- Denmark

- /

- Marine and Shipping

- /

- CPSE:MAERSK B

Is Now the Right Time to Consider Maersk After Its Recent Share Price Slide?

Reviewed by Bailey Pemberton

If you're eyeing A.P. Møller - Mærsk and asking yourself whether now is the right time to buy, sell or just hang tight, you are certainly not alone. While many stocks have been doing a bit of a dance recently, Mærsk has shown its share of interesting moves that should catch the attention of any investor. In the short term, the share price has dipped, dropping 1.4% over the last week and 6.8% in the past month. But zoom out, and it is a very different story. The stock has climbed an impressive 34.1% in the past year and doubled in value over five years, gaining 127.2%. These strong long-term gains reflect shifts in global shipping and logistics trends, with Mærsk well placed to take advantage of a world that is putting fresh value on efficient supply chains.

Of course, there is more to take in than just price history. When it comes to value, Mærsk scores a 2 out of 6 on our undervaluation checks, meaning it is only considered undervalued in a couple of key areas. So how do we square that middling valuation score with the impressive long-term returns and new dynamics in global trade? Let us break down the different valuation approaches next, and stick around, because at the end I will show you an even smarter way to think about what Mærsk is really worth.

A.P. Møller - Mærsk scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

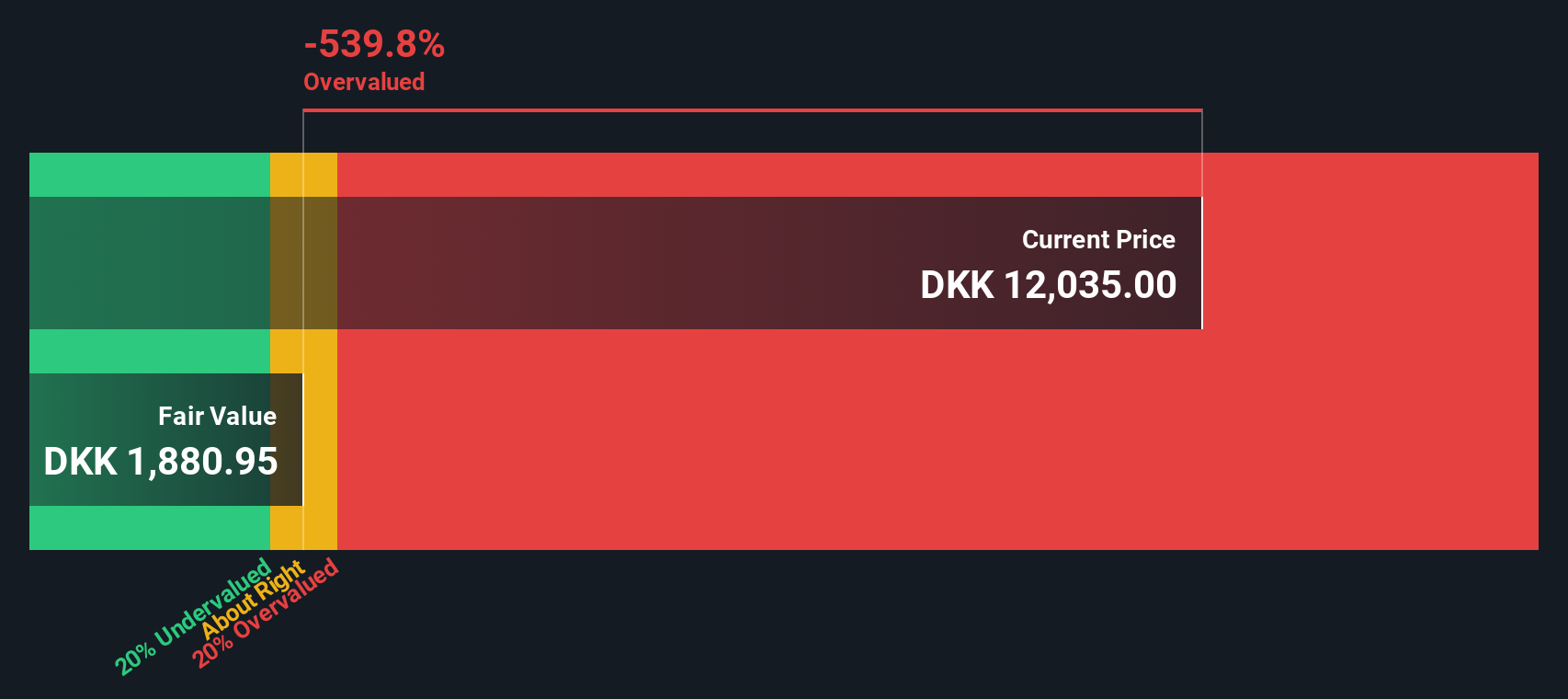

Approach 1: A.P. Møller - Mærsk Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) approach estimates a company's intrinsic value by extrapolating future cash flows and then discounting them back to today's value, offering a picture of what the business is really worth based on its long-term earning ability. For A.P. Møller Mærsk, the model relies on recent actual free cash flow and forward projections, including both analyst estimates and extrapolations for later years.

Over the last twelve months, Mærsk generated $9.28 billion in free cash flow. Analyst expectations point toward a substantial reduction over the coming years, to roughly $778 million in 2027. Projections beyond this year, though based on historical trends and extrapolation, follow a gradual decline, highlighting that Mærsk's recent cash flow spike may not be sustainable in the next decade.

When all these future cash flows are brought back to present value using the DCF process, the model arrives at an intrinsic value of $4,192.59 per share. Compared to the current market price, this suggests the stock is 197.3% overvalued. This indicates the market is pricing in far more optimistic growth than what these cash flow projections currently support.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests A.P. Møller - Mærsk may be overvalued by 197.3%. Find undervalued stocks or create your own screener to find better value opportunities.

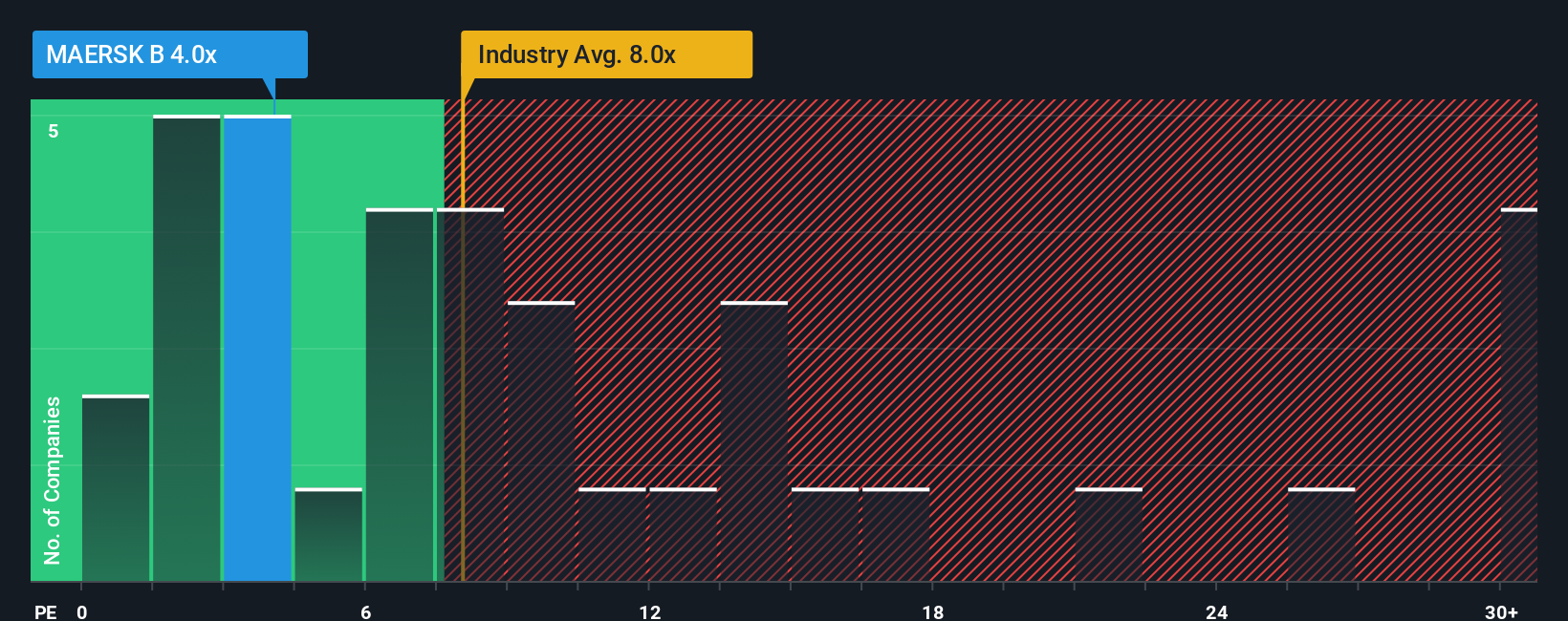

Approach 2: A.P. Møller - Mærsk Price vs Earnings

For profitable companies like A.P. Møller - Mærsk, the Price-to-Earnings (PE) ratio is a favored valuation measure because it directly connects a company’s share price to its actual earnings power. Investors commonly use the PE ratio to gauge how much they are paying for each unit of profit, making it highly relevant for mature businesses with stable earnings.

Context matters, though. A "normal" or fair PE ratio is not one-size-fits-all, as it is influenced by expectations for future growth and perceived risks. Companies with faster growth, higher stability, or stronger market positions often command higher PE multiples. Those facing more uncertainty or sluggish prospects will typically have lower ratios.

Currently, Mærsk trades at a very low PE ratio of 4.2x. This stands out compared to the Shipping industry average of 10.1x and the broader peer average of 14.0x. On the surface, this suggests Mærsk is trading at a substantial discount to its peers. However, Simply Wall St’s proprietary Fair Ratio goes a step further by integrating Mærsk’s growth expectations, risk profile, profit margins, market capitalization, and industry dynamics to estimate what a truly appropriate multiple should be. In this case, the Fair Ratio is 2.2x.

The advantage of the Fair Ratio is that it provides a more tailored benchmark than industry or peer averages, offering a clearer picture of a company’s intrinsic value based on its individual characteristics and prospects rather than broad market trends.

Comparing the Fair Ratio (2.2x) to Mærsk’s actual PE (4.2x), the stock appears somewhat expensive on this metric.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your A.P. Møller - Mærsk Narrative

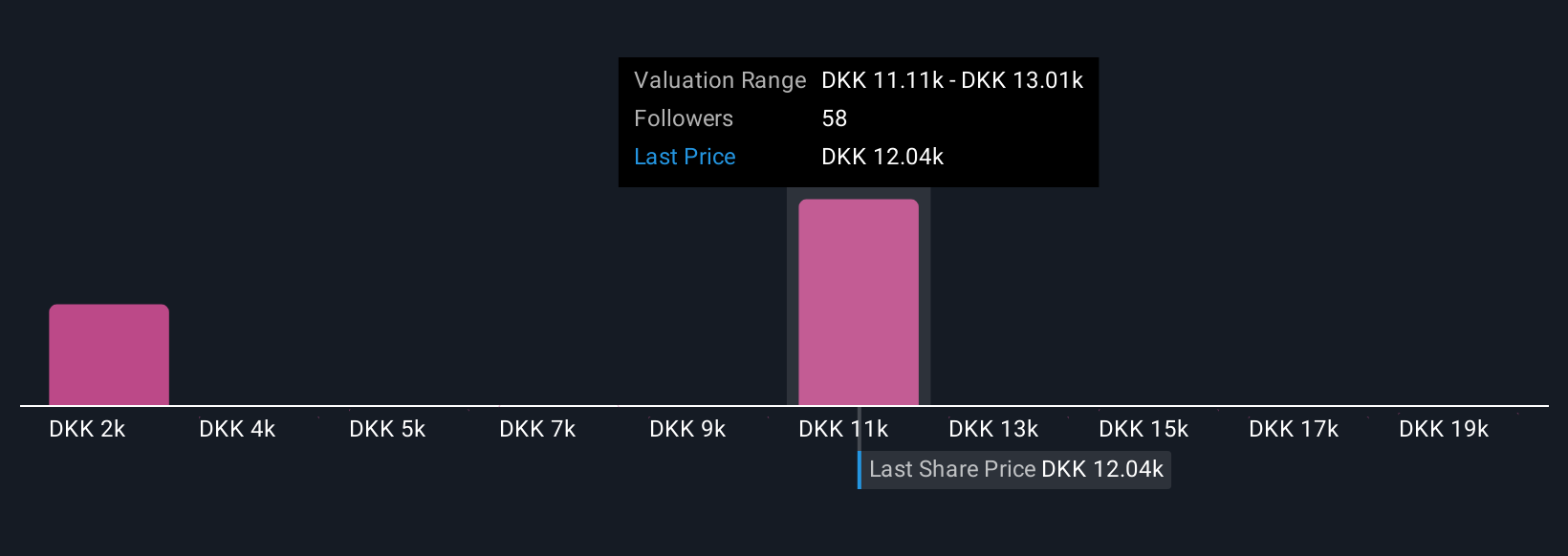

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply your story behind the numbers, a tool for investors to combine their perspective on a company’s strengths, weaknesses, and opportunities with their own fair value estimates and forecasts for revenue, earnings, and profit margins.

By shaping a Narrative, you link what you believe is happening with the business to a concrete financial forecast and, ultimately, to a fair value for the stock. Narratives are easy to create and update on Simply Wall St’s Community page, helping millions of investors quickly connect stories to numbers.

With Narratives, you can easily see whether your estimated fair value is above or below today’s market price, making decisions to buy, sell or hold much clearer. Best of all, each Narrative is updated dynamically as new developments or earnings reports emerge, keeping your analysis up to date without any fuss.

For example, some investors believe Maersk’s future value is as high as DKK15,969, thanks to ongoing global trade growth and logistics expansion. Others see downside to DKK8,469, citing falling Chinese exports and industry overcapacity. By choosing or building your own Narrative, you are empowered to see how your unique view stacks up, then act with confidence.

Do you think there's more to the story for A.P. Møller - Mærsk? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:MAERSK B

A.P. Møller - Mærsk

Operates as an integrated logistics company in Denmark and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives