banco Bilbao Vizcaya Argentaria (it's free!)

Banco Bilbao Vizcaya Argentaria's narrative projects €39.4 billion revenue and €11.4 billion earnings by 2028. This requires 7.9% yearly revenue growth and an increase of €1.3 billion in earnings from €10.1 billion today.

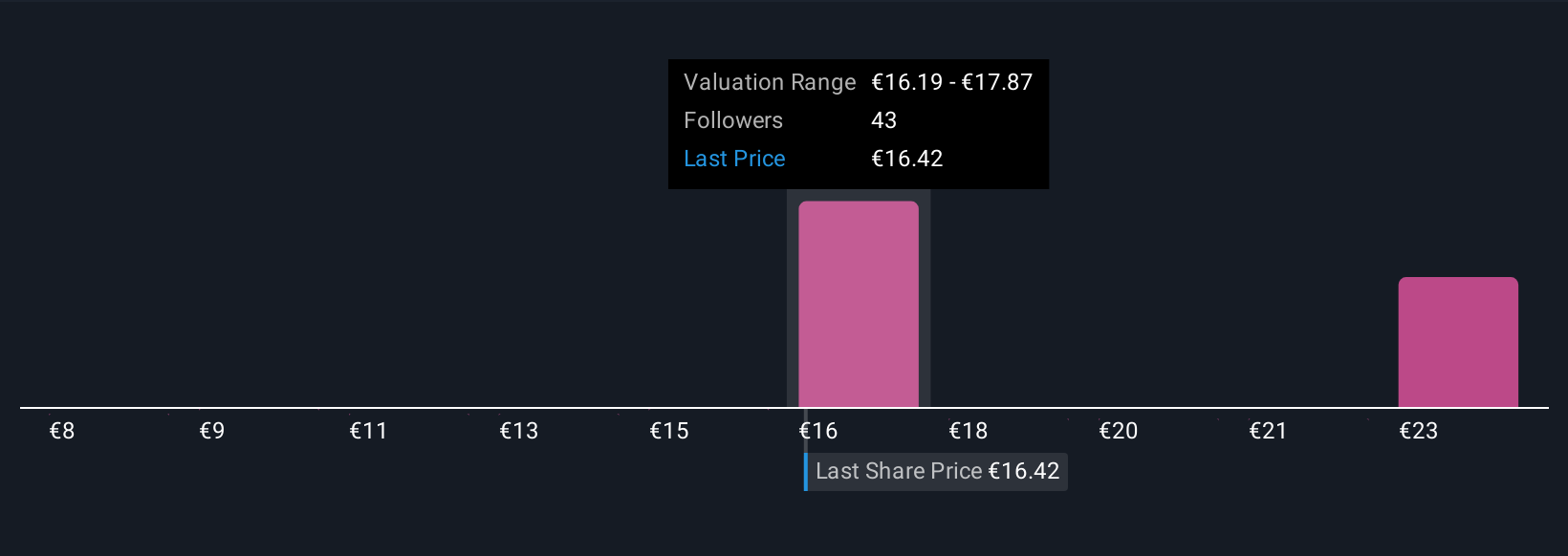

Uncover how Banco Bilbao Vizcaya Argentaria's forecasts yield a €16.90 fair value, a 4% downside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have issued fair value estimates for BBVA ranging from €10.53 to €24.38, with nine unique perspectives reflected. Many see opportunity as the bank’s performance remains sensitive to swings in emerging market conditions, underlining why viewpoints differ so widely.

Explore 9 other fair value estimates on Banco Bilbao Vizcaya Argentaria - why the stock might be worth as much as 39% more than the current price!

Build Your Own Banco Bilbao Vizcaya Argentaria Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Banco Bilbao Vizcaya Argentaria research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Banco Bilbao Vizcaya Argentaria research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Banco Bilbao Vizcaya Argentaria's overall financial health at a glance.

No Opportunity In Banco Bilbao Vizcaya Argentaria?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Banco Bilbao Vizcaya Argentaria might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:BBVA

Banco Bilbao Vizcaya Argentaria

Provides retail banking, wholesale banking, and asset management services primarily in Spain, Mexico, Turkey, South America, rest of Europe, the United States, and Asia.

Good value with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives