The European market has recently shown signs of optimism, bolstered by the potential for a favorable EU-U.S. trade deal and steady economic performance as indicated by the pan-European STOXX Europe 600 Index's modest rise. In this climate of cautious optimism, identifying promising small-cap stocks can be particularly rewarding, as these companies often offer unique growth opportunities that align well with resilient economic indicators and evolving market dynamics.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 26.90% | 4.14% | 7.22% | ★★★★★★ |

| Martifer SGPS | 102.88% | -0.23% | 7.16% | ★★★★★★ |

| La Forestière Equatoriale | NA | -65.30% | 37.55% | ★★★★★★ |

| Dekpol | 63.20% | 11.99% | 14.08% | ★★★★★☆ |

| Deutsche Balaton | 4.58% | -18.46% | -16.14% | ★★★★★☆ |

| va-Q-tec | 43.54% | 8.03% | -34.33% | ★★★★★☆ |

| ABG Sundal Collier Holding | 46.02% | -6.02% | -15.62% | ★★★★☆☆ |

| Darwin | 3.03% | 84.88% | 5.63% | ★★★★☆☆ |

| Eurofins-Cerep | 0.46% | 6.80% | 6.93% | ★★★★☆☆ |

| MCH Group | 124.09% | 12.40% | 43.58% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

SP Group (CPSE:SPG)

Simply Wall St Value Rating: ★★★★★★

Overview: SP Group A/S, with a market cap of DKK3.65 billion, manufactures and sells moulded plastic and composite components across Denmark, Europe, the Americas, Asia, the Middle East, Australia, and Africa.

Operations: SP Group generates revenue primarily from its Plastics & Rubber segment, amounting to DKK2.99 billion.

SP Group, a small cap player in the chemical industry, has shown impressive earnings growth of 59.7% over the past year, outpacing the industry's 8.4%. The company trades at a significant discount to its estimated fair value and boasts high-quality earnings with a net debt to equity ratio reduced from 79.7% to 17.6% over five years. However, recent guidance revisions indicate potential revenue fluctuations between -3% and +3% for 2025 due to market challenges, despite Q1 sales reaching DKK786 million and net income rising to DKK78 million compared to last year’s figures.

Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative (ENXTPA:CRBP2)

Simply Wall St Value Rating: ★★★★★★

Overview: Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative offers diverse banking and financial services to various customer segments in France, with a market capitalization of approximately €1.24 billion.

Operations: Caisse Régionale generates revenue primarily from its retail banking segment, amounting to €624.79 million. The company's market capitalization stands at approximately €1.24 billion.

CRBP2, with total assets of €41.0B and equity at €5.4B, is a financial entity that relies on customer deposits for 93% of its funding, minimizing risk compared to external borrowing. Total loans stand at €33.9B against deposits of €33.0B, reflecting a balanced approach to lending and funding. The bank's allowance for bad loans is sufficient at 110%, covering the non-performing loan ratio of 1.4%. Despite trading at 40% below estimated fair value and showing high-quality earnings with a five-year annual growth rate of 7%, it didn't outpace the industry’s recent growth rate of 3%.

Storytel (OM:STORY B)

