We feel now is a pretty good time to analyse BioPorto A/S' (CPH:BIOPOR) business as it appears the company may be on the cusp of a considerable accomplishment. BioPorto A/S, an in-vitro diagnostics company, provides diagnostic tests and antibodies for healthcare professionals in clinical and research settings worldwide. The kr.1.6b market-cap company’s loss lessened since it announced a kr.70m loss in the full financial year, compared to the latest trailing-twelve-month loss of kr.64m, as it approaches breakeven. Many investors are wondering about the rate at which BioPorto will turn a profit, with the big question being “when will the company breakeven?” We've put together a brief outline of industry analyst expectations for the company, its year of breakeven and its implied growth rate.

View our latest analysis for BioPorto

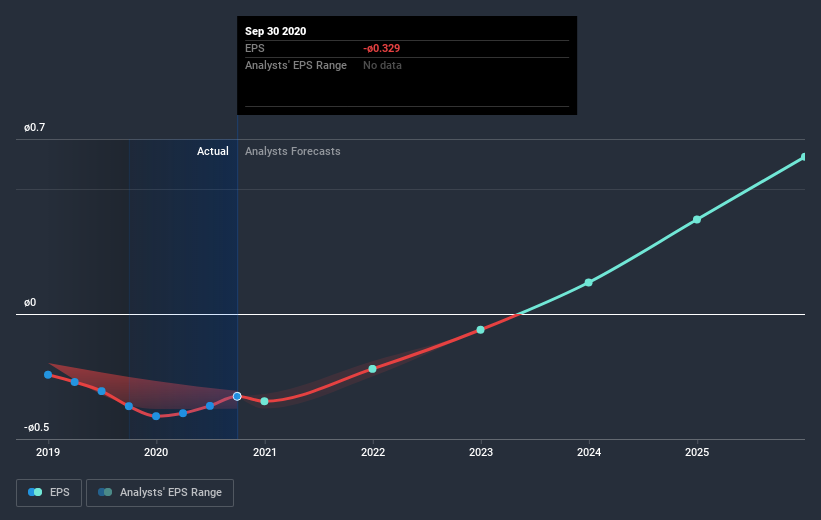

Consensus from 3 of the Danish Biotechs analysts is that BioPorto is on the verge of breakeven. They anticipate the company to incur a final loss in 2022, before generating positive profits of kr.29m in 2023. So, the company is predicted to breakeven approximately 2 years from today. How fast will the company have to grow each year in order to reach the breakeven point by 2023? Working backwards from analyst estimates, it turns out that they expect the company to grow 61% year-on-year, on average, which is rather optimistic! If this rate turns out to be too aggressive, the company may become profitable much later than analysts predict.

Underlying developments driving BioPorto's growth isn’t the focus of this broad overview, but, take into account that generally biotechs, depending on the stage of product development, have irregular periods of cash flow. This means, large upcoming growth rates are not abnormal as the company is beginning to reap the benefits of earlier investments.

One thing we’d like to point out is that BioPorto has no debt on its balance sheet, which is quite unusual for a cash-burning biotech, which typically has high debt relative to its equity. This means that the company has been operating purely on its equity investment and has no debt burden. This aspect reduces the risk around investing in the loss-making company.

Next Steps:

This article is not intended to be a comprehensive analysis on BioPorto, so if you are interested in understanding the company at a deeper level, take a look at BioPorto's company page on Simply Wall St. We've also put together a list of pertinent aspects you should further research:

- Historical Track Record: What has BioPorto's performance been like over the past? Go into more detail in the past track record analysis and take a look at the free visual representations of our analysis for more clarity.

- Management Team: An experienced management team on the helm increases our confidence in the business – take a look at who sits on BioPorto's board and the CEO’s background.

- Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

If you decide to trade BioPorto, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if BioPorto might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About CPSE:BIOPOR

BioPorto

An in-vitro diagnostics company, provides biomarker tools and antibodies for clinical research in Europe, North America, Asia, and internationally.

Flawless balance sheet slight.

Similar Companies

Market Insights

Community Narratives