How Genmab’s Oslo IR Update On Pipeline And Capital Priorities At Genmab (CPSE:GMAB) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- Genmab A/S recently presented at the DNB Carnegie Nordic Healthcare conference in Oslo on 25 November 2025, with VP and Head of Investor Relations Andrew Carlsen outlining the company’s current position to investors.

- This appearance offers investors a fresh read on Genmab’s communication around its pipeline depth, partnership mix, and capital allocation priorities.

- We’ll now examine how Genmab’s high-profile investor relations appearance may shape the existing investment narrative built around its pipeline strength.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

Genmab Investment Narrative Recap

To own Genmab, you need to believe in its ability to convert a broad oncology pipeline and partnered assets into durable, high margin cash flows while managing pricing, competition and regulatory hurdles. The DNB Carnegie appearance itself does not materially change the near term focus on execution around EPKINLY and other late stage programs, nor does it reduce the key risk of revenue concentration in partnered drugs such as DARZALEX.

Genmab’s recent US FDA approval of EPKINLY in combination with rituximab and lenalidomide for relapsed or refractory follicular lymphoma is the announcement that most clearly connects to this investor relations update, because it sharpens the conversation around near term growth drivers and regulatory execution. As the company frames its story in Oslo, investors are likely weighing how this new indication, alongside earlier Japan approvals, fits into expectations for revenue guidance and the balance of pipeline opportunity versus competitive pressure.

Yet even with new approvals and upbeat guidance, the concentration risk around partnered royalties is something investors should be aware of...

Read the full narrative on Genmab (it's free!)

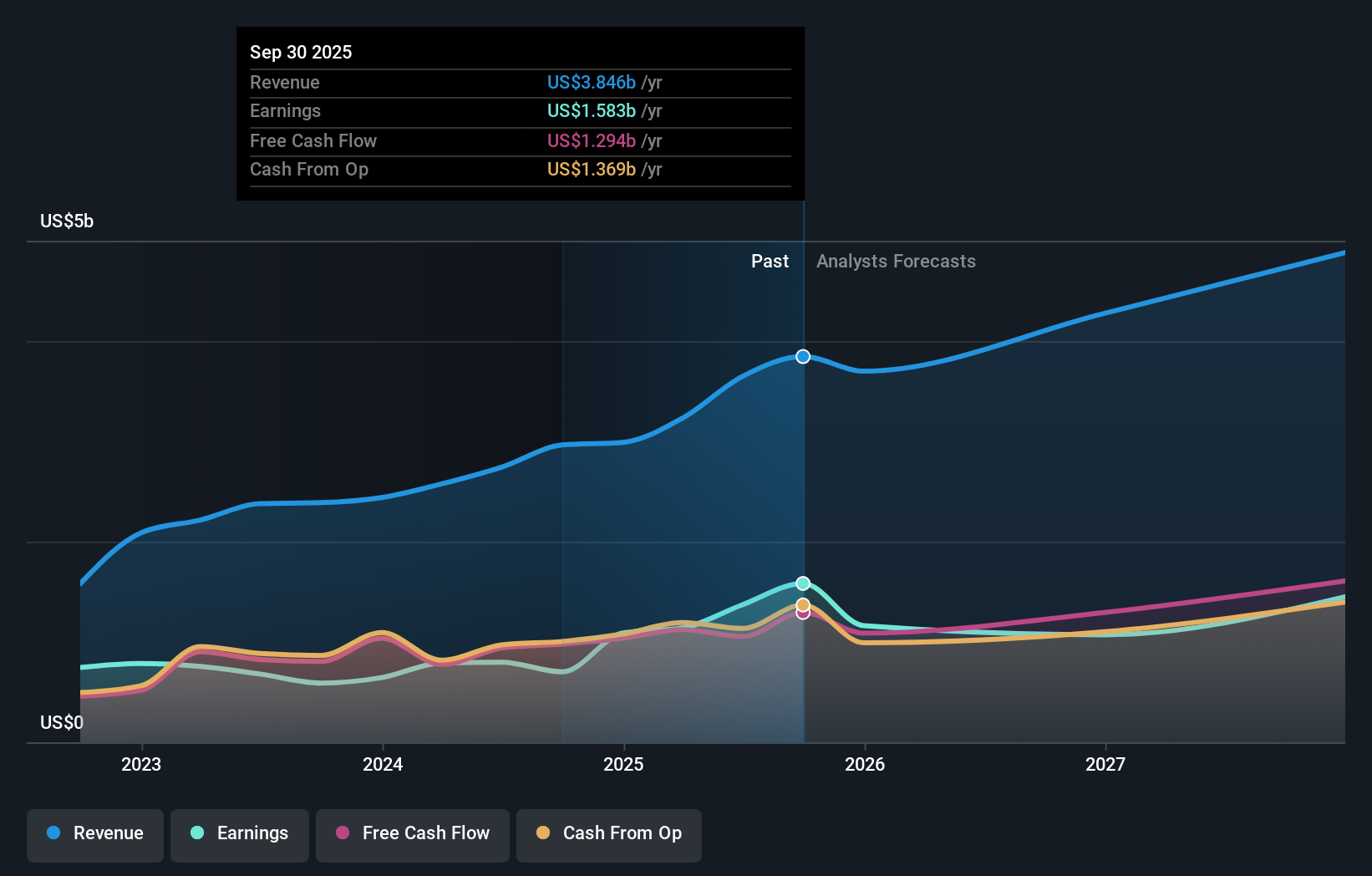

Genmab's narrative projects $5.1 billion revenue and $1.8 billion earnings by 2028. This requires 11.8% yearly revenue growth and roughly a $0.4 billion earnings increase from $1.4 billion today.

Uncover how Genmab's forecasts yield a DKK2055 fair value, in line with its current price.

Exploring Other Perspectives

Sixteen fair value estimates from the Simply Wall St Community span roughly DKK1,015 to DKK5,622, underlining how far apart views on Genmab can be. When you set that spread against the current focus on EPKINLY approvals and partnership dependence, it becomes even more important to compare several independent viewpoints before forming a view of the company’s prospects.

Explore 16 other fair value estimates on Genmab - why the stock might be worth over 2x more than the current price!

Build Your Own Genmab Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Genmab research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Genmab research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Genmab's overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:GMAB

Genmab

A biotechnology company, develops antibody-based products and product candidates for the treatment of cancer and other diseases in Denmark.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026