As global markets continue to navigate the complexities of geopolitical developments and economic shifts, major indices like the S&P 500 have reached record highs, buoyed by optimism surrounding potential trade agreements and advancements in artificial intelligence. While large-cap stocks have generally outperformed their smaller counterparts, small-cap companies remain an intriguing area for investors seeking opportunities that may not yet be fully appreciated by the broader market. In this environment, identifying stocks with strong fundamentals and growth potential can be particularly rewarding as they may offer unique advantages amidst evolving market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Natural Food International Holding | NA | 2.49% | 20.35% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Kenturn Nano. Tec | 45.38% | 9.73% | 28.94% | ★★★★★☆ |

| ONEJOON | 9.85% | 24.95% | 4.85% | ★★★★★☆ |

| Giant Heavy Machinery Service | 17.81% | 21.88% | 48.77% | ★★★★★☆ |

| PAN Group | 132.37% | 16.01% | 28.32% | ★★★★☆☆ |

| Petrolimex Insurance | 32.25% | 4.46% | 7.91% | ★★★★☆☆ |

| Bhakti Multi Artha | 45.21% | 32.37% | -16.43% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

UIE (CPSE:UIE)

Simply Wall St Value Rating: ★★★★★★

Overview: UIE Plc is an investment company involved in the agro-industrial, industrial, and technology sectors across Malaysia, Indonesia, the United States, Europe, and other international markets with a market capitalization of DKK9.63 billion.

Operations: The primary revenue stream for UIE comes from its investment in United Plantations Berhad, generating $462.25 million. The company's market capitalization stands at DKK9.63 billion.

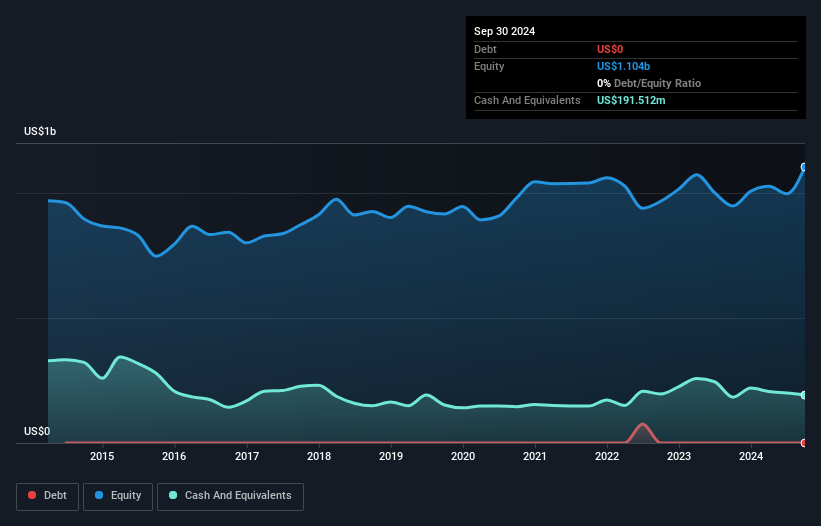

UIE, a promising player in the food industry, reported impressive earnings growth of 83.7% over the past year, outpacing the industry's 16.2%. The company is trading at 28% below its estimated fair value and remains debt-free, which simplifies financial management. Recent results highlight a significant turnaround with net income of US$32.2 million for Q3 compared to a loss last year, supported by sales rising to US$128.52 million from US$115.36 million previously. A notable one-off gain of US$70.2 million has impacted recent financials but speaks to UIE's potential for high-quality earnings moving forward.

- Click here and access our complete health analysis report to understand the dynamics of UIE.

Gain insights into UIE's historical performance by reviewing our past performance report.

Tanmiah Food (SASE:2281)

Simply Wall St Value Rating: ★★★★★☆

Overview: Tanmiah Food Company, with a market cap of SAR2.41 billion, operates in the food and agriculture sector through its subsidiaries both within Saudi Arabia and internationally.

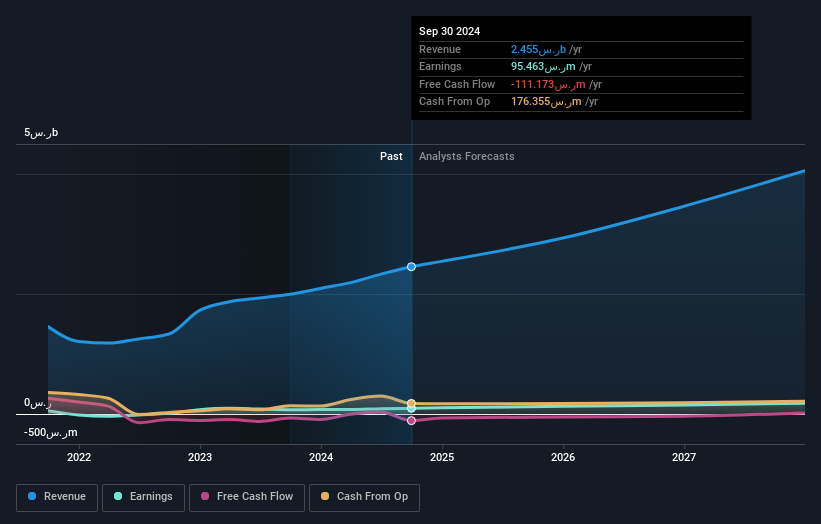

Operations: Tanmiah generates revenue primarily from its agriculture and food business, amounting to SAR2.45 billion.

Tanmiah Food, a small player in the food industry, has shown impressive earnings growth of 36.9% over the past year, surpassing the industry's 20.8%. The company's debt to equity ratio has improved significantly from 145% to 77.1% over five years, though its net debt to equity remains high at 59%. Recently reported sales for Q3 were SAR 657 million compared to SAR 534 million last year, with net income rising from SAR 17 million to SAR 24 million. Despite being undervalued by approximately half of its estimated fair value, Tanmiah's non-cash earnings are notably high.

- Dive into the specifics of Tanmiah Food here with our thorough health report.

Explore historical data to track Tanmiah Food's performance over time in our Past section.

Middle East Pharmaceutical Industries (SASE:4016)

Simply Wall St Value Rating: ★★★★★☆

Overview: Middle East Pharmaceutical Industries Company focuses on the research, development, manufacture, and marketing of generic medicines and pharmaceutical preparations both in Saudi Arabia and internationally, with a market cap of SAR2.62 billion.

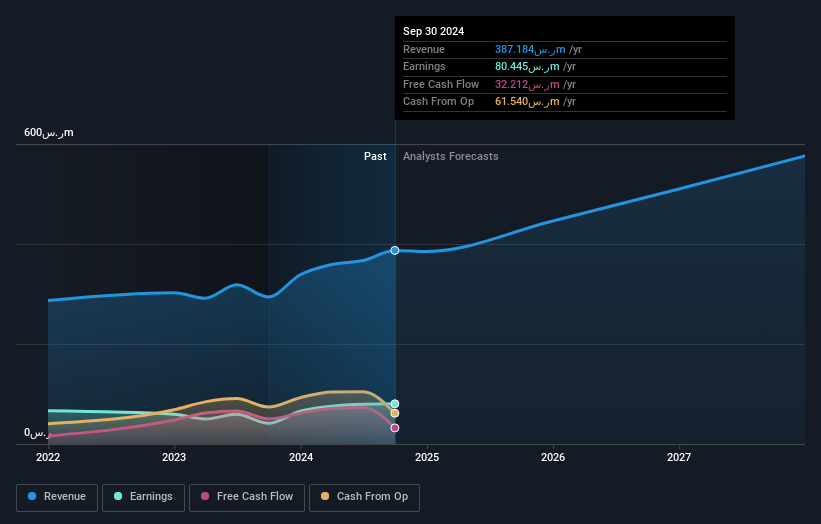

Operations: Middle East Pharmaceutical Industries generates revenue primarily from private customers (SAR244.49 million), followed by public customers (SAR88.23 million) and export customers (SAR54.46 million).

Middle East Pharmaceutical Industries has been making waves with its impressive earnings growth of 94.7% over the past year, outpacing the industry's 8.6%. The company showcases high-quality earnings, supported by a satisfactory net debt to equity ratio of 18.3%, indicating a sound financial position. Levered free cash flow has seen significant improvement, jumping from US$4.84 million in December 2020 to US$73.12 million by June 2024, which suggests robust operational efficiency and potential for future expansion within the pharmaceutical sector. With interest payments well covered at 19.7 times EBIT, financial stability seems assured moving forward.

Summing It All Up

- Discover the full array of 4664 Undiscovered Gems With Strong Fundamentals right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:UIE

UIE

Engages invests in the agro-industrial, and industrial and technology sectors in Malaysia, Indonesia, the United States, Europe, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives