Novo Nordisk (CPSE:NOVO B): Assessing Valuation After Wegovy’s Strong Cardiovascular Data at ESC Congress 2025

Reviewed by Simply Wall St

Investors in Novo Nordisk (CPSE:NOVO B) have just gotten a major jolt with fresh data from the STEER real-world study, presented at the European Society of Cardiology Congress 2025. The company’s obesity drug Wegovy showed a strikingly greater reduction in risk for serious cardiovascular events compared to tirzepatide, among people living with obesity and established cardiovascular disease but no diabetes. With a 57% greater risk reduction for heart attack, stroke, and deaths from any cause when patients stuck to their regimen, this is not just a headline; this could shift perceptions about the role of Wegovy in cardiometabolic care.

This latest announcement adds to a year that has seen plenty of twists and turns for Novo Nordisk. While last month’s collaboration with Replicate Bioscience made some waves, the bigger story for shareholders has been in the numbers. The stock is up just over 20% for the past month but still down nearly 60% for the year, following a tough stretch. Despite recent momentum and the clinical win with Wegovy, longer-term returns remain mixed, keeping the valuation conversation wide open.

So after this surprising boost in both evidence and sentiment, is Novo Nordisk now trading below its real worth, or is the market already counting on future growth?

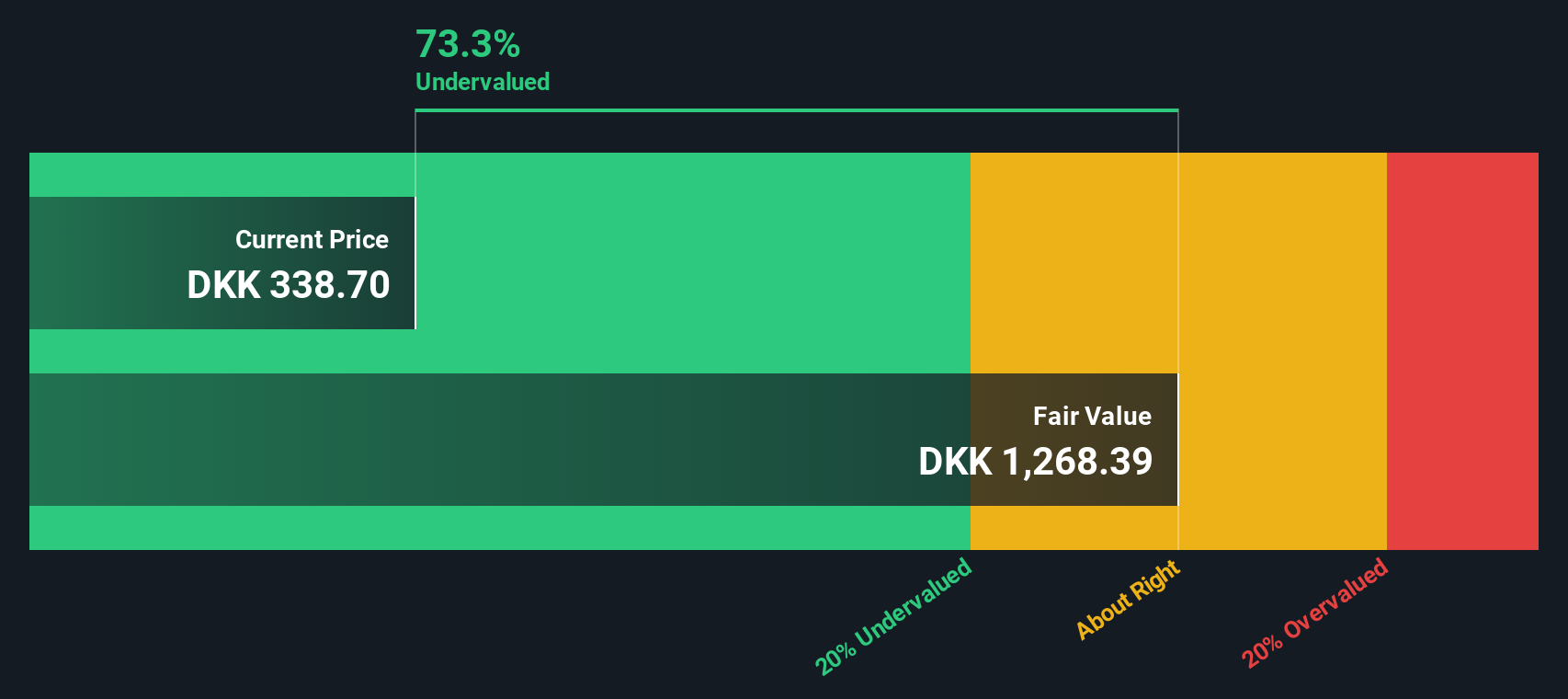

Most Popular Narrative: 58.9% Undervalued

The current share price of Novo Nordisk is seen as deeply undervalued when measured against the most widely followed narrative, with shares trading at a substantial discount to estimated fair value based on forward earnings power and growth potential.

“Novo Nordisk has built a formidable economic moat ("Burggraben") through decades of expertise in diabetes care, world-class manufacturing, and a trusted global brand. With the unexpected success of its obesity drugs, the company has effectively gained a highly profitable new business segment almost for free, built on the same scientific platform. This windfall is now driving massive capital inflows, which Novo Nordisk is wisely reinvesting to secure its leadership for decades to come.”

Want to understand what’s driving such a bold undervaluation call? The key is in aggressive revenue growth assumptions, sustained high margins, and a projected future multiple usually reserved for market leaders. Curious about which optimistic metrics unlock that elevated fair value? Discover the quantitative secrets underpinning this eye-catching discount.

Result: Fair Value of $851.04 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, risks remain, especially from potential regulatory crackdowns or intensified competition. These factors could pressure Novo Nordisk's margins and growth trajectory.

Find out about the key risks to this Novo Nordisk narrative.Another View: Testing the Discount

While the most popular narrative points to deep undervaluation, our DCF model also values Novo Nordisk well below its fair price. This perspective reinforces the first take using a different approach. Is this consensus too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Novo Nordisk for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Novo Nordisk Narrative

If you see things differently, or want to dig deeper into the numbers yourself, you can quickly craft your own perspective in just a few minutes. Do it your way

A great starting point for your Novo Nordisk research is our analysis highlighting 4 key rewards and 4 important warning signs that could impact your investment decision.

Ready for More Investing Opportunities?

Don't let your investment strategy miss a beat. Quickly pinpoint stocks that match your goals with these handpicked opportunities and see where smart investors are searching next.

- Find value by targeting shares trading below their true potential using the undervalued stocks based on cash flows as your guide.

- Discover the next tech revolution by uncovering firms breaking new ground in artificial intelligence through our AI penny stocks.

- Increase your income with companies rewarding shareholders through impressive payments with our dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Novo Nordisk might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About CPSE:NOVO B

Novo Nordisk

Engages in the research and development, manufacture, and distribution of pharmaceutical products in Europe, the Middle East, Africa, Mainland China, Hong Kong, Taiwan, North America, and internationally.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives