- Germany

- /

- Tech Hardware

- /

- DB:JY0

High Growth Tech Stocks in Europe to Watch This March 2025

Reviewed by Simply Wall St

Amidst a backdrop of global trade policy uncertainty and mixed economic signals, the European market has shown resilience, with Germany's DAX Index rising by over 2% despite broader concerns impacting investor sentiment. As the European Central Bank adjusts its monetary policies to address inflation and growth challenges, investors are keeping an eye on high-growth tech stocks that can capitalize on increased infrastructure spending and innovation-driven opportunities.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Elicera Therapeutics | 63.53% | 97.24% | ★★★★★★ |

| Pharma Mar | 24.24% | 40.82% | ★★★★★★ |

| Bonesupport Holding | 30.48% | 50.17% | ★★★★★★ |

| CD Projekt | 27.71% | 41.31% | ★★★★★★ |

| Yubico | 20.88% | 26.53% | ★★★★★★ |

| Xbrane Biopharma | 73.73% | 139.21% | ★★★★★★ |

| Devyser Diagnostics | 26.50% | 94.65% | ★★★★★★ |

| Elliptic Laboratories | 49.76% | 88.21% | ★★★★★★ |

| Ascelia Pharma | 46.09% | 66.93% | ★★★★★★ |

| Skolon | 29.71% | 91.18% | ★★★★★★ |

Let's dive into some prime choices out of from the screener.

Zealand Pharma (CPSE:ZEAL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Zealand Pharma A/S is a biotechnology company focused on discovering, developing, and commercializing peptide-based medicines in Denmark and the United States, with a market capitalization of DKK42.53 billion.

Operations: Zealand Pharma generates revenue primarily from its biotechnology segment, amounting to DKK62.69 million. The company's operations are centered around peptide-based medicines in Denmark and the United States.

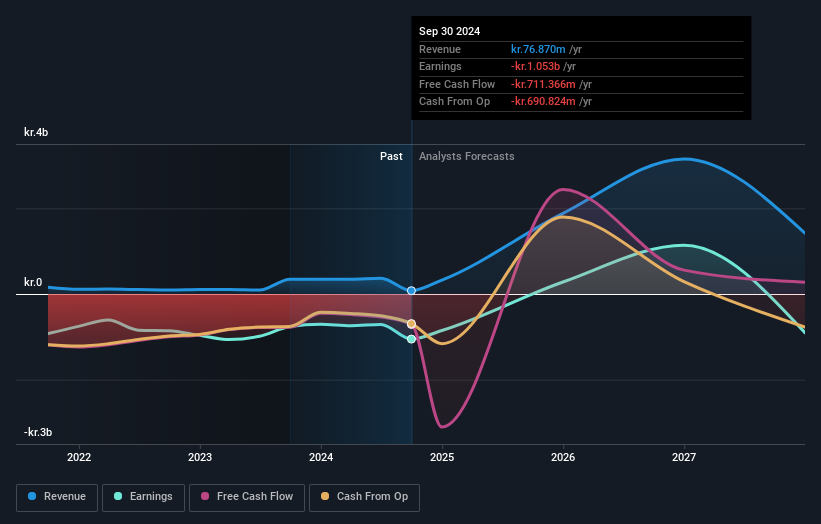

Zealand Pharma, navigating the high-stakes biotech landscape, demonstrates a robust revenue growth trajectory at 22.3% annually, significantly outpacing the Danish market's 8.9%. Despite current unprofitability and a forecasted average earnings decline of 4.7% over the next three years, strategic maneuvers such as the recent collaboration with Roche and an aggressive R&D stance underscore its commitment to innovation. The firm's inclusion in the OMX Nordic 40 Index and ongoing efforts to expand its product pipeline through rigorous FDA engagements highlight both challenges and potential in harnessing cutting-edge biotechnological advancements for growth.

- Dive into the specifics of Zealand Pharma here with our thorough health report.

Review our historical performance report to gain insights into Zealand Pharma's's past performance.

ParTec (DB:JY0)

Simply Wall St Growth Rating: ★★★★★☆

Overview: ParTec AG specializes in the development, manufacturing, and supply of supercomputer and quantum computer solutions with a market capitalization of €280 million.

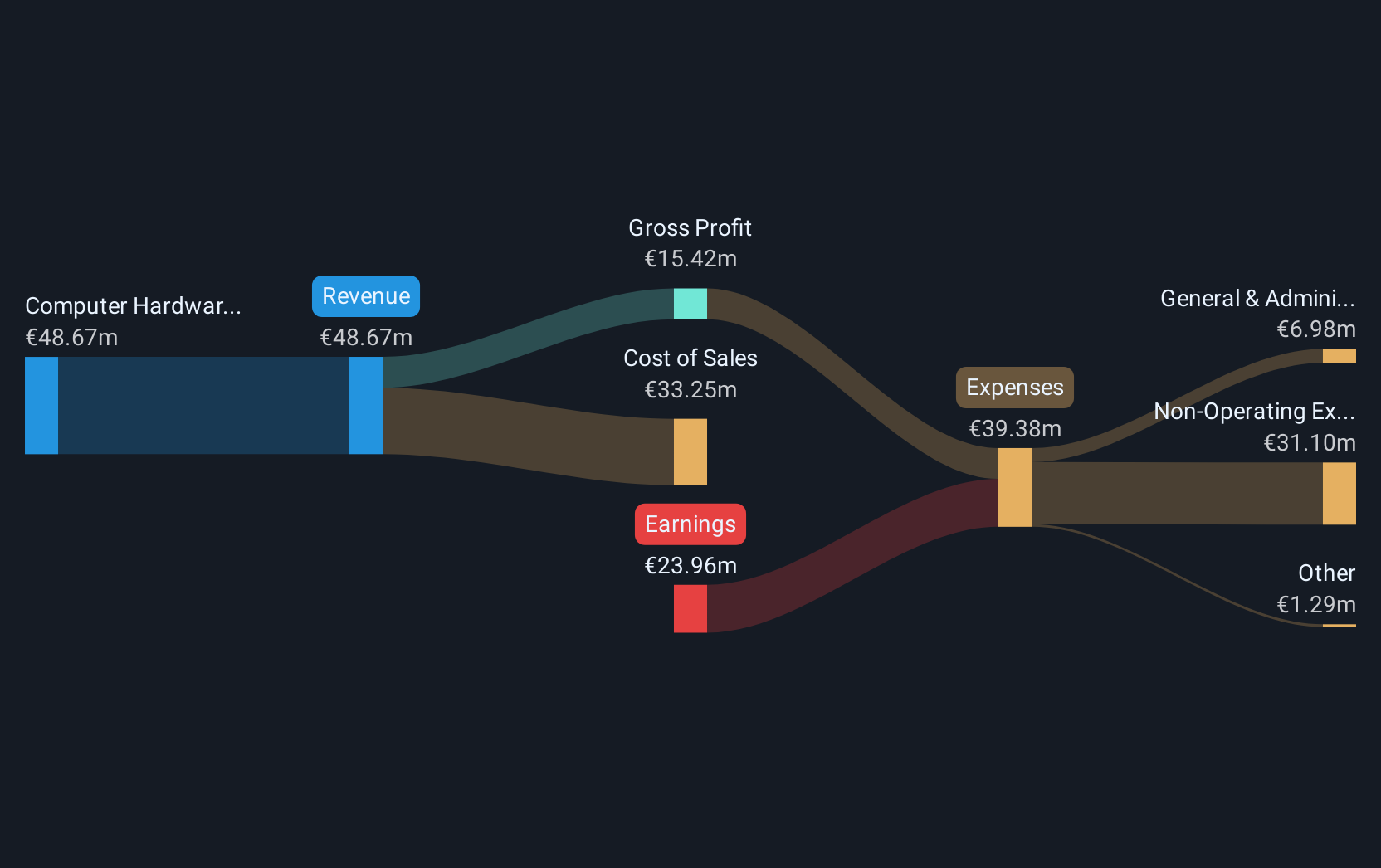

Operations: ParTec AG generates revenue primarily from its computer hardware segment, amounting to approximately €48.67 million.

Amidst a reshuffling of its executive team, ParTec AG continues to make significant strides in the tech industry, with an annual revenue growth forecast at 32.5%, starkly outperforming Germany's average of 5.8%. Despite current unprofitability, the company is poised for a turnaround with earnings expected to surge by 41.7% annually over the next three years. Recent presentations at major international tech conferences underscore ParTec's commitment to remaining at the forefront of high-performance computing solutions, signaling robust future prospects despite a volatile share price and ongoing management transitions.

- Click here and access our complete health analysis report to understand the dynamics of ParTec.

Understand ParTec's track record by examining our Past report.

Nordhealth (OB:NORDH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Nordhealth AS is a company that offers healthcare software solutions across various countries including Norway, Finland, Sweden, Denmark, and Germany with a market capitalization of NOK3.11 billion.

Operations: Nordhealth AS generates revenue primarily through its healthcare software solutions offered in multiple countries. The company operates with a focus on delivering digital tools to enhance healthcare management and efficiency.

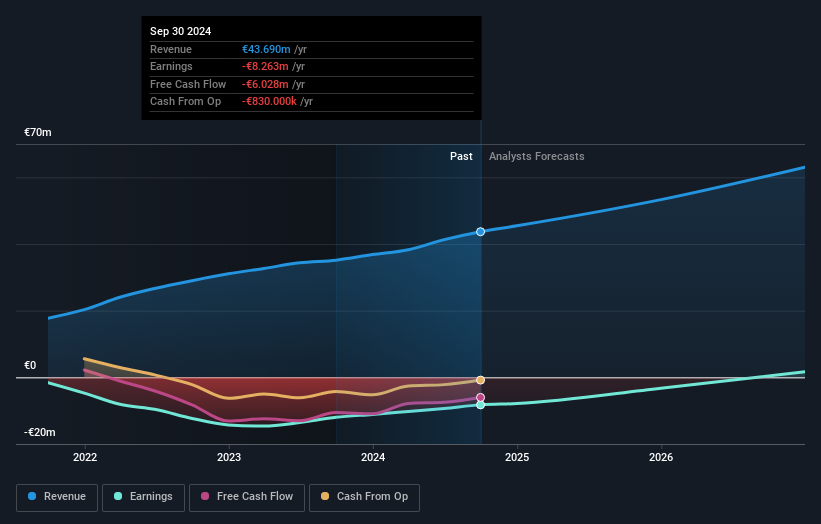

Nordhealth, a player in the cloud-based veterinary software market, is navigating a transformative phase with notable strategic moves. Recently appointing Alexander Cram as CFO, the company aims to bolster its financial leadership amidst a challenging yet improving fiscal landscape—evidenced by Q4 sales rising to €12.14 million from €10.17 million year-over-year and reducing net loss to €2.81 million from €3.4 million. Particularly promising is Provet Cloud's expansion into North America through a pilot program with a major U.S. veterinary group, enhancing its client base and potentially stabilizing revenue streams in this high-growth sector despite current unprofitability and share price volatility.

- Click here to discover the nuances of Nordhealth with our detailed analytical health report.

Gain insights into Nordhealth's past trends and performance with our Past report.

Seize The Opportunity

- Take a closer look at our European High Growth Tech and AI Stocks list of 246 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DB:JY0

ParTec

Partec AG develops, manufacturers, and supplies supercomputer and quantum computer solutions.

High growth potential and slightly overvalued.

Market Insights

Community Narratives