We Think You Should Be Aware Of Some Concerning Factors In Trifork Group's (CPH:TRIFOR) Earnings

Trifork Group AG's (CPH:TRIFOR) robust recent earnings didn't do much to move the stock. We think this is due to investors looking beyond the statutory profits and being concerned with what they see.

How Do Unusual Items Influence Profit?

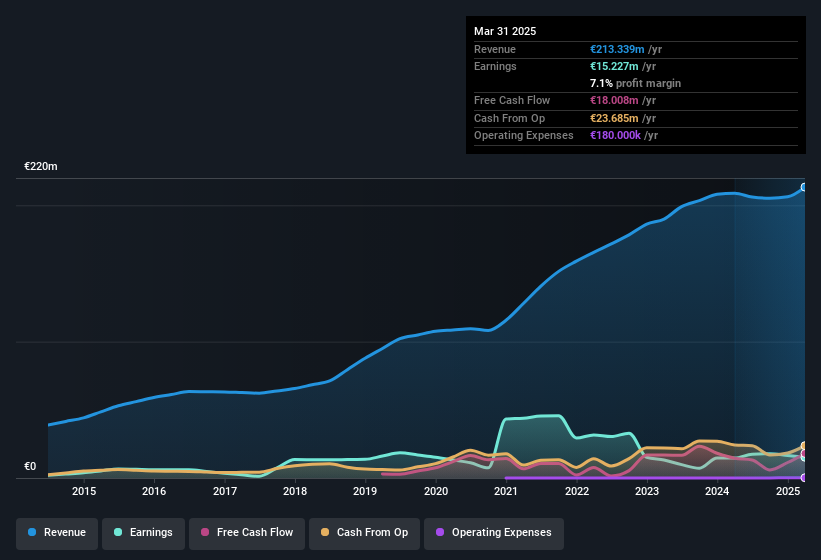

To properly understand Trifork Group's profit results, we need to consider the €11m gain attributed to unusual items. While it's always nice to have higher profit, a large contribution from unusual items sometimes dampens our enthusiasm. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And, after all, that's exactly what the accounting terminology implies. Trifork Group had a rather significant contribution from unusual items relative to its profit to March 2025. As a result, we can surmise that the unusual items are making its statutory profit significantly stronger than it would otherwise be.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Our Take On Trifork Group's Profit Performance

As previously mentioned, Trifork Group's large boost from unusual items won't be there indefinitely, so its statutory earnings are probably a poor guide to its underlying profitability. For this reason, we think that Trifork Group's statutory profits may be a bad guide to its underlying earnings power, and might give investors an overly positive impression of the company. The good news is that its earnings per share increased slightly in the last year. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. So while earnings quality is important, it's equally important to consider the risks facing Trifork Group at this point in time. You'd be interested to know, that we found 2 warning signs for Trifork Group and you'll want to know about these.

Today we've zoomed in on a single data point to better understand the nature of Trifork Group's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

Valuation is complex, but we're here to simplify it.

Discover if Trifork Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CPSE:TRIFOR

Trifork Group

Provides information technology and other business services in Switzerland, Denmark, the United Kingdom, the Netherlands, the United States, and internationally.

Very undervalued with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026