- United Kingdom

- /

- Specialty Stores

- /

- LSE:WOSG

Undervalued European Small Caps With Insider Activity To Watch In April 2025

Reviewed by Simply Wall St

As the European markets experience a recovery, with the pan-European STOXX Europe 600 Index climbing 3.93% over recent days, investor sentiment has been buoyed by the European Central Bank's rate cuts and a delay in tariff hikes. This environment presents an intriguing backdrop for small-cap stocks, which often thrive on economic shifts and insider activity—factors that can signal potential opportunities amid broader market movements.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Morgan Advanced Materials | 10.2x | 0.5x | 45.00% | ★★★★★★ |

| Tristel | 27.6x | 3.9x | 27.25% | ★★★★★☆ |

| Kitwave Group | 13.6x | 0.3x | 49.02% | ★★★★★☆ |

| Savills | 23.4x | 0.5x | 43.87% | ★★★★☆☆ |

| IAR Systems Group | 10.2x | 2.6x | 18.27% | ★★★★☆☆ |

| Norcros | 24.1x | 0.6x | 28.84% | ★★★☆☆☆ |

| Italmobiliare | 10.9x | 1.4x | -256.53% | ★★★☆☆☆ |

| Arendals Fossekompani | 20.5x | 1.6x | 49.12% | ★★★☆☆☆ |

| Speedy Hire | NA | 0.2x | -3.28% | ★★★☆☆☆ |

| FastPartner | 15.4x | 4.4x | -70.91% | ★★★☆☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

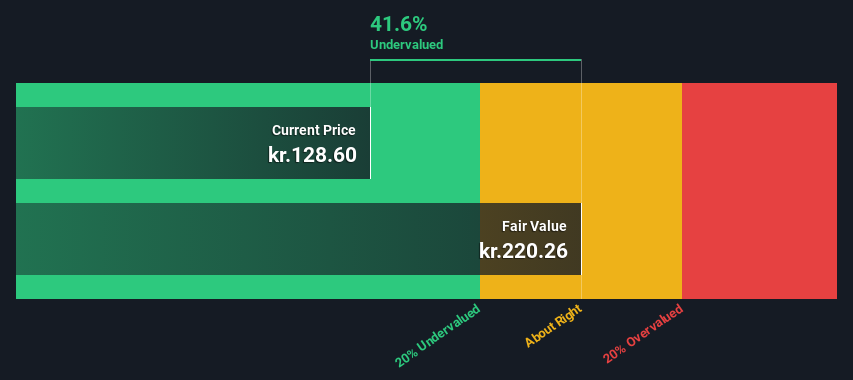

H+H International (CPSE:HH)

Simply Wall St Value Rating: ★★★★☆☆

Overview: H+H International is a company that specializes in the production of construction materials, with operations focused on providing aerated concrete products and other building solutions, and it has a market capitalization of approximately DKK 2.52 billion.

Operations: The company generates revenue primarily from its construction materials segment, with recent figures showing a gross profit margin of 21.08%. Over the periods observed, costs of goods sold (COGS) have been a significant component of expenses, impacting overall profitability.

PE: -34.2x

H+H International, a European building materials company, recently saw insider confidence with Jorg Brinkmann purchasing 4,000 shares for approximately DKK 433,429 in March 2025. Despite a volatile share price over the last three months and reliance on higher-risk external borrowing, the company projects revenue growth of 5% to 10% for 2025. Recent board changes aim to streamline operations further. Notably, their net loss narrowed significantly from DKK 248 million in 2023 to DKK 53 million in 2024.

- Click to explore a detailed breakdown of our findings in H+H International's valuation report.

Examine H+H International's past performance report to understand how it has performed in the past.

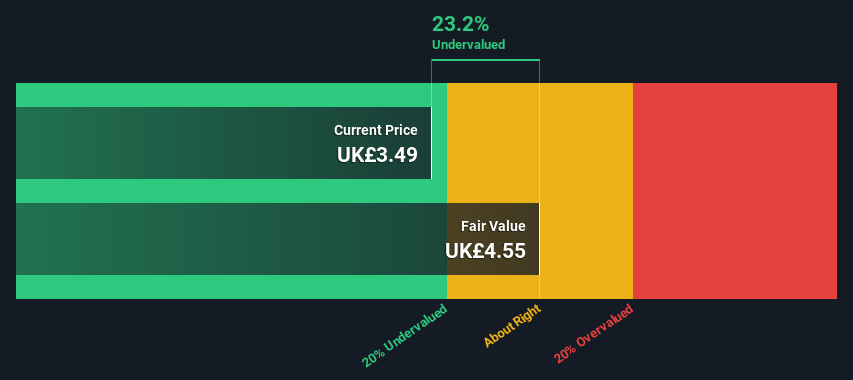

Watches of Switzerland Group (LSE:WOSG)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Watches of Switzerland Group is a leading retailer specializing in luxury watches and jewelry, operating primarily in the UK, Europe, and the US with a market capitalization of approximately £1.28 billion.

Operations: The company's revenue is primarily derived from the UK & Europe (£842.40 million) and the US (£718.90 million). Over recent periods, the gross profit margin has shown a declining trend, reaching 12.39% in October 2024 and continuing at that level into April 2025. Operating expenses have remained relatively stable around £47 million in recent quarters, while non-operating expenses increased to £104.6 million by October 2024, impacting net income margins which decreased to 2.63%.

PE: 21.3x

Watches of Switzerland Group, a prominent player in the luxury watch retail sector, is capturing attention due to its potential for growth and current market valuation. Despite profit margins dropping from 6.8% to 2.6%, earnings are projected to rise at an impressive 27% annually. The company recently initiated a share repurchase program authorized by shareholders, signaling confidence in its future prospects despite relying solely on external borrowing for funding.

- Get an in-depth perspective on Watches of Switzerland Group's performance by reading our valuation report here.

Learn about Watches of Switzerland Group's historical performance.

Cint Group (OM:CINT)

Simply Wall St Value Rating: ★★★★★☆

Overview: Cint Group operates a global software platform for digital insights gathering, with a market cap of €1.09 billion.

Operations: Cint's revenue primarily comes from Cint Exchange and Media Measurement, with recent data showing a gross profit margin reaching 86.93%. The company has experienced fluctuations in net income, with significant non-operating expenses impacting financial results.

PE: -18.7x

Cint Group, a smaller European company, has shown signs of potential value despite recent challenges. Their earnings report for Q4 2024 revealed EUR 45.36 million in sales and a net income of EUR 2.5 million, contrasting with last year's substantial loss. Insider confidence is evident as Independent Director Carl Sparks purchased 300,000 shares for approximately SEK 21.55 million between January and March 2025. The company completed a SEK 584 million equity offering in March to bolster financial flexibility amidst volatile share prices and reliance on external borrowing for funding.

- Delve into the full analysis valuation report here for a deeper understanding of Cint Group.

Gain insights into Cint Group's past trends and performance with our Past report.

Summing It All Up

- Gain an insight into the universe of 61 Undervalued European Small Caps With Insider Buying by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Watches of Switzerland Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:WOSG

Watches of Switzerland Group

Operates as a retailer of luxury watches and jewelry in the United Kingdom, Europe, and the United States.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives