Strong week for Brødrene Hartmann (CPH:HART) shareholders doesn't alleviate pain of five-year loss

It's nice to see the Brødrene Hartmann A/S (CPH:HART) share price up 14% in a week. But over the last half decade, the stock has not performed well. You would have done a lot better buying an index fund, since the stock has dropped 34% in that half decade.

On a more encouraging note the company has added kr.214m to its market cap in just the last 7 days, so let's see if we can determine what's driven the five-year loss for shareholders.

Though if you're not interested in researching what drove HART's performance, we have a free list of interesting investing ideas to potentially inspire your next investment!

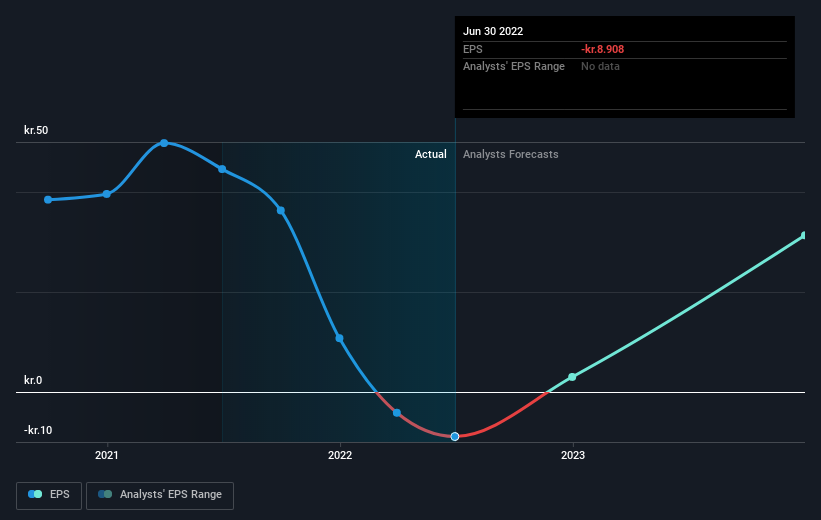

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Over five years Brødrene Hartmann's earnings per share dropped significantly, falling to a loss, with the share price also lower. The recent extraordinary items contributed to this situation. At present it's hard to make valid comparisons between EPS and the share price. However, we can say we'd expect to see a falling share price in this scenario.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Dive deeper into Brødrene Hartmann's key metrics by checking this interactive graph of Brødrene Hartmann's earnings, revenue and cash flow.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Brødrene Hartmann's total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Brødrene Hartmann's TSR of was a loss of 30% for the 5 years. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

We regret to report that Brødrene Hartmann shareholders are down 29% for the year. Unfortunately, that's worse than the broader market decline of 5.2%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 5% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Brødrene Hartmann has 1 warning sign we think you should be aware of.

We will like Brødrene Hartmann better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on DK exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Brødrene Hartmann might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CPSE:HART

Brødrene Hartmann

Brødrene Hartmann A/S produces and sells moulded-fibre packaging for eggs and fruits in Denmark, rest of Europe, North and South America, India, and internationally.

Adequate balance sheet and fair value.

Market Insights

Community Narratives