Evaluating Schouw & Co (CPSE:SCHO): Is There Value Left After a Strong Climb?

Reviewed by Kshitija Bhandaru

See our latest analysis for Aktieselskabet Schouw.

Aktieselskabet Schouw’s share price has enjoyed a steady climb this year, gaining 10.5% year-to-date. Looking further back, its 8.1% total shareholder return over the last year and an impressive 40% over three years suggest that momentum remains firmly positive. Long-term shareholders have been rewarded for their patience.

If you’re interested in what other investors are uncovering, this is an ideal opportunity to broaden your search and discover fast growing stocks with high insider ownership

With shares up for the year but still trading at a discount to analyst targets, the key question now is whether Aktieselskabet Schouw remains undervalued or if the current price already reflects strong future growth prospects.

Most Popular Narrative: 13.9% Undervalued

Compared to the last close price, the most widely followed narrative suggests Aktieselskabet Schouw could be trading below its estimated fair value. Investors are questioning if strong future prospects have been fully priced in or if further upside could be ahead.

Ongoing expansion of BioMar's feed volumes, supported by long-term demand for healthy, protein-rich food sources and increasing aquaculture adoption, positions Schouw for sustained revenue and margin growth as global dietary trends shift and middle class consumption rises.

What key drivers are hidden behind this bullish assessment? The narrative's foundation rests on steady revenue gains, margin uplift, and ambitious profit growth dreams. But what set of numbers justifies its above-market valuation multiple? There is a financial leap baked in. Curious? Unpack the unique forecasting logic and discover what could fuel the next move in the share price.

Result: Fair Value of $708.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, structural labor cost inflation and lingering demand softness in key sectors could challenge margin expansion. This may possibly disrupt the upbeat outlook.

Find out about the key risks to this Aktieselskabet Schouw narrative.

Another View: Looking Through the Lens of Earnings

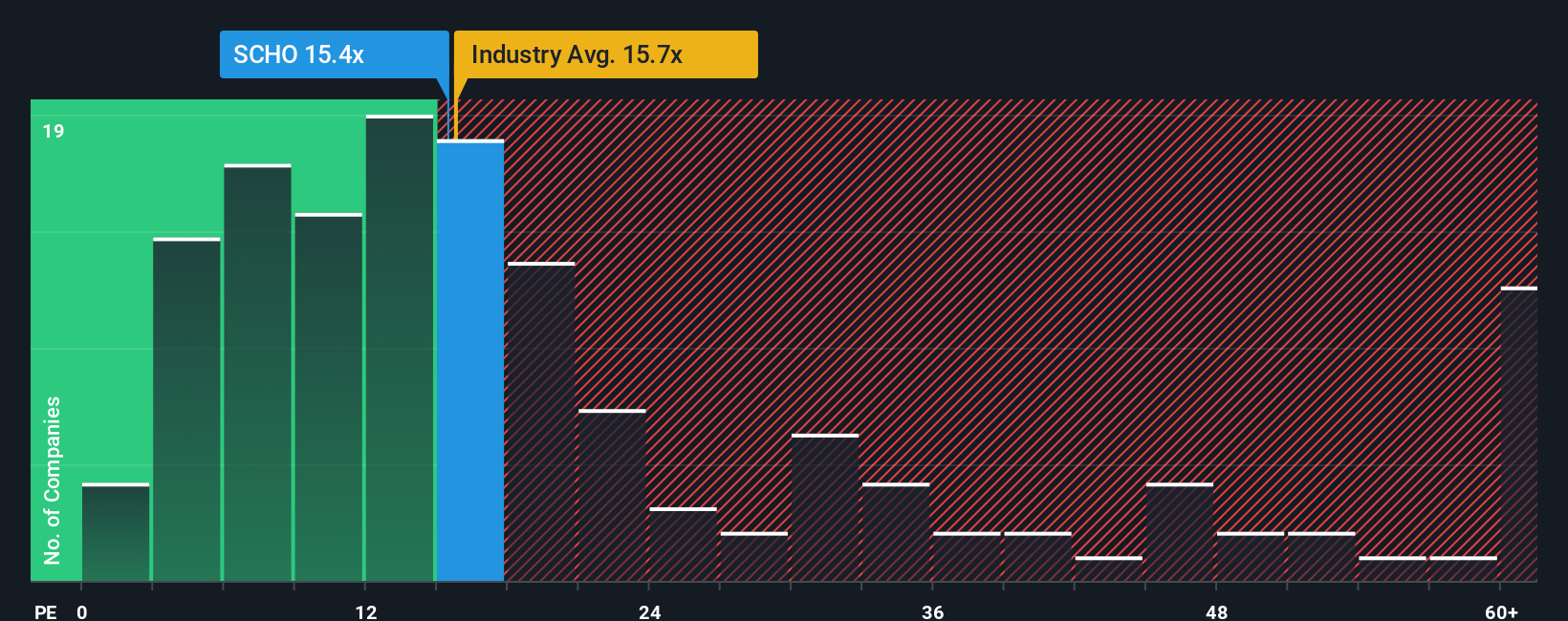

Shifting perspective, let’s consider valuation using the price-to-earnings ratio. Aktieselskabet Schouw trades at 15.3 times earnings, which is lower than the peer average of 16.1 and the broader European Food industry’s 15.6. However, it remains above its fair ratio of 13.1. This gap highlights both potential and risk; could the market push the multiple lower, or does relative value offer a cushion? The answer depends on how much faith investors have in future profit growth.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Aktieselskabet Schouw Narrative

If our analysis does not match your outlook or you enjoy digging into the numbers independently, you can easily build your own view in just a few minutes with Do it your way.

A great starting point for your Aktieselskabet Schouw research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t wait for opportunities to pass you by. Supercharge your portfolio by checking out these lucrative investment angles, handpicked to help you spot the next winner before everyone else:

- Unlock bold growth potential by targeting these 24 AI penny stocks making waves with artificial intelligence breakthroughs and transforming entire industries.

- Maximize your income stream by zeroing in on these 19 dividend stocks with yields > 3% that consistently deliver healthy yields above 3% and can strengthen your portfolio’s cash flow.

- Jump ahead of the market with these 26 quantum computing stocks that are fueling innovation at the intersection of technology and computing, setting the pace for tomorrow’s breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:SCHO

Aktieselskabet Schouw

An industrial conglomerate, provides feed products used in aquaculture in Norway, Chile, Denmark, the United Kingdom, the United States, Ecuador, and internationally.

Established dividend payer and good value.

Market Insights

Community Narratives