Simply Wall St Value Rating: ★★★★★★

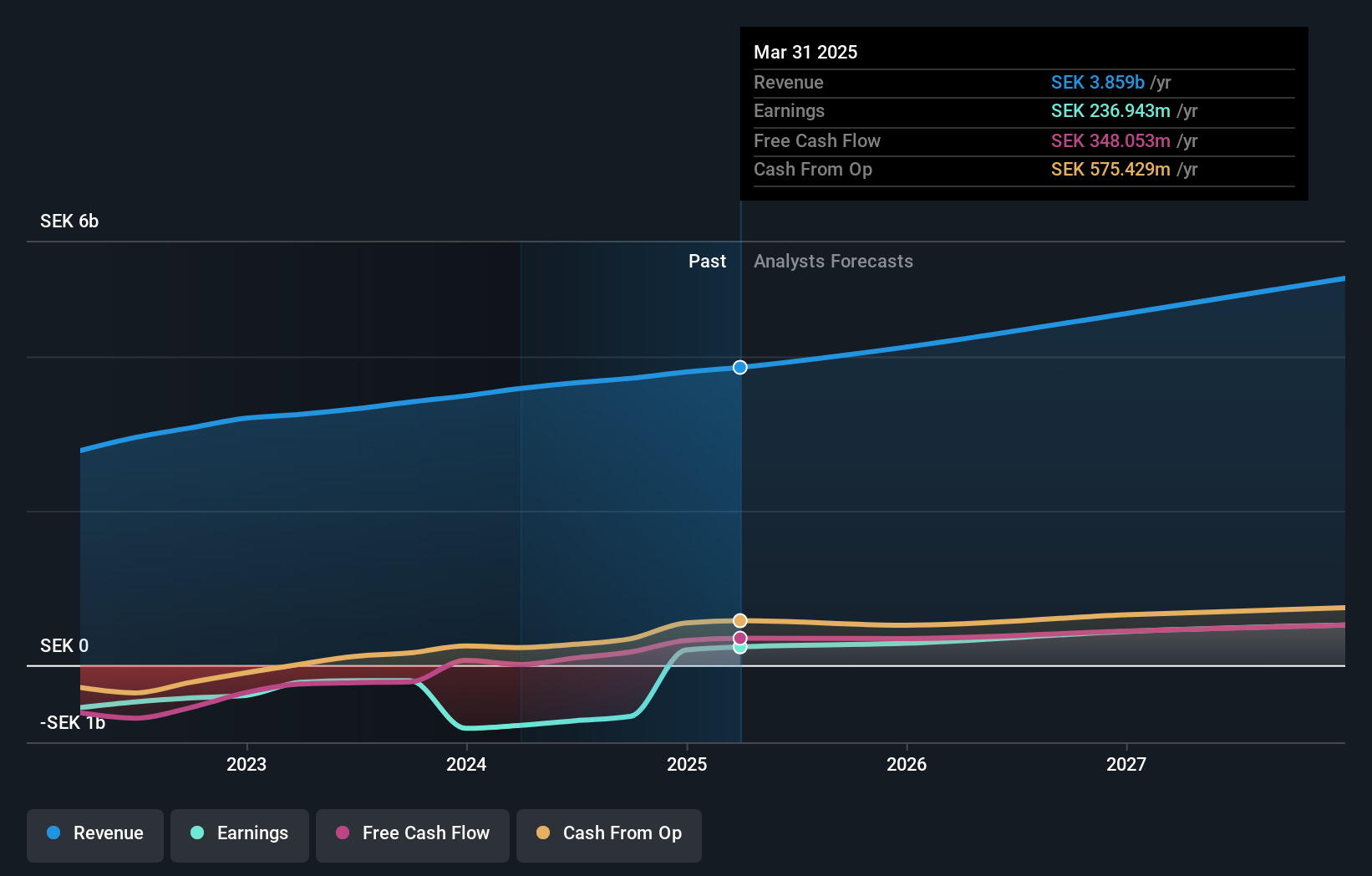

Overview: Storytel AB (publ) offers audiobooks and e-books streaming services, with a market capitalization of approximately SEK7.36 billion.

Operations: Storytel generates revenue primarily from its Streaming segment, which contributed SEK3.43 billion, and its Publishing segment, accounting for SEK1.16 billion. The net profit margin is a key metric to consider when evaluating the company's financial performance.

Storytel, a nimble player in the audiobook and e-book streaming space, is making waves with its strategic moves. The company has recently turned profitable, showing impressive growth as it expands beyond Nordic markets. Its acquisition of Bokfabriken aims to bolster content offerings and enhance customer retention through personalized recommendations. Despite facing competition from giants like Spotify, Storytel's net income reached SEK 15 million in Q1 2025 from a previous loss of SEK 25 million. Trading at a significant discount to its estimated fair value, Storytel projects revenue growth between 7% and 10% for this year.

Next Steps

- Discover the full array of 320 European Undiscovered Gems With Strong Fundamentals right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:STORY B

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives