- Denmark

- /

- Medical Equipment

- /

- CPSE:EMBLA

Embla Medical hf.'s (CPH:EMBLA) Share Price Matching Investor Opinion

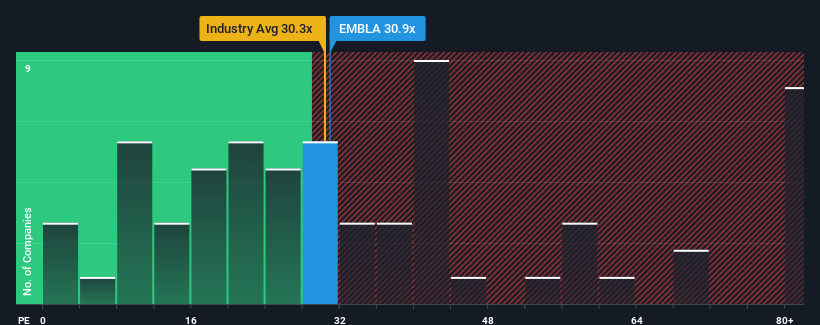

When close to half the companies in Denmark have price-to-earnings ratios (or "P/E's") below 16x, you may consider Embla Medical hf. (CPH:EMBLA) as a stock to avoid entirely with its 30.9x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

With earnings growth that's superior to most other companies of late, Embla Medical hf has been doing relatively well. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. If not, then existing shareholders might be a little nervous about the viability of the share price.

See our latest analysis for Embla Medical hf

How Is Embla Medical hf's Growth Trending?

In order to justify its P/E ratio, Embla Medical hf would need to produce outstanding growth well in excess of the market.

Retrospectively, the last year delivered an exceptional 32% gain to the company's bottom line. As a result, it also grew EPS by 21% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing earnings over that time.

Shifting to the future, estimates from the five analysts covering the company suggest earnings should grow by 25% each year over the next three years. That's shaping up to be materially higher than the 15% each year growth forecast for the broader market.

In light of this, it's understandable that Embla Medical hf's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Embla Medical hf's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Embla Medical hf that you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if Embla Medical hf might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CPSE:EMBLA

Embla Medical hf

Provides non-invasive orthopedic products in Europe, the Middle East, Africa, the Americas, and the Asia-Pacific.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives