- Denmark

- /

- Marine and Shipping

- /

- CPSE:MAERSK B

Is There Still Opportunity in Maersk as Shares Surge 55% Ahead of 2025?

Reviewed by Simply Wall St

If you have been weighing what to do with your A.P. Møller Mærsk stock, or are eyeing it for your portfolio, you are definitely not alone. With global trade dynamics constantly shifting and shipping stocks often acting as a barometer of economic sentiment, the decisions around this Danish giant are anything but dull right now.

Let’s cut straight to what has people talking. The mood around Mærsk has shifted over the past year. Shares are up a huge 54.7% over the last twelve months, powering through some choppier waters that hit much of the market. In the past week, the stock inched up by 0.7%, helping offset a softer stretch earlier this month when it slipped by 3.3% over thirty days. Year to date, it has still logged a healthy 8.0% gain, and if you zoom out to the last five years, the total return climbs to a striking 169.1%.

This renewed momentum is not just about shipping containers or short-term news flashes. Instead, it reflects changing risk perceptions among investors as global shipping routes adjust to new patterns and costs, plus some big-picture optimism about where the industry is heading. Against this backdrop, many are wondering whether this rally still has legs, or if the stock is running ahead of its true value.

On that front, the numbers are interesting. Based on six key valuation checks, Mærsk scores a 4 for undervaluation, suggesting it remains attractively priced by several measures but not all. In the next section, we will dig into those valuation approaches, while keeping an eye out for the bigger picture view that could add even more insight by the end of the article.

A.P. Møller - Mærsk delivered 54.7% returns over the last year. See how this stacks up to the rest of the Shipping industry.Approach 1: A.P. Møller Mærsk Discounted Cash Flow (DCF) Analysis

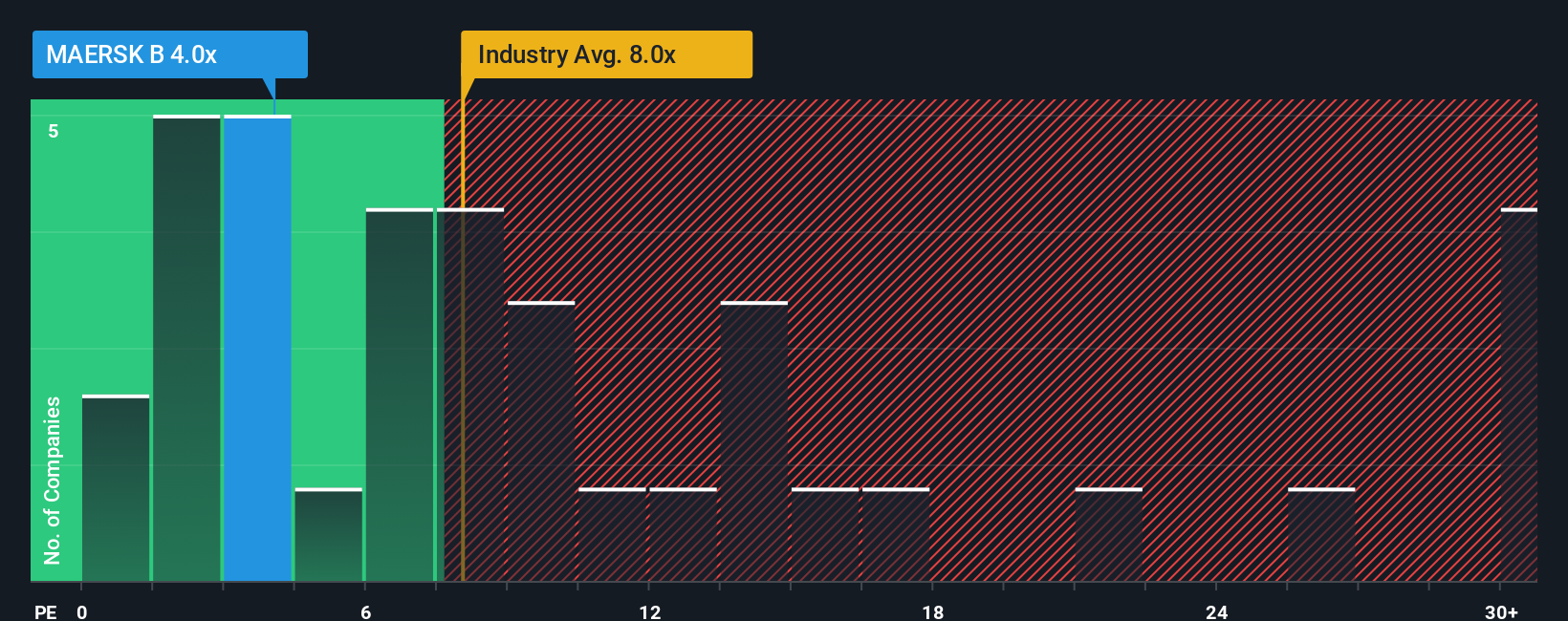

The Discounted Cash Flow (DCF) model estimates the intrinsic value of a company by projecting its future cash flows and discounting them back to today’s value, reflecting the time value of money. For A.P. Møller Mærsk, the DCF approach uses a two-stage Free Cash Flow to Equity model, which means cash flows are forecast over several years before growth is projected to level out.

Based on the latest available data, Mærsk’s trailing twelve-month Free Cash Flow stands at an impressive $9.28 Billion. Looking ahead, analysts expect the company’s free cash flow to fluctuate, starting with $80.20 Million in 2026 and increasing to $1.01 Billion by 2029. Beyond this, further growth projections by Simply Wall St show steady increases out to 2035, with cash flows potentially reaching above $4 Billion. These projections combine both analyst consensus and statistical extrapolation, providing a long-term outlook on value creation.

Bringing it together, the intrinsic value calculated is $28,717.74 per share. With the DCF model implying the stock is trading at a 53.0% discount to its fair value, Mærsk appears to be significantly undervalued at current prices.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for A.P. Møller - Mærsk.

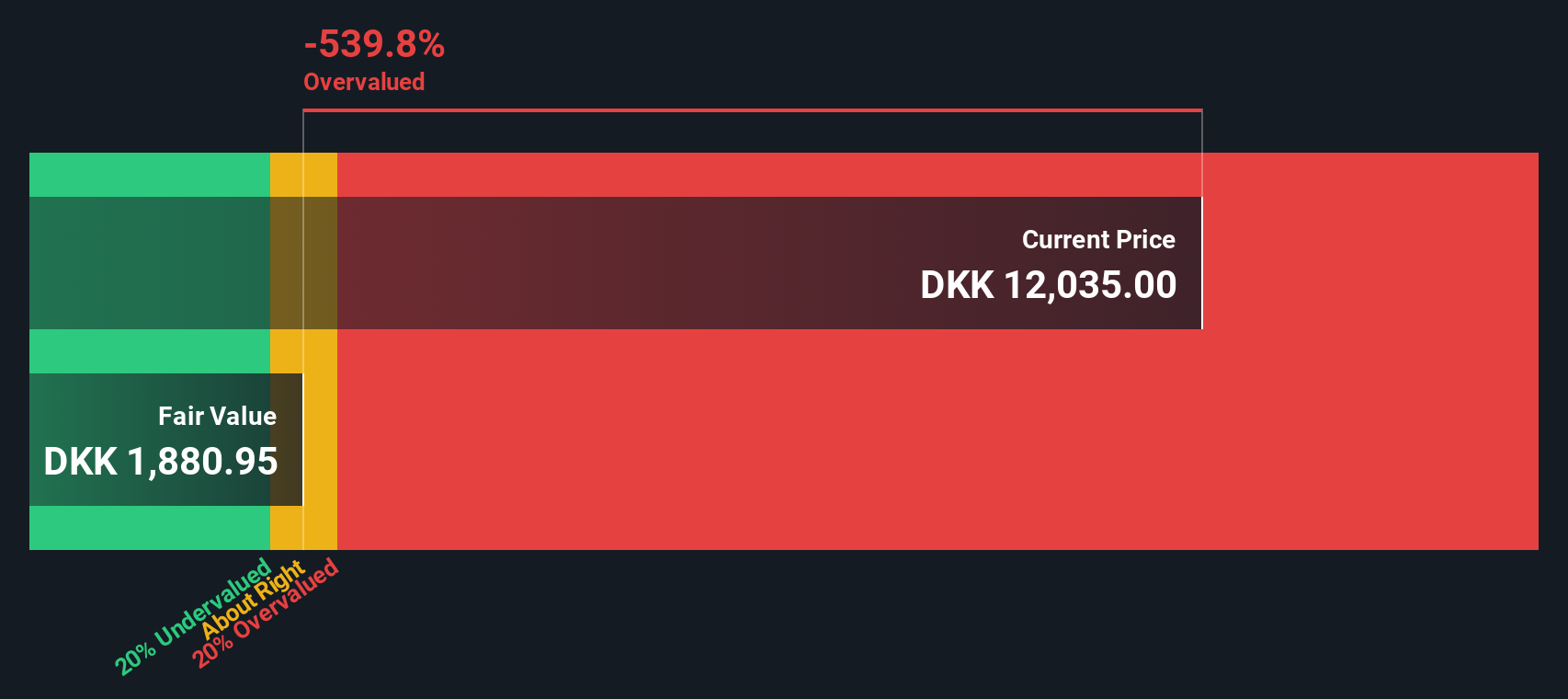

Approach 2: A.P. Møller - Mærsk Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies because it reflects how much investors are willing to pay for each unit of earnings. For businesses like A.P. Møller & Mærsk that consistently generate profits, PE is a go-to measure for assessing value in context.

"Normal" or "fair" PE ratios are not set in stone. They tend to rise when investors expect higher growth and fall when risks or uncertainties dominate the outlook. As a result, it is important to compare a company’s PE not only with its direct peers and industry averages, but also with broader market expectations.

Right now, A.P. Møller & Mærsk trades at a notably low PE ratio of 4.7x. That is less than half the industry average of 10.1x and far below the peer group’s 15.0x. This might suggest a substantial discount, but it is just one side of the story.

To provide a more accurate perspective, Simply Wall St calculates a proprietary “Fair Ratio,” blending together factors like expected earnings growth, risks, profit margins, the company’s global industry, and overall scale. Because it tailors to the specific context of each company, the Fair Ratio is a more nuanced tool than blanket peer or sector comparisons. For Mærsk, this Fair PE is 2.8x, which is lower than both its actual ratio and the industry averages. This indicates the stock may even be priced above its optimal level based on these fundamentals.

Result: OVERVALUED

Upgrade Your Decision Making: Choose your A.P. Møller - Mærsk Narrative

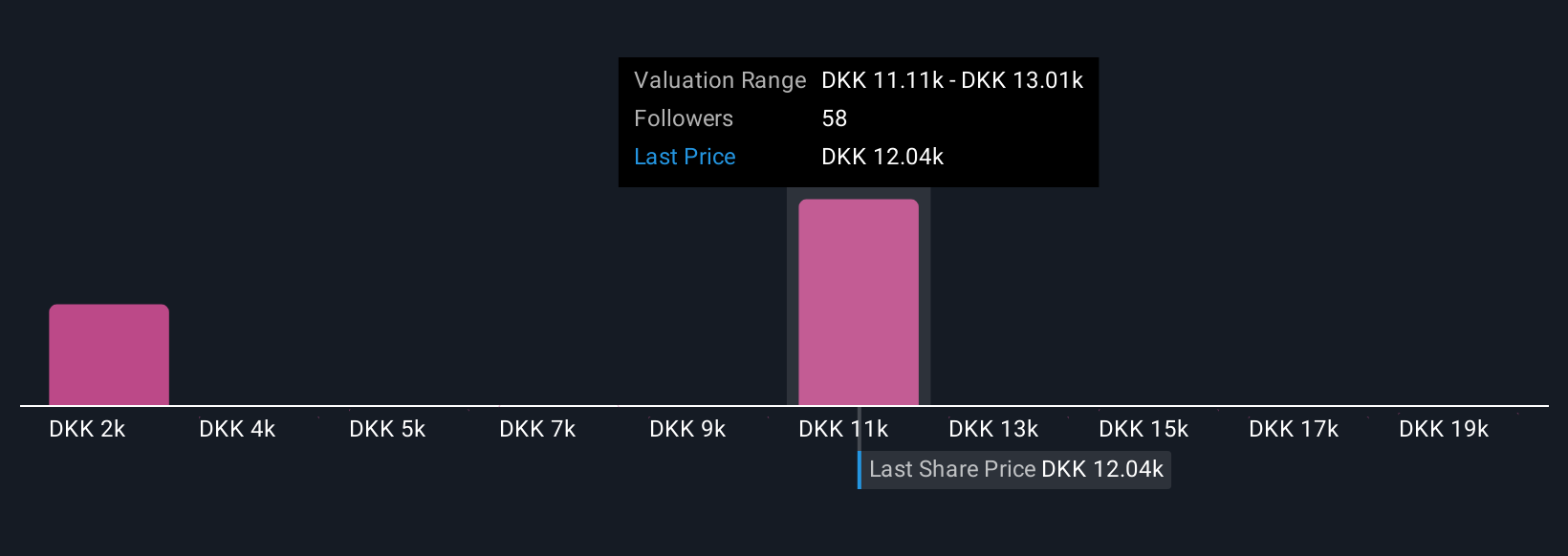

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your story or perspective about a company’s future. It is how you connect your assumptions on revenue growth, margins, and fair value to what the business does and where it is heading.

With Narratives, you are not just looking at isolated numbers; you are linking the company’s unique journey to its financial forecasts and, ultimately, to your own estimate of fair value. Narratives are quickly becoming one of the most accessible and dynamic tools for investors. On Simply Wall St’s Community page, millions of investors share and update their Narratives as new events like earnings reports or global news unfold.

This feature helps you make smarter decisions about when to buy or sell by comparing each Narrative’s Fair Value with the latest share price. You can see if the market aligns with your thesis, or if opportunity hides in plain sight. Best of all, Narratives update automatically when new information is published, meaning your investment story evolves in real time with the facts.

- For example, one investor’s Narrative for A.P. Møller - Mærsk projects a future fair value as high as DKK15,968.87, while another sees it as low as DKK8,469.66. This demonstrates how your own assumptions and research turn market data into actionable insights.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:MAERSK B

A.P. Møller - Mærsk

Operates as an integrated logistics company in Denmark and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives