- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6804

High Growth Tech Stocks To Watch In December 2024

Reviewed by Simply Wall St

As global markets continue to show resilience with major indices like the S&P 500 and Russell 2000 reaching record highs, investor sentiment remains buoyed despite geopolitical uncertainties and tariff concerns. In this dynamic environment, high growth tech stocks stand out as potential opportunities for those seeking innovation-driven performance, particularly in sectors that can navigate economic shifts and capitalize on emerging trends.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Mental Health TechnologiesLtd | 24.68% | 97.53% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Fine M-TecLTD | 36.23% | 131.08% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1286 stocks from our High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

Netcompany Group (CPSE:NETC)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Netcompany Group A/S is an IT services company that provides business critical IT solutions to public and private sector clients across Denmark, Norway, the UK, the Netherlands, Belgium, Luxembourg, Greece, and internationally with a market cap of DKK17.28 billion.

Operations: Netcompany Group generates revenue primarily from public sector clients, contributing DKK4.41 billion, and private sector clients, adding DKK2.04 billion.

Netcompany Group has demonstrated a robust financial trajectory, with its recent earnings report showcasing a significant uptick in both sales and net income. For Q3 2024, sales surged to DKK 1.61 billion from DKK 1.46 billion year-over-year, while net income almost doubled to DKK 139.5 million from DKK 79.8 million, reflecting a strong operational execution amid challenging market conditions. This performance is underpinned by an aggressive R&D strategy which aligns with their forecasted annual earnings growth of approximately 30%, significantly outpacing the Danish market average of around 11.9%. Moreover, the company's commitment to innovation is evident from its R&D expenses which are strategically aimed at enhancing their technological offerings and maintaining competitive advantage in the rapidly evolving tech landscape. Despite these positive indicators, Netcompany's revenue growth projection of 10.1% annually trails behind the more ambitious industry benchmarks but remains aligned with broader market expectations for Denmark. The firm’s strategic focus on expanding its software solutions while managing a complex regulatory environment underscores its potential to sustain growth momentum over the long term. This balanced approach between aggressive financial goals and prudent management practices positions Netcompany as a noteworthy entity within the tech sector, navigating through periods of volatility with resilience and strategic foresight.

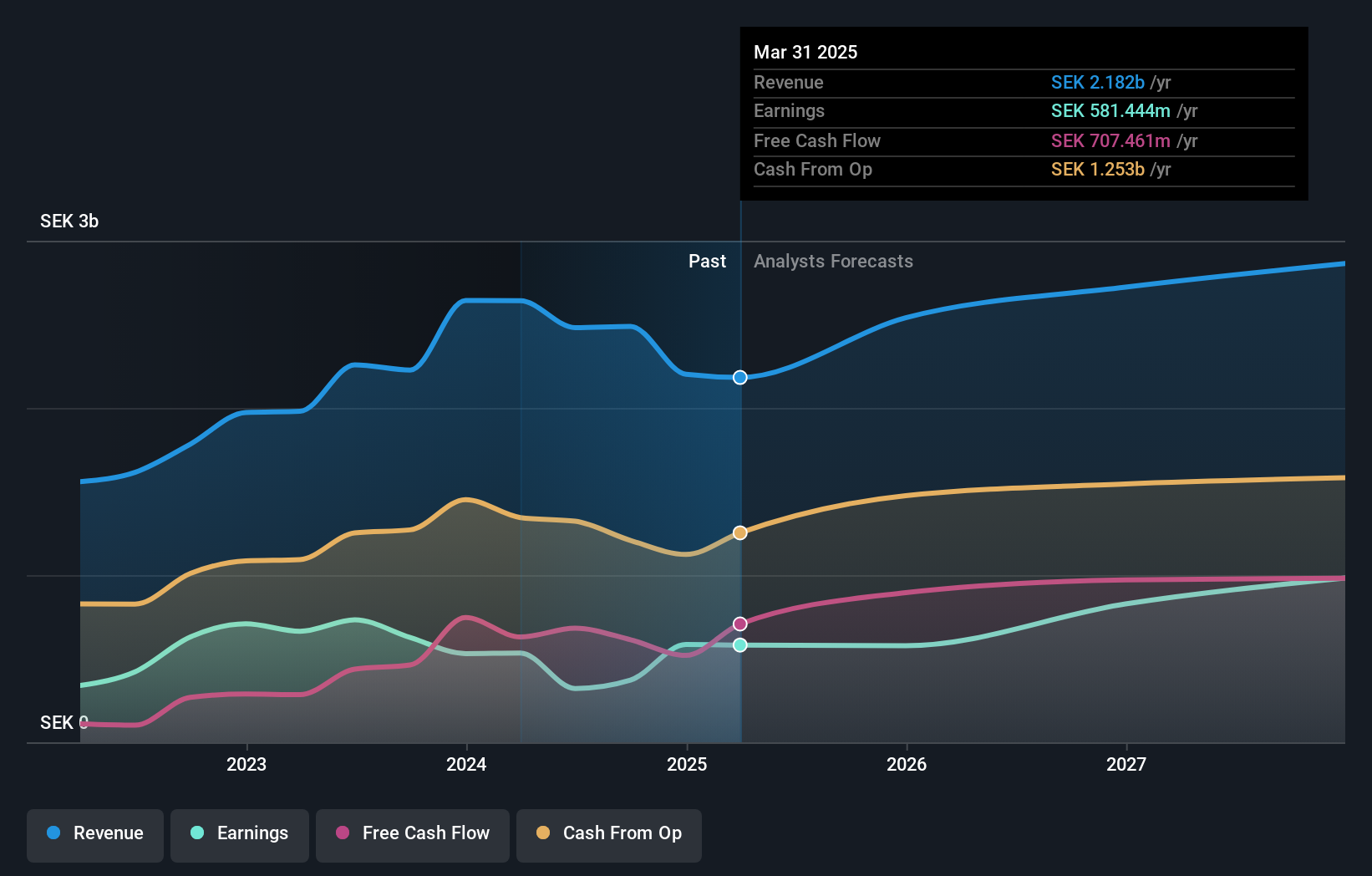

Paradox Interactive (OM:PDX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Paradox Interactive AB (publ) is a company that develops and publishes strategy and management games for PC and consoles across various global regions, with a market capitalization of SEK20.23 billion.

Operations: Paradox Interactive generates revenue primarily through the development and publication of strategy and management games for PC and consoles, with a significant portion coming from its Computer Graphics segment, totaling SEK2.49 billion. The company operates in diverse regions including North America, Latin America, Europe, the Middle East, Africa, and the Asia Pacific.

Paradox Interactive, amid a challenging landscape, is steering towards robust growth with an expected annual revenue increase of 9.5%, outpacing the Swedish market's modest 0.2%. This growth is supported by a significant forecast in earnings growth at 41.5% annually, well above Sweden's average of 15.1%. Despite facing a substantial one-off loss which impacted its recent financial results, the company continues to prioritize R&D investments, dedicating substantial resources to foster innovation and maintain its competitive edge in the gaming sector. These strategic decisions are evident in their recent launches like 'First Contact' and 'Galactic Paragons' for Stellaris: Console Edition, enhancing both game complexity and player engagement.

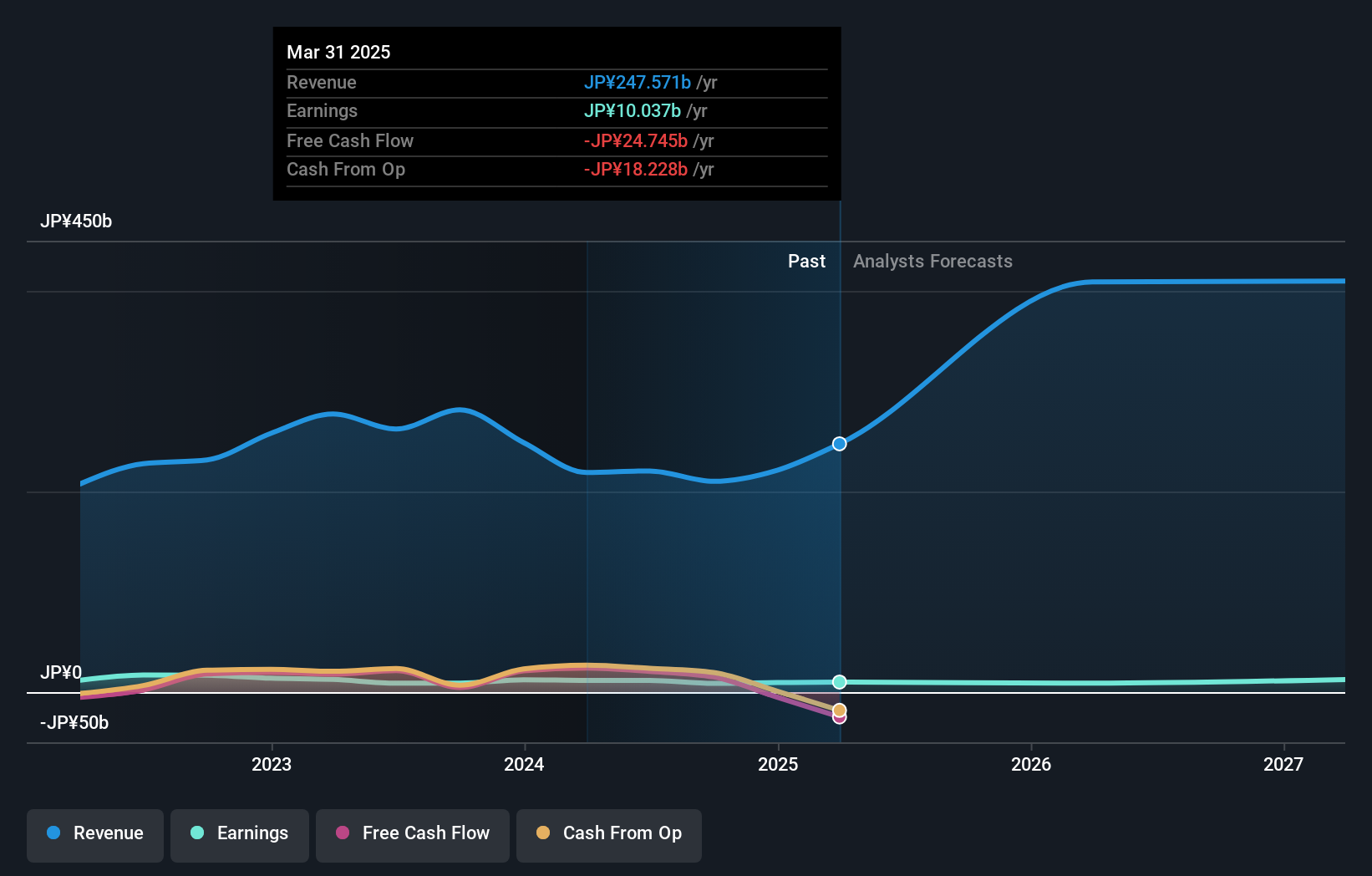

Hosiden (TSE:6804)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hosiden Corporation is engaged in the development, manufacturing, and sales of electronic components both domestically and internationally, with a market capitalization of ¥123.19 billion.

Operations: The company's primary revenue streams include mechanical parts, generating ¥174.75 billion, and audio parts, contributing ¥21.72 billion. Display parts and composite parts add smaller portions to the overall revenue mix.

Hosiden is navigating a dynamic trajectory with its revenue projected to climb by 19.9% annually, outstripping the Japanese market's growth of 4.2%. This surge is underpinned by an even more impressive anticipated annual earnings increase of 32.7%, significantly eclipsing the market average of 7.9%. Central to this financial vitality is the company's commitment to innovation, as evidenced by their R&D expenses which strategically fuel developments in electronic components that are critical for tech advancements in various industries. With recent announcements set for Q2 2025 results on November 8, Hosiden appears poised to capitalize on these robust growth metrics and maintain its competitive stance in the electronics sector, potentially enhancing future prospects if trends persist.

- Dive into the specifics of Hosiden here with our thorough health report.

Evaluate Hosiden's historical performance by accessing our past performance report.

Taking Advantage

- Take a closer look at our High Growth Tech and AI Stocks list of 1286 companies by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hosiden might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6804

Hosiden

Develops, manufactures, and sells electronic components in Japan and internationally.

Flawless balance sheet and undervalued.