As the European market experiences a mix of gains and losses, with Germany's DAX showing positive momentum while France's CAC 40 and the UK's FTSE 100 see slight declines, investors are closely watching the European Central Bank's potential rate hikes amid resilient economic indicators. In this fluctuating environment, dividend stocks can offer a stable income stream, making them an attractive option for those seeking to balance growth with regular returns.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.16% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.64% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.05% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.87% | ★★★★★★ |

| Evolution (OM:EVO) | 4.88% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.10% | ★★★★★★ |

| Credito Emiliano (BIT:CE) | 4.90% | ★★★★★☆ |

| Cembra Money Bank (SWX:CMBN) | 4.26% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.27% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.44% | ★★★★★☆ |

Click here to see the full list of 202 stocks from our Top European Dividend Stocks screener.

We'll examine a selection from our screener results.

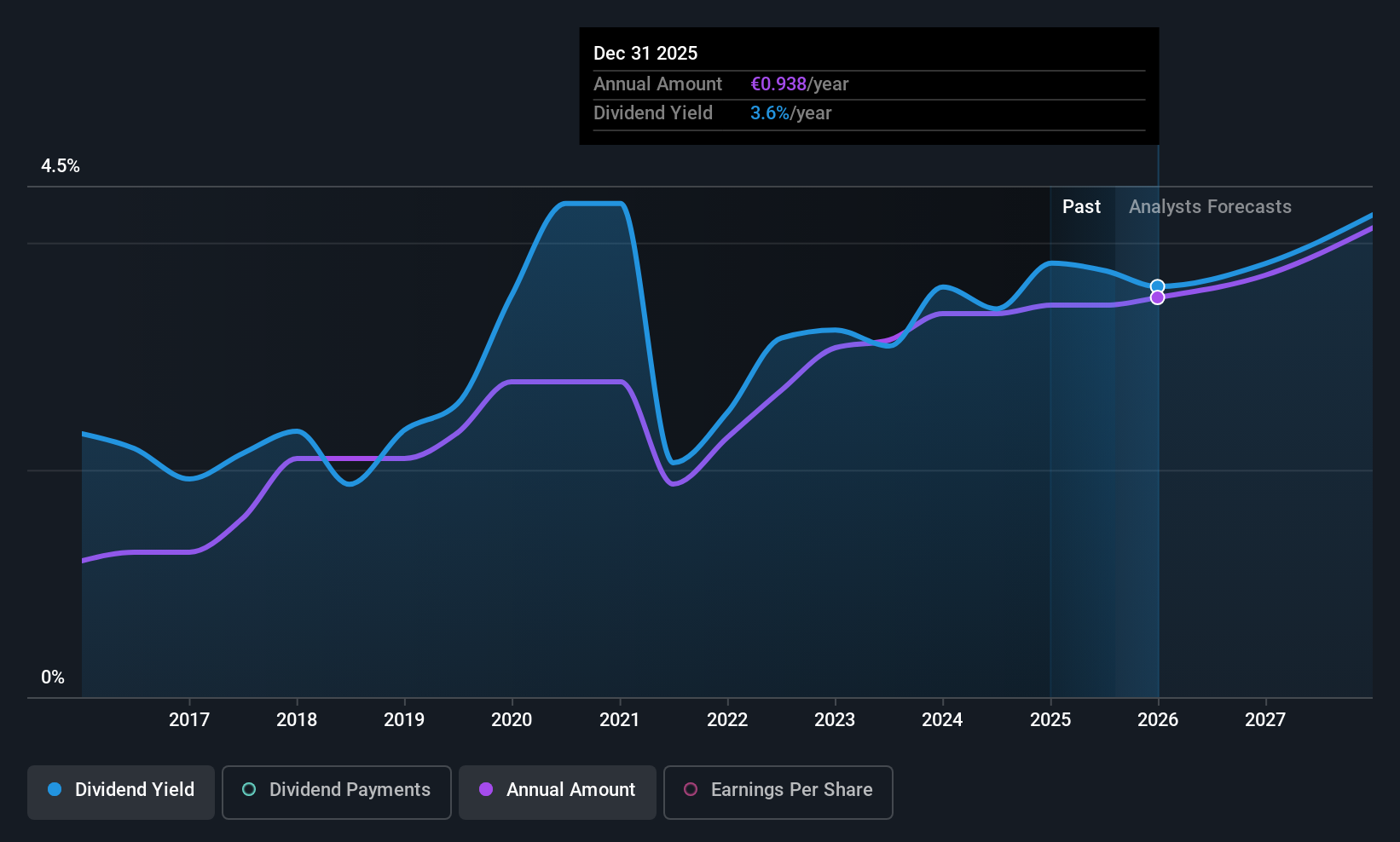

CIE Automotive (BME:CIE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CIE Automotive, S.A., along with its subsidiaries, designs, manufactures, and sells automotive components and sub-assemblies, with a market cap of €3.56 billion.

Operations: CIE Automotive generates revenue through the design, manufacturing, and sale of automotive components and sub-assemblies.

Dividend Yield: 3.1%

CIE Automotive offers a mixed profile for dividend investors. While its dividends are well-covered by earnings and cash flows, with payout ratios of 16.6% and 32.1% respectively, the dividend yield of 3.1% is lower than top-tier Spanish market payers. Its dividend history has been volatile over the past decade, despite recent earnings growth of 6.4%. Recent events include a €120 million stake acquisition by an undisclosed buyer, reflecting ongoing investor interest.

- Unlock comprehensive insights into our analysis of CIE Automotive stock in this dividend report.

- Insights from our recent valuation report point to the potential undervaluation of CIE Automotive shares in the market.

Caisse Régionale de Crédit Agricole Mutuel de la Touraine et du Poitou Société Coopérative (ENXTPA:CRTO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Caisse Régionale de Crédit Agricole Mutuel de La Touraine et du Poitou Société Coopérative offers a range of banking products and services in France, with a market cap of €663.53 million.

Operations: Caisse Régionale de Crédit Agricole Mutuel de La Touraine et du Poitou Société Coopérative operates in France, focusing on delivering a variety of banking products and services.

Dividend Yield: 3%

Caisse Régionale de Crédit Agricole Mutuel de la Touraine et du Poitou Société Coopérative provides a stable dividend history over the past decade, with payments reliably growing and well-covered by earnings due to a low payout ratio of 25%. However, its dividend yield of 3.03% is below top-tier French market payers. Recent half-year earnings were slightly lower at €64.57 million compared to last year, and funding relies heavily on higher-risk external borrowing sources.

- Delve into the full analysis dividend report here for a deeper understanding of Caisse Régionale de Crédit Agricole Mutuel de la Touraine et du Poitou Société Coopérative.

- Our valuation report here indicates Caisse Régionale de Crédit Agricole Mutuel de la Touraine et du Poitou Société Coopérative may be undervalued.

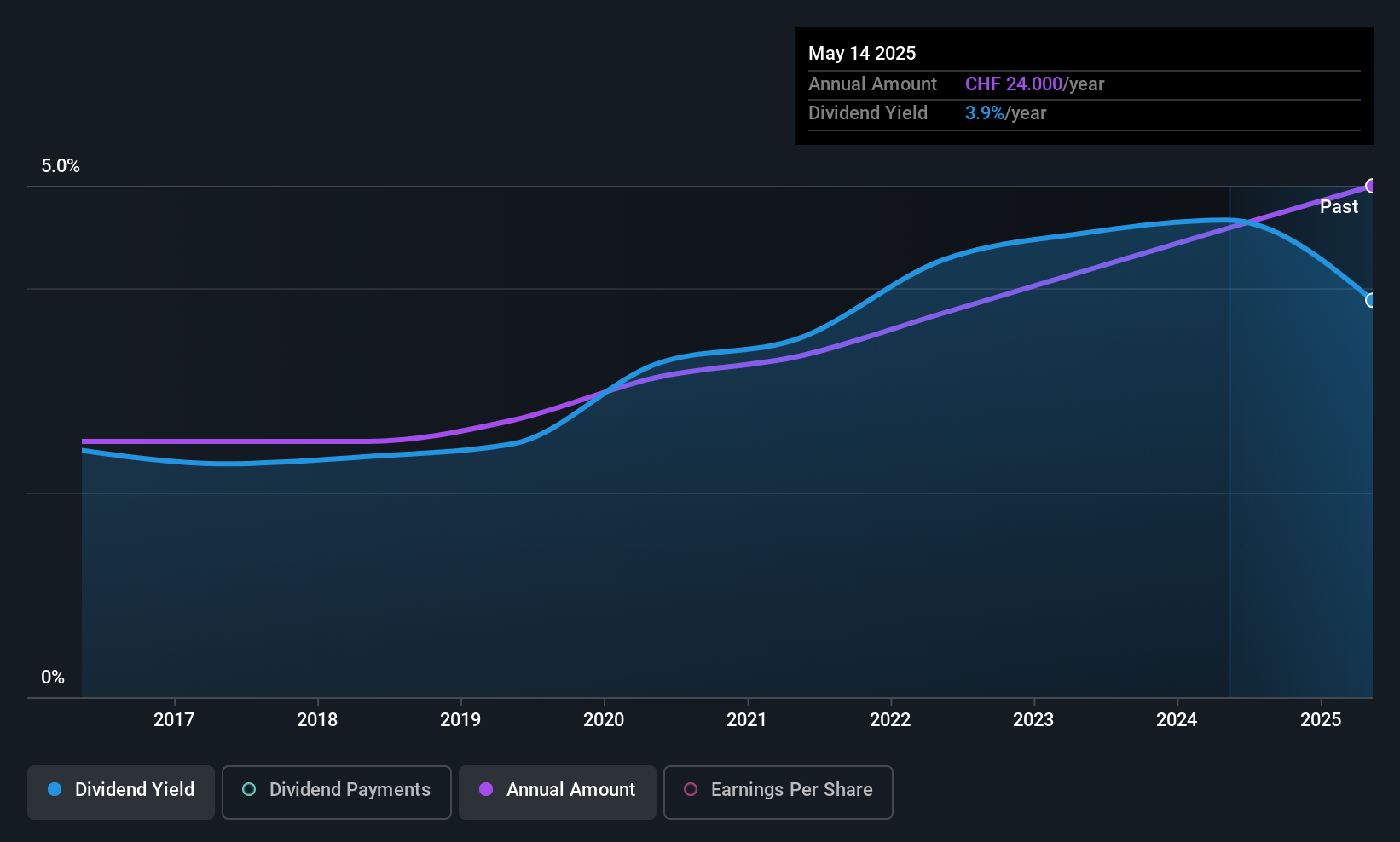

Vaudoise Assurances Holding (SWX:VAHN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Vaudoise Assurances Holding SA offers insurance products and services mainly in Switzerland, with a market cap of CHF2 billion.

Operations: Vaudoise Assurances Holding SA generates its revenue from various insurance products and services in Switzerland.

Dividend Yield: 3.5%

Vaudoise Assurances Holding offers a stable dividend history with consistent growth over the past decade, supported by a low payout ratio of 46.5%, ensuring coverage by earnings despite lacking free cash flow support. However, its 3.47% yield is below the top tier in the Swiss market. Recently added to the S&P Global BMI Index, it trades at a significant discount to its estimated fair value, presenting potential for capital appreciation alongside dividends.

- Navigate through the intricacies of Vaudoise Assurances Holding with our comprehensive dividend report here.

- Our comprehensive valuation report raises the possibility that Vaudoise Assurances Holding is priced lower than what may be justified by its financials.

Summing It All Up

- Unlock our comprehensive list of 202 Top European Dividend Stocks by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:CRTO

Caisse Régionale de Crédit Agricole Mutuel de la Touraine et du Poitou Société Coopérative

Caisse Régionale de Crédit Agricole Mutuel de La Touraine et du Poitou Société Coopérative provides various banking products and services in France.

Adequate balance sheet average dividend payer.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion