- Denmark

- /

- Medical Equipment

- /

- CPSE:COLO B

Coloplast (CPH:COLO B) Strong Profits May Be Masking Some Underlying Issues

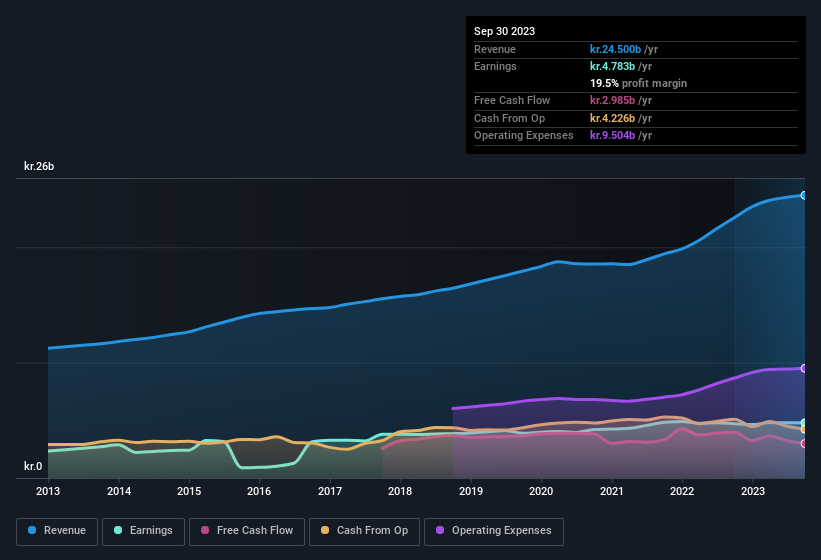

The stock price didn't jump after Coloplast A/S (CPH:COLO B) posted decent earnings last week. We did some digging and believe investors may be worried about some underlying factors in the report.

View our latest analysis for Coloplast

In order to understand the potential for per share returns, it is essential to consider how much a company is diluting shareholders. Coloplast expanded the number of shares on issue by 5.8% over the last year. Therefore, each share now receives a smaller portion of profit. To talk about net income, without noticing earnings per share, is to be distracted by the big numbers while ignoring the smaller numbers that talk to per share value. You can see a chart of Coloplast's EPS by clicking here.

How Is Dilution Impacting Coloplast's Earnings Per Share (EPS)?

Coloplast has improved its profit over the last three years, with an annualized gain of 14% in that time. However, net income was pretty flat over the last year with a miniscule increase. Earnings per share are pretty much flat, too over the last twelve months, but EPS growth came in below below net income growth. So you can see that the dilution has had a bit of an impact on shareholders.

In the long term, earnings per share growth should beget share price growth. So Coloplast shareholders will want to see that EPS figure continue to increase. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Our Take On Coloplast's Profit Performance

Coloplast shareholders should keep in mind how many new shares it is issuing, because, dilution clearly has the power to severely impact shareholder returns. Therefore, it seems possible to us that Coloplast's true underlying earnings power is actually less than its statutory profit. Nonetheless, it's still worth noting that its earnings per share have grown at 12% over the last three years. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. So if you'd like to dive deeper into this stock, it's crucial to consider any risks it's facing. To that end, you should learn about the 3 warning signs we've spotted with Coloplast (including 1 which is a bit unpleasant).

Today we've zoomed in on a single data point to better understand the nature of Coloplast's profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CPSE:COLO B

Coloplast

Engages in the development and sale of intimate healthcare products and services in Denmark, the United States, the United Kingdom, France, and internationally.

Good value with moderate growth potential.