How Investors Are Reacting To Tryg (CPSE:TRYG) Attracting Strong Demand For New Capital Notes

Reviewed by Sasha Jovanovic

- Earlier this week, Tryg Forsikring A/S completed the successful pricing and subscription of new Perpetual Restricted Tier 1 Capital Notes, raising NOK300 million and SEK700 million, with demand very large and mostly placed with asset managers in the Nordic region.

- This transaction reflects investor confidence and will allow Tryg to proactively manage its capital structure by repurchasing outstanding notes at a premium, contingent on the full settlement of the new issue.

- We'll explore how Tryg's strong investor demand for its new capital notes may influence its investment approach and future prospects.

Find companies with promising cash flow potential yet trading below their fair value.

Tryg Investment Narrative Recap

To be a shareholder in Tryg, you need to believe in its ability to manage capital efficiently and sustain operational improvements, despite macroeconomic and regulatory uncertainties. The recent strong Nordic demand for perpetual capital notes reinforces confidence in Tryg’s capital position, but doesn’t materially change near-term catalysts: delivering on profitability initiatives and customer retention. However, risks such as regulatory scrutiny on pricing, particularly around indexation practices in Denmark, remain present.

Among recent company announcements, the nine-month earnings result in October 2025 stands out, showing continued earnings growth and consistent dividends. Taken together, this reliability in payouts and steady profit progression underpins current investor confidence, but potential regulatory interventions could impact net margins and future dividend consistency.

By contrast, one pressing issue that investors should be aware of is the ongoing regulatory scrutiny regarding indexation practices and its possible effects on...

Read the full narrative on Tryg (it's free!)

Tryg's narrative projects DKK 44.3 billion revenue and DKK 5.7 billion earnings by 2028. This requires 2.6% yearly revenue growth and a DKK 0.7 billion earnings increase from DKK 5.0 billion.

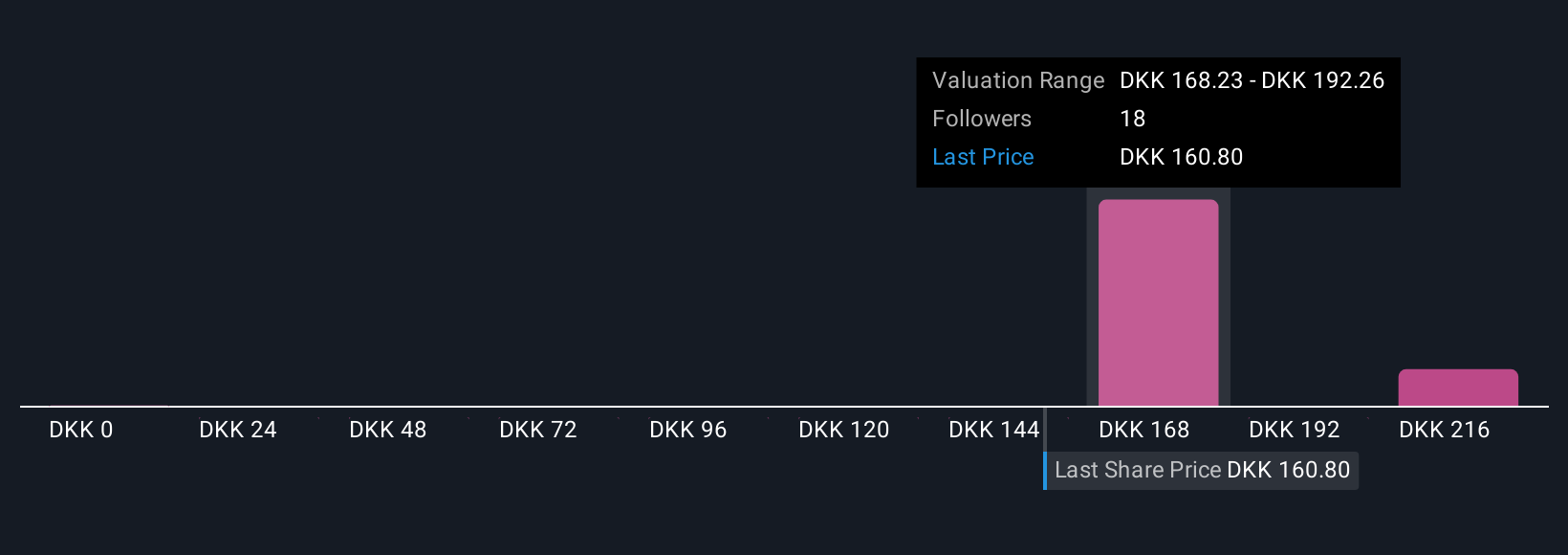

Uncover how Tryg's forecasts yield a DKK175.00 fair value, a 8% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members produced four fair value estimates for Tryg ranging widely from DKK24.03 to DKK240.33. With earnings growth forecast to be slower than the industry, it is worth weighing these different outlooks to see how your view stacks up.

Explore 4 other fair value estimates on Tryg - why the stock might be worth as much as 49% more than the current price!

Build Your Own Tryg Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tryg research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Tryg research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tryg's overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tryg might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:TRYG

Tryg

Provides insurance products and services for private and corporate customers, and small and medium-sized businesses in Denmark, Sweden, the United Kingdom, and Norway.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives