- Denmark

- /

- Transportation

- /

- CPSE:NTG

European Growth Stocks With Significant Insider Ownership

Reviewed by Simply Wall St

In recent weeks, the European market has experienced mixed performances, with the pan-European STOXX Europe 600 Index ending slightly lower as expectations for further interest rate cuts from the European Central Bank diminished. Amidst this backdrop of economic uncertainty and geopolitical tensions, growth companies with high insider ownership can be particularly appealing as they often indicate strong confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Pharma Mar (BME:PHM) | 12% | 58.2% |

| MilDef Group (OM:MILDEF) | 13.7% | 83% |

| MedinCell (ENXTPA:MEDCL) | 12.5% | 95.9% |

| Magnora (OB:MGN) | 10.4% | 75.1% |

| KebNi (OM:KEBNI B) | 36.3% | 69.2% |

| Egetis Therapeutics (OM:EGTX) | 10.3% | 85.9% |

| CTT Systems (OM:CTT) | 17.5% | 52% |

| Circus (XTRA:CA1) | 24.1% | 65.5% |

| CD Projekt (WSE:CDR) | 29.7% | 49.6% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 51.4% |

Let's dive into some prime choices out of the screener.

NTG Nordic Transport Group (CPSE:NTG)

Simply Wall St Growth Rating: ★★★★★☆

Overview: NTG Nordic Transport Group A/S, with a market cap of DKK3.89 billion, offers asset-light freight forwarding services across road, rail, air, and ocean in Denmark, Sweden, the United States, Germany, Finland, and internationally.

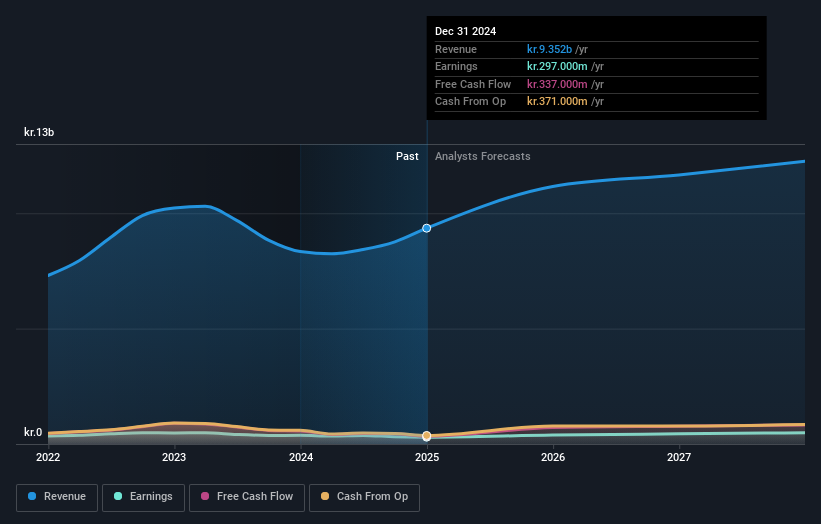

Operations: NTG Nordic Transport Group's revenue is primarily derived from its Road & Logistics segment, which accounts for DKK7.66 billion, and its Air & Ocean segment, contributing DKK2.83 billion.

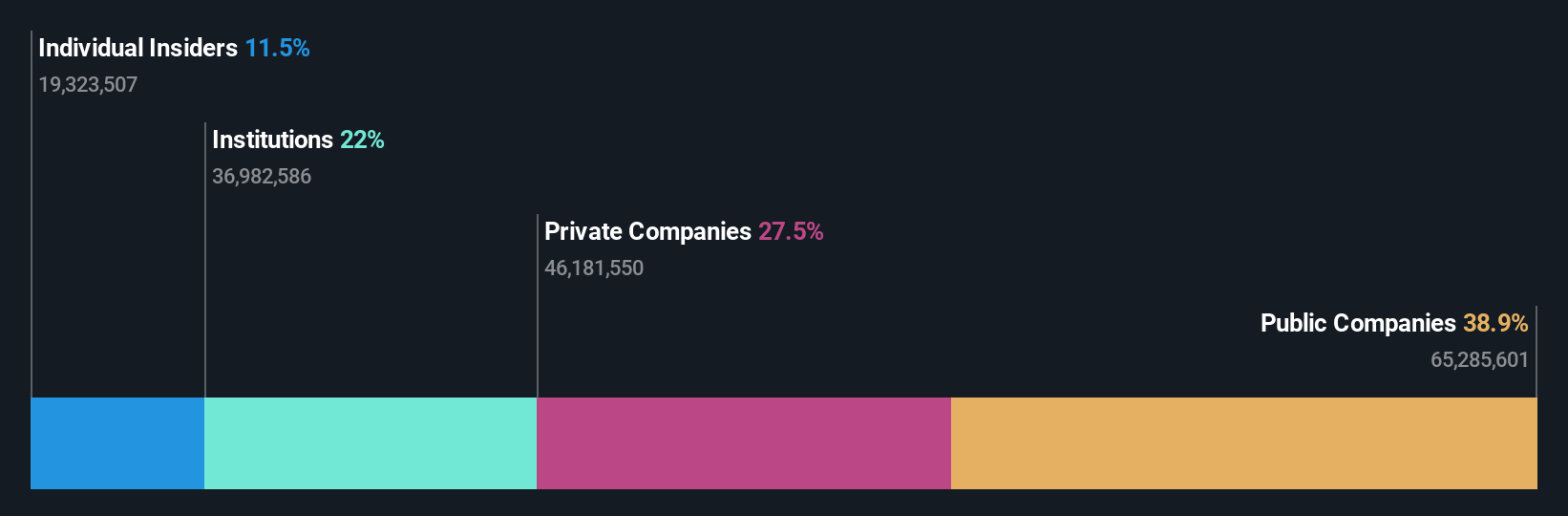

Insider Ownership: 14.7%

NTG Nordic Transport Group exhibits strong growth potential, with earnings forecasted to grow significantly at 31.2% annually, outpacing the Danish market. Despite trading at 72.1% below its estimated fair value, NTG faces challenges with declining profit margins and a high debt level. Recent earnings showed increased sales but reduced net income and EPS compared to last year, reflecting operational pressures despite promising revenue growth forecasts of 6.9% per year.

- Unlock comprehensive insights into our analysis of NTG Nordic Transport Group stock in this growth report.

- The analysis detailed in our NTG Nordic Transport Group valuation report hints at an deflated share price compared to its estimated value.

Swedencare (OM:SECARE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Swedencare AB (publ) develops, manufactures, markets, and sells animal healthcare products for cats, dogs, and horses across North America, Europe, and internationally with a market cap of SEK5.75 billion.

Operations: The company's revenue segments include SEK599.80 million from Europe, SEK682.50 million from Production, and SEK1.62 billion from North America.

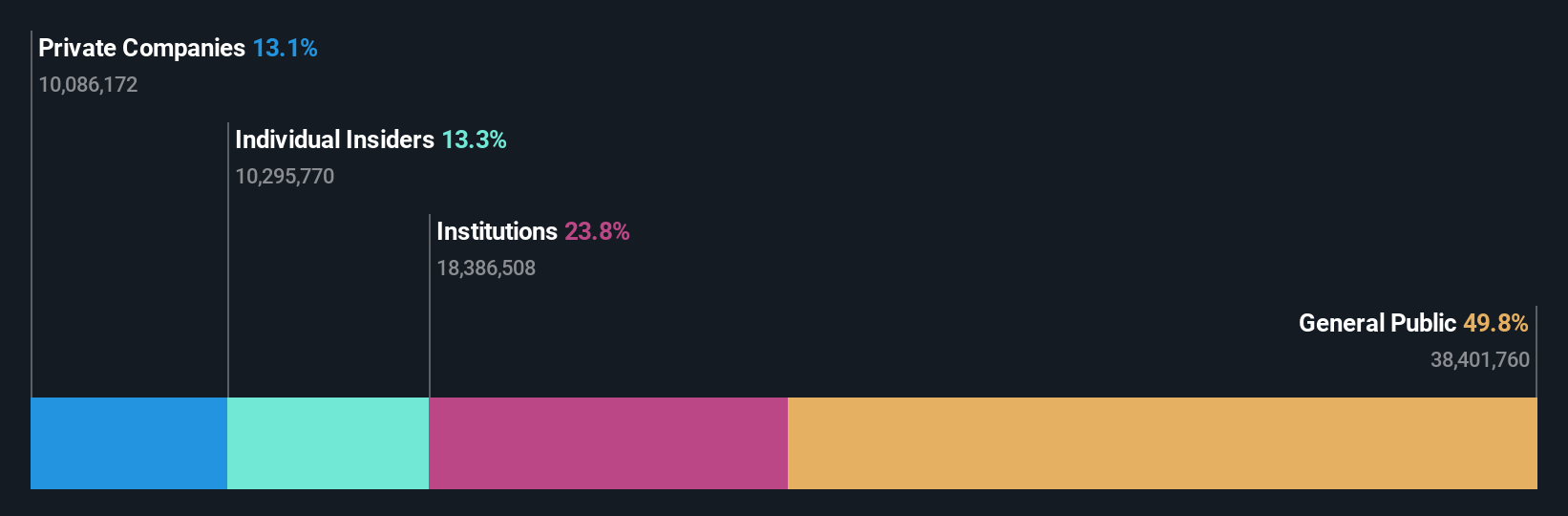

Insider Ownership: 11.6%

Swedencare's earnings are projected to grow significantly at 69.7% annually, surpassing the Swedish market's growth rate. Despite trading 67.9% below its estimated fair value, recent earnings report a slight decline in net income and EPS year-on-year, indicating potential operational challenges. Revenue is expected to increase by 9.9% per year, faster than the broader market but not exceeding high-growth benchmarks. Insider activity shows more buying than selling recently, though not in large volumes.

- Click to explore a detailed breakdown of our findings in Swedencare's earnings growth report.

- Upon reviewing our latest valuation report, Swedencare's share price might be too pessimistic.

Storytel (OM:STORY B)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Storytel AB (publ) offers streaming services for audiobooks and e-books, with a market cap of approximately SEK6.79 billion.

Operations: The company generates revenue primarily from its streaming services, which account for SEK3.48 billion, and publishing operations, contributing SEK1.24 billion.

Insider Ownership: 12.7%

Storytel's revenue is expected to grow at 7.4% annually, outpacing the Swedish market but not reaching high-growth thresholds. Earnings are projected to rise by 17.9% per year, faster than the market average. Recently profitable, Storytel trades significantly below its estimated fair value. The company has expanded through strategic partnerships with Klarna and RDF Media, enhancing its audiobook offerings across multiple markets without recent significant insider trading activity noted.

- Click here to discover the nuances of Storytel with our detailed analytical future growth report.

- Our comprehensive valuation report raises the possibility that Storytel is priced lower than what may be justified by its financials.

Next Steps

- Access the full spectrum of 191 Fast Growing European Companies With High Insider Ownership by clicking on this link.

- Seeking Other Investments? We've found 20 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if NTG Nordic Transport Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:NTG

NTG Nordic Transport Group

Provides asset-light freight forwarding services through road, rail, air, and ocean in Denmark, Sweden, the United States, Germany, Finland, and internationally.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives