- Taiwan

- /

- Construction

- /

- TPEX:5511

Top 3 Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

As global markets experience fluctuations with U.S. consumer confidence dipping and major stock indexes showing moderate gains, investors are increasingly seeking stability amidst economic uncertainties. In this environment, dividend stocks offer an attractive option for those looking to enhance their portfolios by providing regular income and potential for growth.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.05% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.09% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.84% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.04% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.45% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.83% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.38% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.82% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.02% | ★★★★★★ |

Click here to see the full list of 1958 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

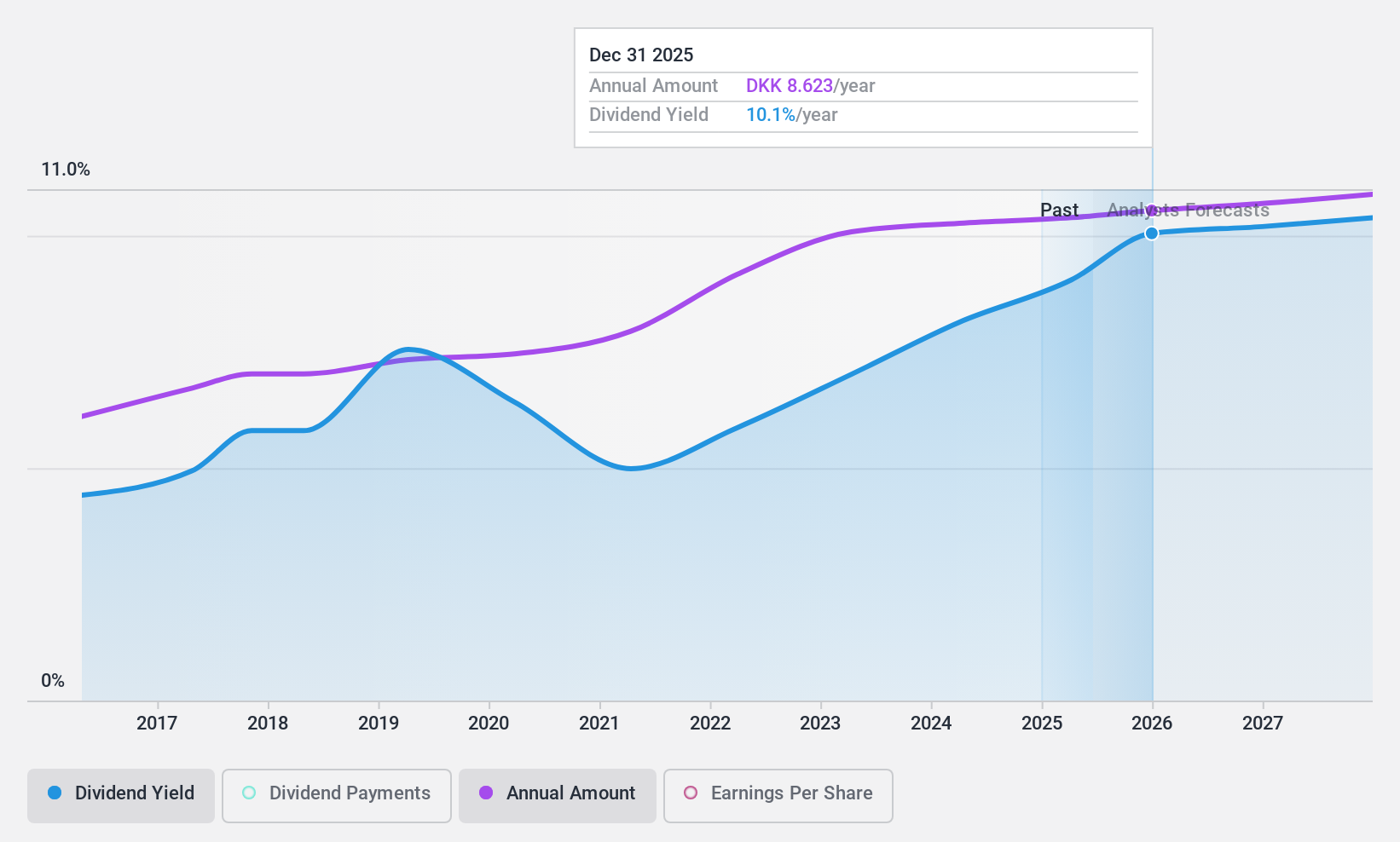

Scandinavian Tobacco Group (CPSE:STG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Scandinavian Tobacco Group A/S is a manufacturer and seller of cigars and pipe tobacco operating in the United States, Europe, and internationally with a market cap of DKK7.52 billion.

Operations: Scandinavian Tobacco Group A/S generates revenue through its segments: Europe Branded (DKK3.04 billion), North America Online & Retail (DKK2.97 billion), and North America Branded & Rest of World (Row) (DKK3.01 billion).

Dividend Yield: 8.7%

Scandinavian Tobacco Group offers a compelling dividend yield of 8.66%, ranking in the top 25% of Danish market payers. Despite only nine years of dividend history, payments have been stable and growing, supported by earnings and cash flows with payout ratios at 72% and 87.1%, respectively. However, recent financials show declining profit margins and net income year-over-year, alongside a significant share buyback program totaling DKK 825 million to date.

- Take a closer look at Scandinavian Tobacco Group's potential here in our dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Scandinavian Tobacco Group shares in the market.

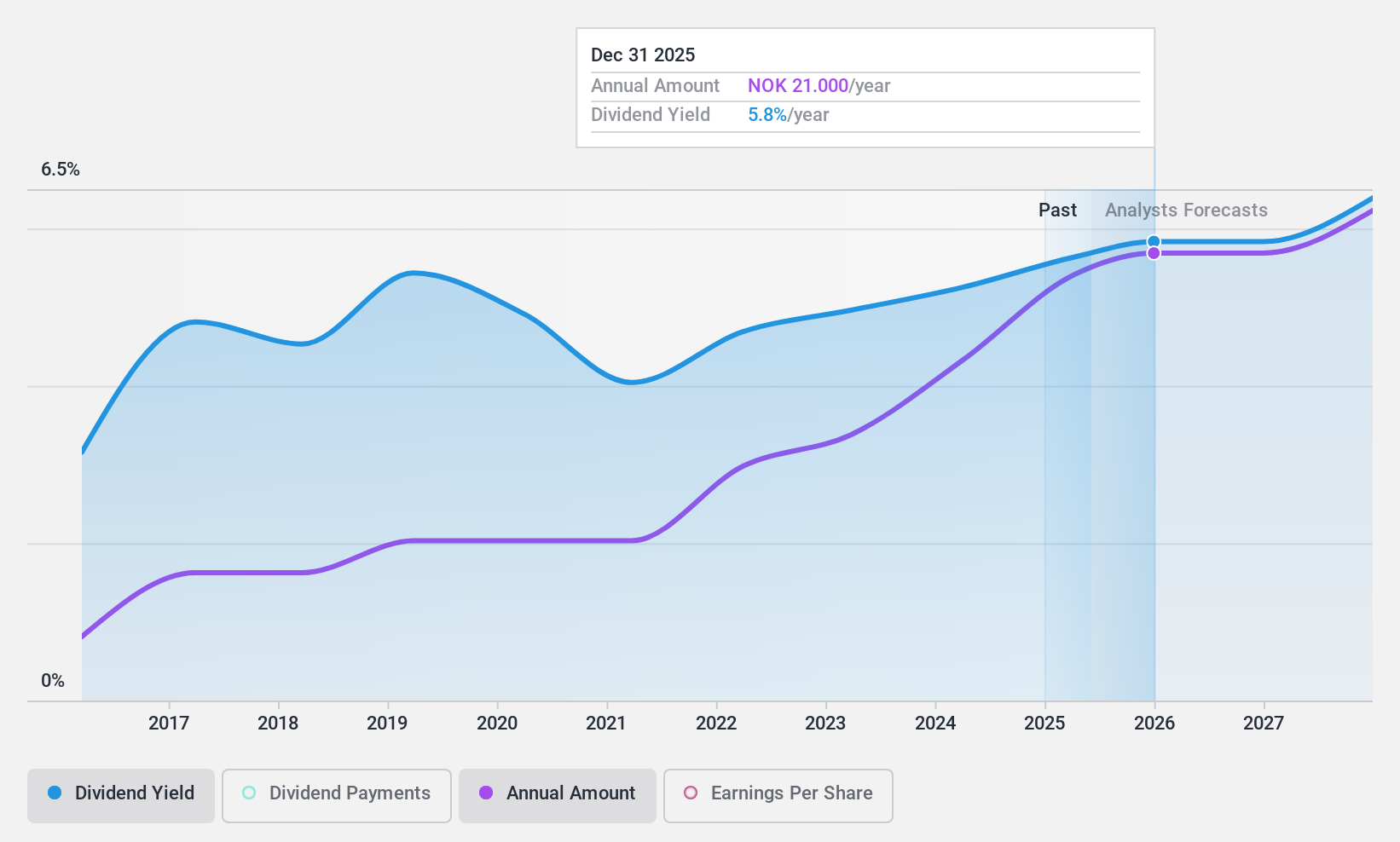

Jæren Sparebank (OB:JAREN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jæren Sparebank offers a range of financial products and services to individuals and businesses in Norway, with a market cap of NOK1.62 billion.

Operations: Jæren Sparebank generates revenue through its Retail Market segment, contributing NOK266.70 million, and its Corporate Market segment, adding NOK166.69 million.

Dividend Yield: 4.8%

Jæren Sparebank's dividends are covered by earnings with a current payout ratio of 58.9%, and this is expected to remain sustainable in three years at 62.7%. However, the bank has an unstable dividend history, marked by volatility over the past decade. Despite this, recent financial performance shows growth; net income for Q3 2024 increased to NOK 62.96 million from NOK 53.53 million last year, indicating potential for future earnings support of dividends.

- Click here to discover the nuances of Jæren Sparebank with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Jæren Sparebank is priced higher than what may be justified by its financials.

Te Chang Construction (TPEX:5511)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Te Chang Construction Co., Ltd. operates in the construction contracting and civil engineering sectors in Taiwan and Thailand, with a market cap of NT$7.24 billion.

Operations: Te Chang Construction Co., Ltd. generates revenue primarily from its construction, real estate leasing, and other businesses, amounting to NT$10.11 billion.

Dividend Yield: 7.8%

Te Chang Construction's dividend yield of 7.84% ranks among the top in Taiwan, yet its sustainability is questionable due to a high cash payout ratio of 266.1%, indicating dividends are not well covered by free cash flows. Despite a reasonable earnings payout ratio of 65.7%, dividends have been volatile over the past decade, lacking reliability and consistent growth. Recent earnings show improved Q3 net income at TWD 348.81 million, but nine-month sales declined year-over-year.

- Unlock comprehensive insights into our analysis of Te Chang Construction stock in this dividend report.

- Upon reviewing our latest valuation report, Te Chang Construction's share price might be too optimistic.

Seize The Opportunity

- Take a closer look at our Top Dividend Stocks list of 1958 companies by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Te Chang Construction might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:5511

Te Chang Construction

Engages in the construction contracting and civil engineering business in Taiwan and Thailand.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives