- Japan

- /

- Real Estate

- /

- TSE:3480

Discovering Tivoli And 2 Other Small Cap Gems With Strong Metrics

Reviewed by Simply Wall St

As global markets navigate through a mix of moderate gains and economic uncertainties, small-cap stocks, such as those in the S&P 600, are drawing attention for their potential resilience amid fluctuating consumer confidence and shifting economic indicators. In this environment, identifying promising small-cap companies with strong financial metrics can offer valuable opportunities for investors seeking growth.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Tokyo Tekko | 9.82% | 7.91% | 12.42% | ★★★★★★ |

| Nihon Parkerizing | 0.31% | 2.12% | 6.94% | ★★★★★★ |

| Padma Oil | 0.76% | 4.42% | 9.81% | ★★★★★★ |

| QuickLtd | 0.62% | 9.82% | 15.64% | ★★★★★★ |

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| AJIS | 0.79% | 1.12% | -12.92% | ★★★★★☆ |

| Ogaki Kyoritsu Bank | 136.00% | 2.73% | 2.17% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

We'll examine a selection from our screener results.

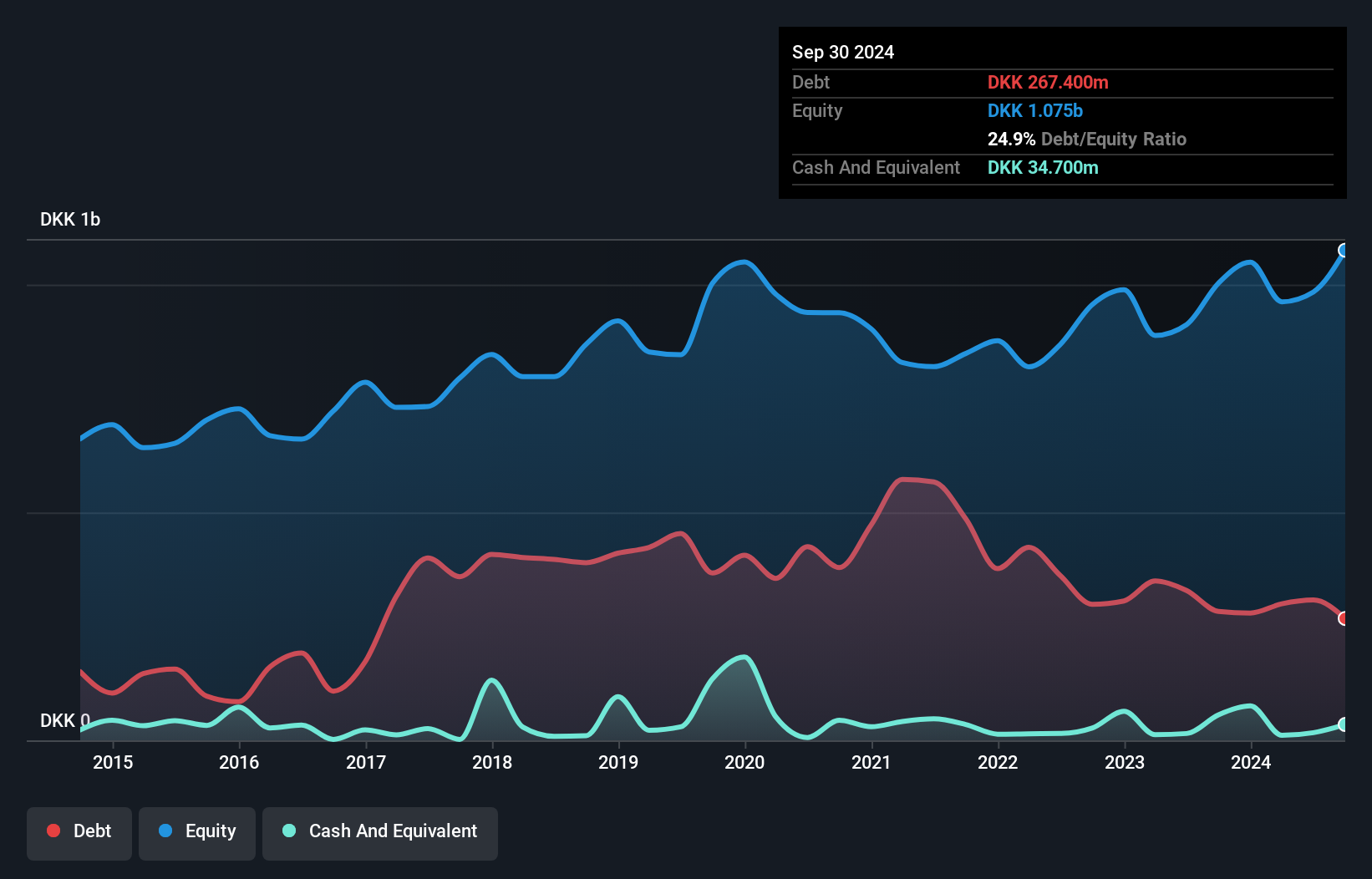

Tivoli (CPSE:TIV)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Tivoli A/S operates in the entertainment industry in Denmark with a market capitalization of DKK 3.75 billion.

Operations: Tivoli A/S generates revenue primarily from Sales (DKK 641.80 million), High-End offerings (DKK 231 million), and Food & Beverage services (DKK 201.60 million). Other significant contributions come from Enterprise Rental and Culture, with Games adding a smaller portion to the total revenue.

Tivoli, a notable player in the hospitality sector, has demonstrated robust financial health with a net debt to equity ratio of 21.6%, deemed satisfactory. The company's interest payments are well covered by EBIT at 20.4 times, reflecting solid operational efficiency. Tivoli's earnings have surged by 72.1% over the past year, outpacing industry growth of 4%. Recent corporate guidance raised expectations for revenue to DKK 1.3 billion and profit before tax to DKK 150 million for 2024, highlighting strong performance momentum despite executive board changes earlier this year.

- Take a closer look at Tivoli's potential here in our health report.

Examine Tivoli's past performance report to understand how it has performed in the past.

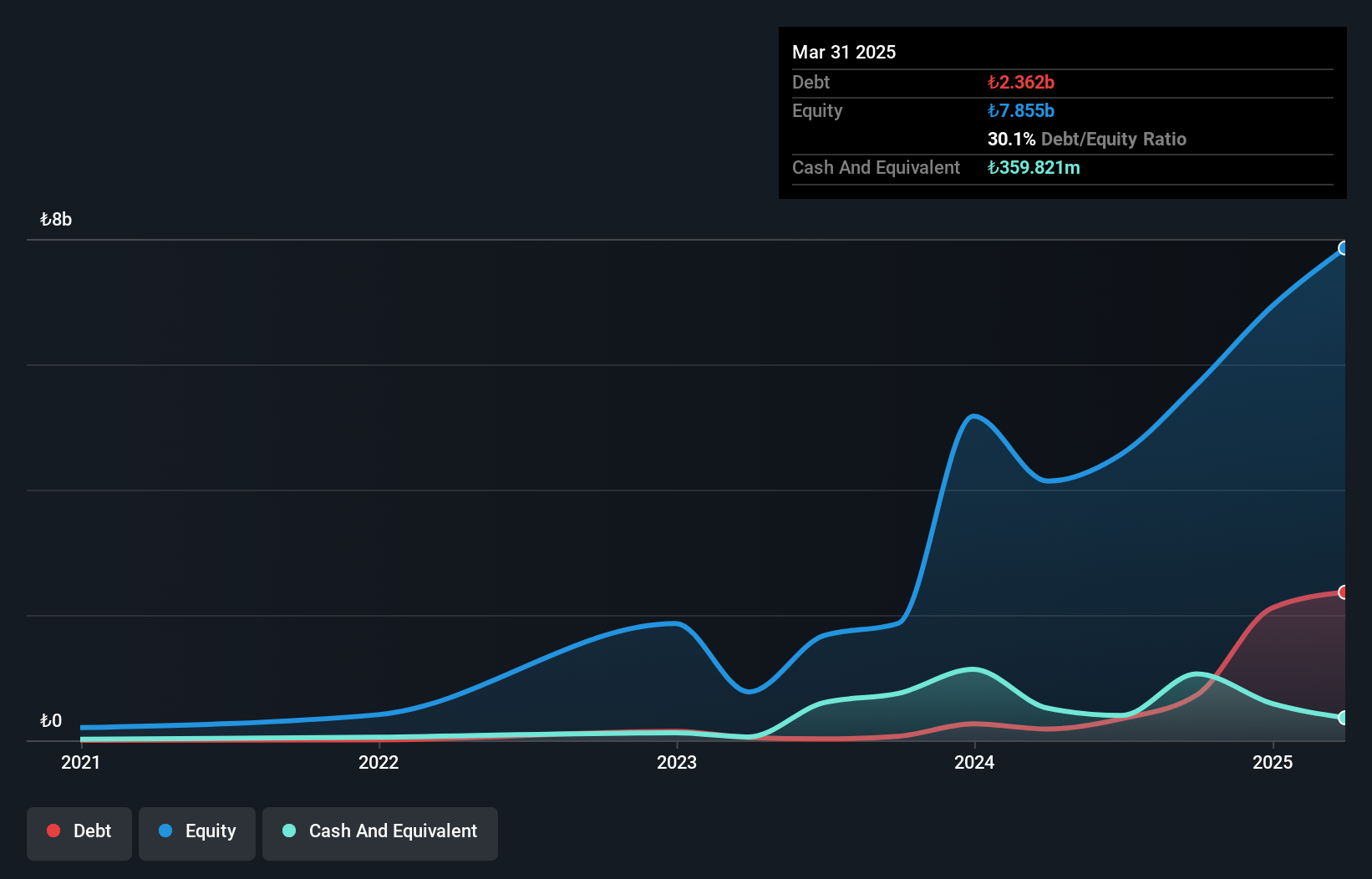

CVK Maden Isletmeleri Sanayi ve Ticaret Anonim Sirketi (IBSE:CVKMD)

Simply Wall St Value Rating: ★★★★★☆

Overview: CVK Maden Isletmeleri Sanayi ve Ticaret Anonim Sirketi is involved in the production, marketing, and sale of chrome, marble, travertine, lead, zinc, copper, and magnesite ores with a market capitalization of TRY11.66 billion.

Operations: CVK Maden generates revenue primarily from its Metals & Mining segment, which amounts to TRY2.37 billion. The company's financial performance is influenced by the profitability of these operations, with a focus on controlling costs and optimizing revenue streams within this sector.

CVK Maden Isletmeleri, a small player in the metals and mining sector, has shown impressive financial resilience despite industry challenges. Over the past year, earnings surged by 22%, outpacing the sector's -10.7% growth rate. The company reported a net income of TRY 190.94 million for Q3 2024, reversing a net loss from the previous year and achieving basic earnings per share of TRY 4.55 compared to a loss of TRY 4.77 last year. With cash exceeding total debt and profitability intact, CVKMD seems well-positioned to navigate future uncertainties while maintaining robust interest coverage capabilities.

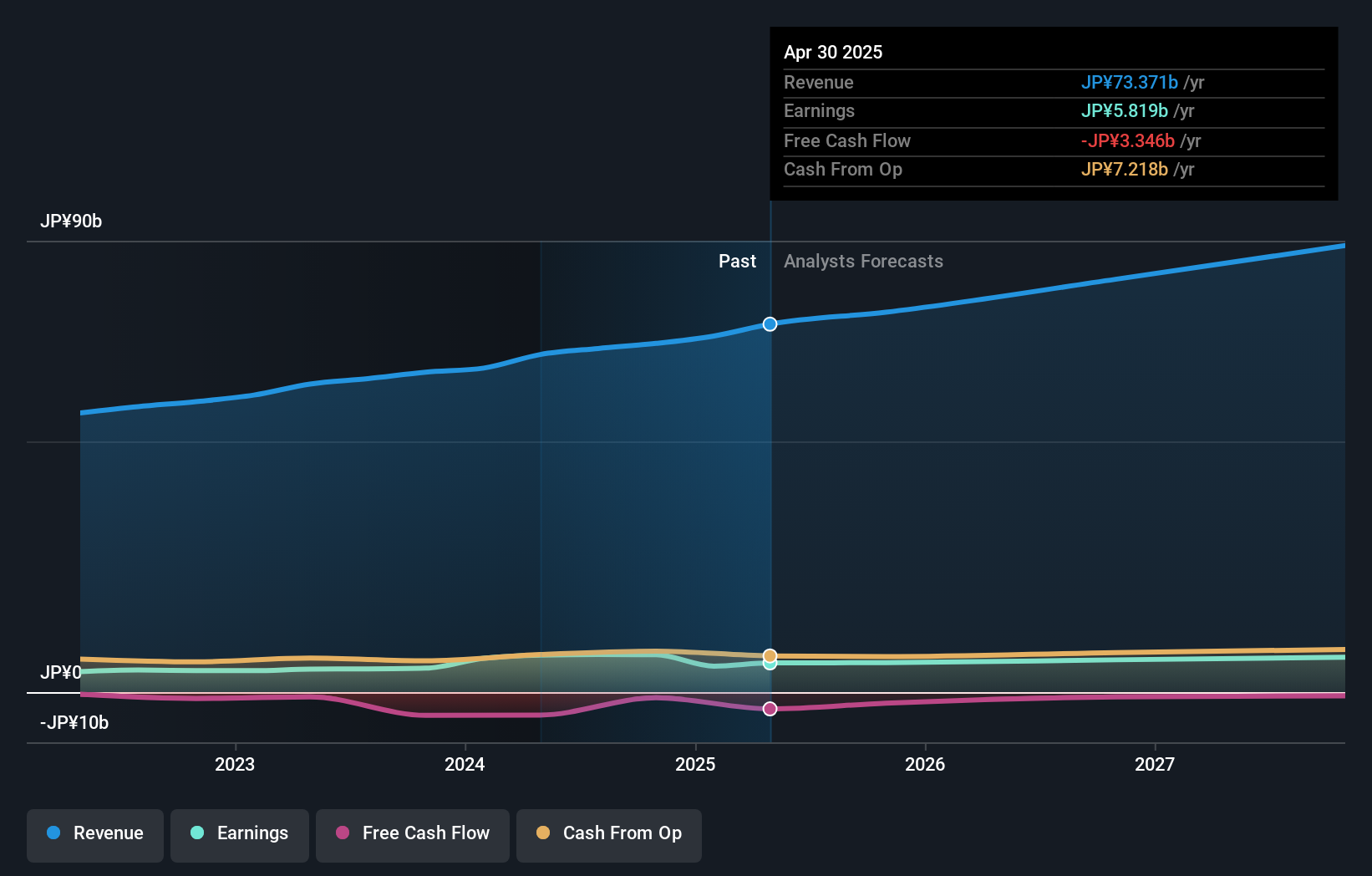

J.S.B.Co.Ltd (TSE:3480)

Simply Wall St Value Rating: ★★★★★☆

Overview: J.S.B. Co., Ltd. is involved in the planning, development, brokerage, and management of condominiums in Japan and has a market cap of approximately ¥57.82 billion.

Operations: J.S.B. Co., Ltd. generates revenue primarily through its Real Estate Rental Management Business, which accounted for ¥66.81 billion. The company's market cap stands at approximately ¥57.82 billion, reflecting its scale in the Japanese real estate sector.

J.S.B. Co., Ltd. stands out with a notable earnings growth of 62% over the past year, significantly surpassing the Real Estate industry average of 22%. The company benefits from a satisfactory net debt to equity ratio of 16%, indicating manageable leverage. A large one-off gain of ¥3.1 billion has impacted its recent financial results, which might skew perceptions of consistent performance. Trading at a price-to-earnings ratio of 7.7x, it offers good value compared to the broader JP market's 13.7x average. Despite these strengths, future earnings are projected to decrease by an average of 8% annually over the next three years.

Seize The Opportunity

- Gain an insight into the universe of 4629 Undiscovered Gems With Strong Fundamentals by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3480

J.S.B.Co.Ltd

Engages in the planning, development, brokerage, and management of condominiums in Japan.

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives