The Case For Alm. Brand A/S (CPH:ALMB): Could It Be A Nice Addition To Your Dividend Portfolio?

Is Alm. Brand A/S (CPH:ALMB) a good dividend stock? How can we tell? Dividend paying companies with growing earnings can be highly rewarding in the long term. Yet sometimes, investors buy a popular dividend stock because of its yield, and then lose money if the company's dividend doesn't live up to expectations.

One way to look into the risks is to look at a snapshot of Alm. Brand's latest financial position, by checking our visualisation of its financial health.

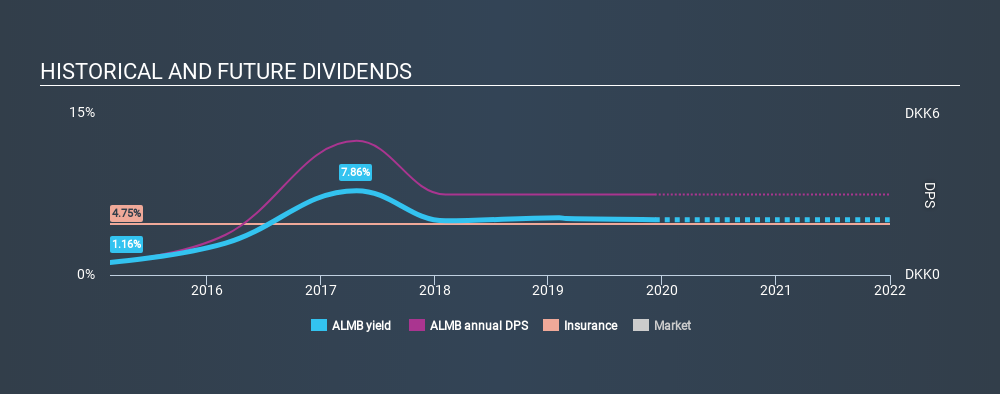

With a goodly-sized dividend yield despite a relatively short payment history, investors might be wondering if Alm. Brand is a new dividend aristocrat in the making. It sure looks interesting on these metrics - but there's always more to the story . During the year, the company also conducted a buyback equivalent to around 1.4% of its market capitalisation. There are a few simple ways to reduce the risks of buying Alm. Brand for its dividend, and we'll go through these below.

Click the interactive chart for our full dividend analysis

Payout ratios

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. So we need to form a view on if a company's dividend is sustainable, relative to its net profit after tax. Alm. Brand paid out 48% of its profit as dividends, over the trailing twelve month period. This is a medium payout level that leaves enough capital in the business to fund opportunities that might arise, while also rewarding shareholders. Besides, if reinvestment opportunities dry up, the company has room to increase the dividend.

Dividend Volatility

Before buying a stock for its income, we want to see if the dividends have been stable in the past, and if the company has a track record of maintaining its dividend. Looking at the data, we can see that Alm. Brand has been paying a dividend for the past five years. During the past five-year period, the first annual payment was ø0.50 in 2014, compared to ø3.00 last year. Dividends per share have grown at approximately 43% per year over this time. The growth in dividends has not been linear, but the CAGR is a decent approximation of the rate of change over this time frame.

So, its dividends have grown at a rapid rate over this time, but payments have been cut in the past. The stock may still be worth considering as part of a diversified dividend portfolio.

Dividend Growth Potential

With a relatively unstable dividend, it's even more important to see if earnings per share (EPS) are growing. Why take the risk of a dividend getting cut, unless there's a good chance of bigger dividends in future? It's good to see Alm. Brand has been growing its earnings per share at 25% a year over the past five years. Earnings per share have rocketed in recent times, and we like that the company is retaining more than half of its earnings to reinvest. However, always remember that very few companies can grow at double digit rates forever.

Conclusion

When we look at a dividend stock, we need to form a judgement on whether the dividend will grow, if the company is able to maintain it in a wide range of economic circumstances, and if the dividend payout is sustainable. We're glad to see Alm. Brand has a low payout ratio, as this suggests earnings are being reinvested in the business. Next, earnings growth has been good, but unfortunately the dividend has been cut at least once in the past. Overall we think Alm. Brand is an interesting dividend stock, although it could be better.

Are management backing themselves to deliver performance? Check their shareholdings in Alm. Brand in our latest insider ownership analysis.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About CPSE:ALMB

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion