Assessing Novo Nordisk After Major Stock Recovery and Obesity Drug Demand Headlines

Reviewed by Simply Wall St

Trying to figure out what to do with Novo Nordisk stock right now? You are definitely not alone. It is one of those moments when the numbers beg for a closer look. Novo Nordisk has always attracted attention for its innovation, but lately investors are watching its price moves just as closely. Over the last month, the stock is up 6.9%, recouping some ground after a tougher spell this year. Despite being down 45.5% year-to-date and 61.0% over the past year, Novo Nordisk’s five-year return stands strong at 74.5%, reminding us that sentiment and potential can shift rapidly in either direction. Market watchers point to shifting demand in the pharmaceutical sector and changes in risk appetite as factors in these swings, signaling that there might be more upside or more volatility ahead.

If you are weighing whether to buy, hold, or wait, valuation is a must-know starting place. Novo Nordisk currently scores a 5 out of 6 on our value checklist, meaning it looks fundamentally undervalued in five separate ways. That is an impressive mark for such a well-known name, and it sets the stage for some deeper analysis. Coming up, we will dig into the details of how Novo Nordisk stacks up across several valuation methods. Stick around though. Even after all the quantitative checks, there might be an even more insightful way to judge the stock’s real value, and we will wrap up the article with that perspective.

Why Novo Nordisk is lagging behind its peersApproach 1: Novo Nordisk Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today’s value. This helps investors understand whether the stock is trading below or above its true financial worth.

For Novo Nordisk, the DCF model starts with its latest twelve-month Free Cash Flow (FCF) of DKK 68.4 billion. Analysts forecast that by 2029, FCF will rise to approximately DKK 148.4 billion, with projections continuing to increase in subsequent years. Notably, only the next five years of FCF estimates are sourced directly from analysts; the remainder is extrapolated by Simply Wall St based on expected growth.

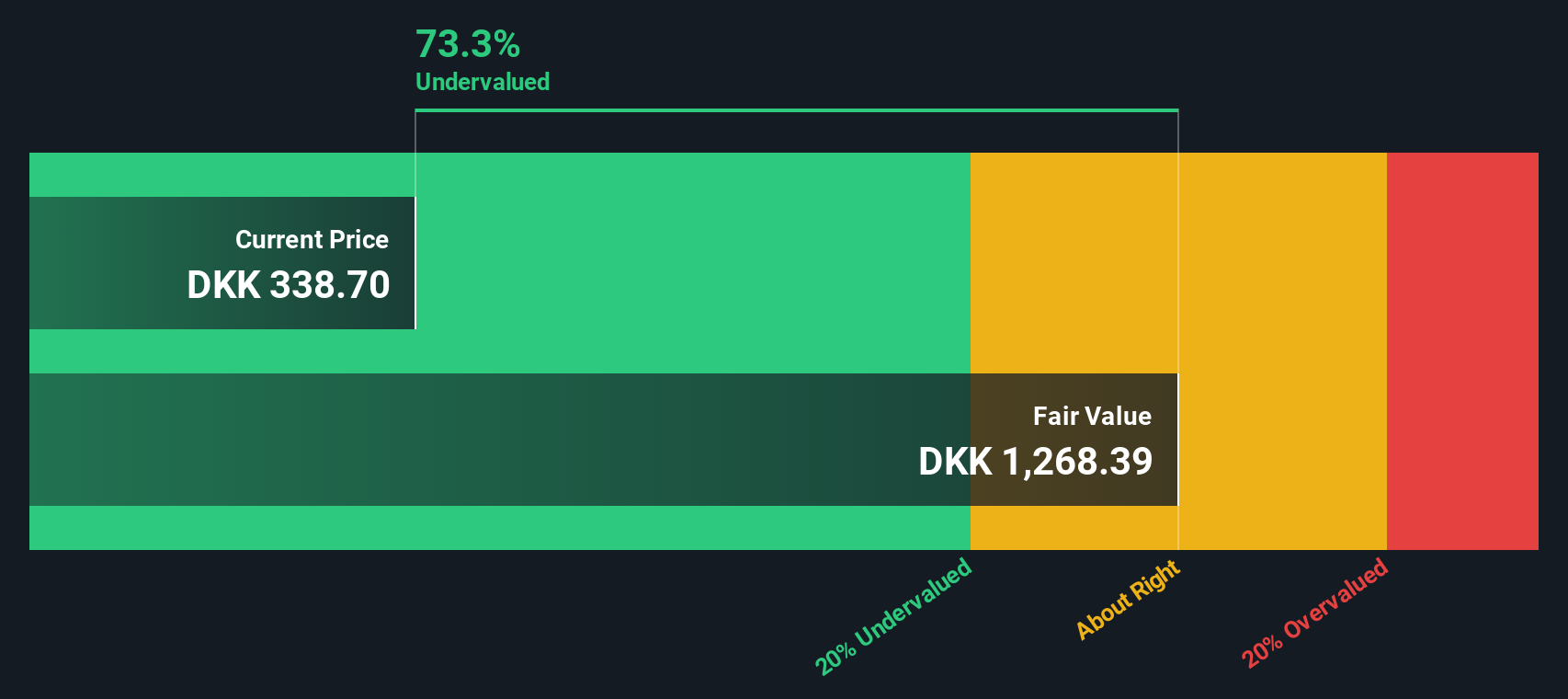

The estimated fair value per share from this model is DKK 1,239. This figure is 71.9% above the current market price, which indicates the stock is undervalued according to this approach.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Novo Nordisk.

Approach 2: Novo Nordisk Price vs Earnings (PE Ratio)

For profitable companies like Novo Nordisk, the Price-to-Earnings (PE) ratio is often a primary metric for gauging valuation. The PE ratio reflects how much investors are willing to pay for each unit of earnings, making it especially relevant for businesses with solid, consistent profits.

Growth expectations and perceived risk play a significant role in determining what qualifies as a “normal” or “fair” PE ratio. Companies with faster earnings growth and lower risk generally trade at higher PE multiples, while slower-growing or riskier businesses tend to be valued at lower multiples.

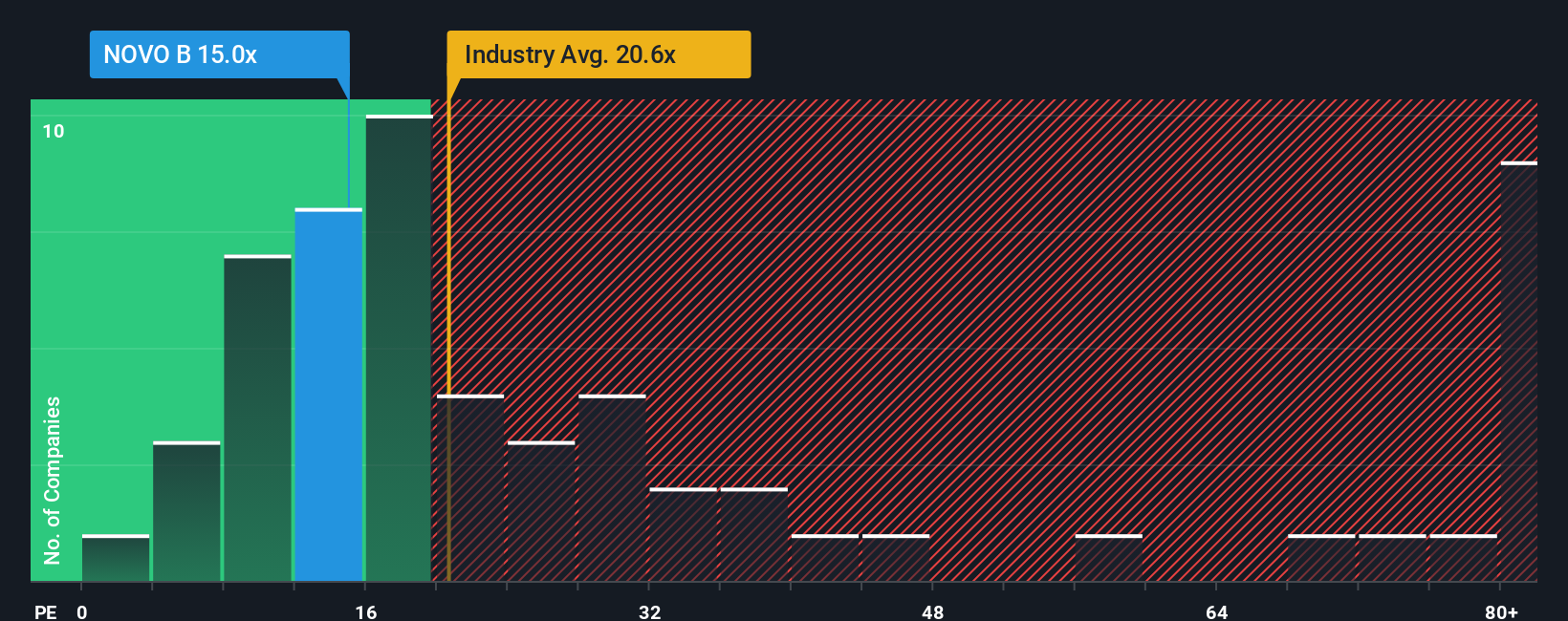

Novo Nordisk’s current PE ratio is 13.9x. For context, this is well below the pharmaceuticals industry average of 25.1x and also under the average of its peers at 26.3x. At first glance, the stock appears inexpensive compared to these benchmarks.

This is where Simply Wall St’s proprietary “Fair Ratio” becomes relevant. The Fair Ratio takes into account not just what peers and the industry are paying, but also considers factors like Novo Nordisk’s growth outlook, profitability, risk profile, and its market capitalization. This comprehensive perspective aims to provide a more accurate sense of how the market should be pricing the company based on its own merits, rather than relying solely on comparison.

Novo Nordisk’s Fair Ratio is calculated at 29.8x, which is much higher than its current 13.9x. That significant gap suggests the market is undervaluing Novo Nordisk on a PE basis, given its fundamentals and outlook.

Result: UNDERVALUED

Upgrade Your Decision Making: Choose your Novo Nordisk Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. In the investing world, a Narrative is simply the story behind a company: your perspective on its future growth, opportunities, and risks, which you connect to real financial assumptions like fair value and forecasts for revenue, earnings, and profit margins.

A Narrative ties together what you believe about a company’s prospects, how you expect its financials to develop, and what you think its shares are actually worth. This approach goes beyond just crunching numbers, as it helps you see the direct link between a company’s story and its potential value.

On Simply Wall St, Narratives are made easily accessible within the Community page, where millions of investors build, share, and update their perspectives dynamically as new information comes in, from news headlines to quarterly earnings reports. Narratives make it straightforward to compare a stock’s current price with your estimated fair value, providing a clear framework for deciding whether to buy, hold, or sell.

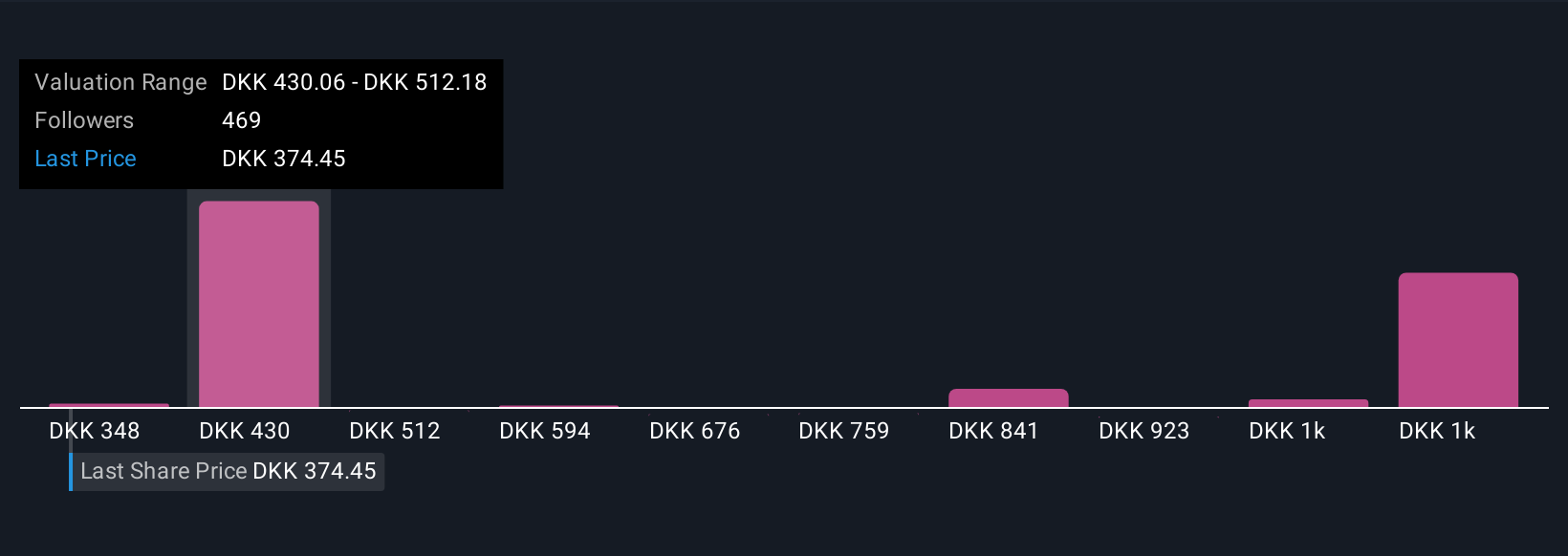

For example, looking at Novo Nordisk, some investors’ Narratives see a fair value above DKK 1,000 as obesity and diabetes treatments expand, while others expect a fair value below DKK 500 due to competitive pressures and regulatory risks. This highlights how your own expectations can drive different investment decisions.

Do you think there's more to the story for Novo Nordisk? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Novo Nordisk might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:NOVO B

Novo Nordisk

Engages in the research and development, manufacture, and distribution of pharmaceutical products in Europe, the Middle East, Africa, Mainland China, Hong Kong, Taiwan, North America, and internationally.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives