- Denmark

- /

- Real Estate

- /

- CPSE:MOVINN

A Piece Of The Puzzle Missing From Movinn A/S' (CPH:MOVINN) 28% Share Price Climb

Despite an already strong run, Movinn A/S (CPH:MOVINN) shares have been powering on, with a gain of 28% in the last thirty days. Notwithstanding the latest gain, the annual share price return of 9.0% isn't as impressive.

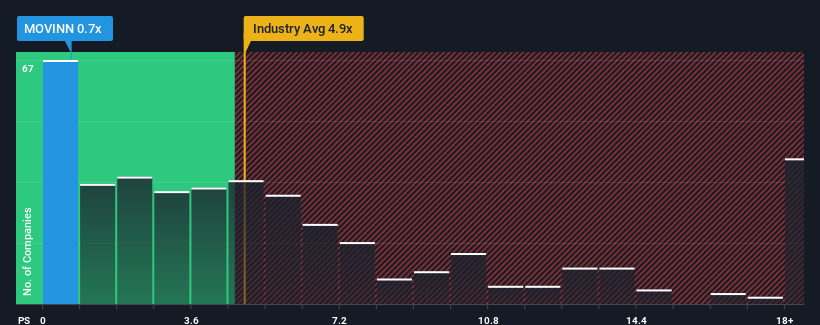

Even after such a large jump in price, given close to half the companies in Denmark's Real Estate industry have price-to-sales ratios (or "P/S") above 5.2x, you may still consider Movinn as a highly attractive investment with its 0.7x P/S ratio. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Movinn

How Has Movinn Performed Recently?

Movinn has been doing a good job lately as it's been growing revenue at a solid pace. It might be that many expect the respectable revenue performance to degrade substantially, which has repressed the P/S. Those who are bullish on Movinn will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for Movinn, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Movinn's to be considered reasonable.

Retrospectively, the last year delivered a decent 8.6% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 84% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that to the industry, which is predicted to shrink 8.1% in the next 12 months, the company's positive momentum based on recent medium-term revenue results is a bright spot for the moment.

With this information, we find it very odd that Movinn is trading at a P/S lower than the industry. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

What Does Movinn's P/S Mean For Investors?

Movinn's recent share price jump still sees fails to bring its P/S alongside the industry median. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Movinn revealed that despite growing revenue over the medium-term in a shrinking industry, the P/S doesn't reflect this as it's lower than the industry average. We think potential risks might be placing significant pressure on the P/S ratio and share price. The most obvious risk is that its revenue trajectory may not keep outperforming under these tough industry conditions. At least the risk of a price drop looks to be subdued, but investors think future revenue could see a lot of volatility.

There are also other vital risk factors to consider before investing and we've discovered 4 warning signs for Movinn that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:MOVINN

Movinn

Provides furnished and serviced accommodation in Denmark and Sweden.

Low and slightly overvalued.

Similar Companies

Market Insights

Community Narratives