- Denmark

- /

- Renewable Energy

- /

- CPSE:ORSTED

Ørsted (CPSE:ORSTED) Is Down 47.8% After Announcing DKK 59.99 Billion Rights Offering Has The Bull Case Changed?

Reviewed by Simply Wall St

- Ørsted A/S recently announced a follow-on equity offering, filing to raise DKK 59.99 billion by issuing 900,816,600 new ordinary shares at DKK 66.6 each.

- This sizable capital raise through a rights offering structure represents one of the largest share issuances in the company's history and signals a significant move to strengthen its financial position.

- Next, we'll explore how this capital-raising effort through a large-scale rights offering could impact Ørsted's investment narrative.

Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Ørsted's Investment Narrative?

For anyone considering Ørsted as an investment, the big picture is still centered on the future of global renewables and Ørsted’s ability to stay a leader as the industry scales. The recent DKK59.99 billion rights offering marks a dramatic move to shore up the balance sheet right after a period of financial recovery, with fresh profitability highlighted in the latest earnings. While accelerating profit growth had looked like a short-term catalyst, such a huge capital raise directly affecting share count and price now puts immediate focus on whether Ørsted can deploy that new capital into growth fast enough to justify dilution. On the risk side, already high board turnover and recent project cancellations could be amplified by the pressure from this offering. At the same time, with the share price sharply down, expectations and valuations may need to be reset across the board.

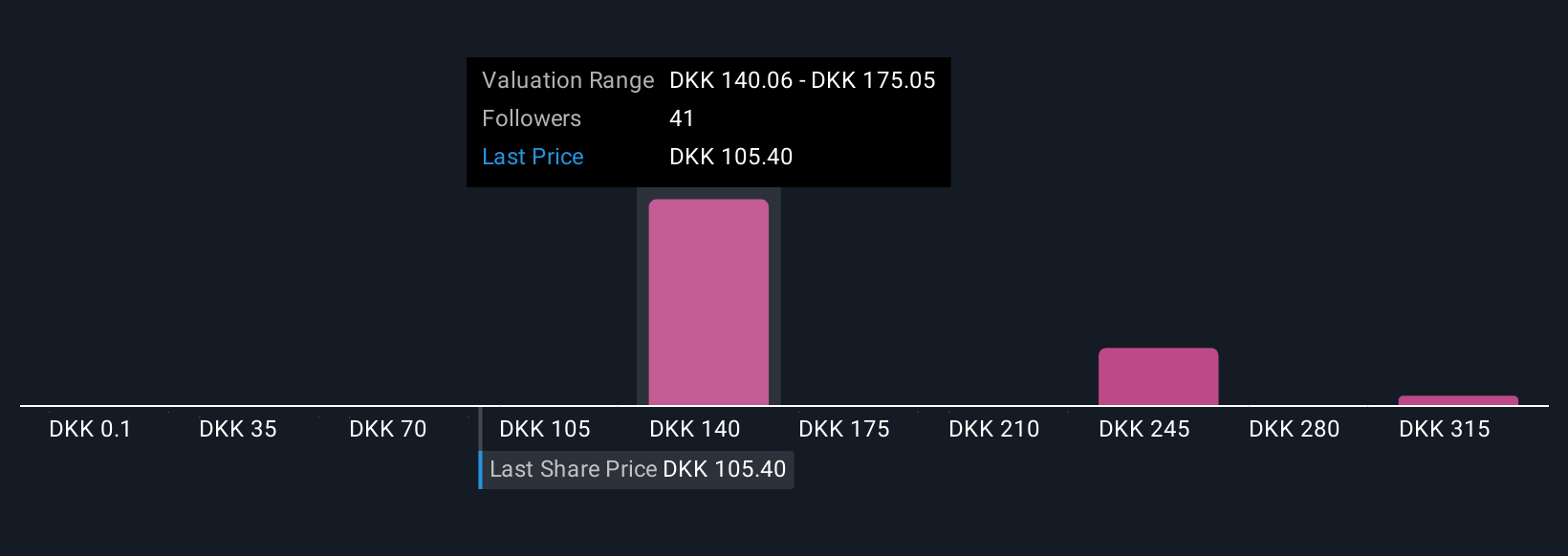

But lingering board inexperience remains a concern investors should not overlook. Despite retreating, Ørsted's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 11 other fair value estimates on Ørsted - why the stock might be worth less than half the current price!

Build Your Own Ørsted Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ørsted research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Ørsted research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ørsted's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ørsted might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:ORSTED

Ørsted

Owns, develops, constructs, and operates offshore and onshore wind farms, solar farms, energy storage and renewable hydrogen facilities, and bioenergy plants.

Good value with low risk.

Similar Companies

Market Insights

Community Narratives