Succession Plan May Change the Case for Investing in Pandora (CPSE:PNDORA)

Reviewed by Sasha Jovanovic

- Pandora announced that CEO Alexander Lacik will retire at the next annual general meeting in March 2026, with Chief Marketing Officer Berta de Pablos-Barbier set to succeed him following her influential role in the company’s brand transformation since November 2024.

- This leadership transition follows a period of substantial revenue expansion and workforce growth, with de Pablos-Barbier’s deep experience across luxury and consumer goods expected to support Pandora’s continued evolution as a full jewellery brand.

- We’ll examine how the upcoming appointment of Berta de Pablos-Barbier as CEO might shape Pandora’s long-term investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Pandora Investment Narrative Recap

To own shares in Pandora, an investor needs to believe in the company’s ongoing transformation from a charms brand to a full-spectrum jewelry leader, backed by strong product innovation and an expanding omnichannel presence. The announced CEO transition to Berta de Pablos-Barbier, following her recent success as CMO, does not materially change near-term catalysts, such as demand for new product launches, or the biggest current risk, which remains cost headwinds from currency movements and tariffs. Stability in top-line growth and margins is still the critical short-term focus.

Of Pandora’s recent developments, the February 2025 launch of a new share buyback program stands out. While not directly linked to the executive handover, ongoing capital returns signal management’s confidence in both underlying cash flow and future business momentum, supporting the investment case and potentially cushioning shares during the leadership transition.

However, investors should also be mindful that external cost headwinds could intensify, particularly if raw material prices or tariffs rise faster than management can offset...

Read the full narrative on Pandora (it's free!)

Pandora's outlook points to DKK39.1 billion in revenue and DKK6.5 billion in earnings by 2028. This scenario assumes a 6.4% annual revenue growth rate and a DKK1.1 billion increase in earnings from the current DKK5.4 billion.

Uncover how Pandora's forecasts yield a DKK1057 fair value, a 28% upside to its current price.

Exploring Other Perspectives

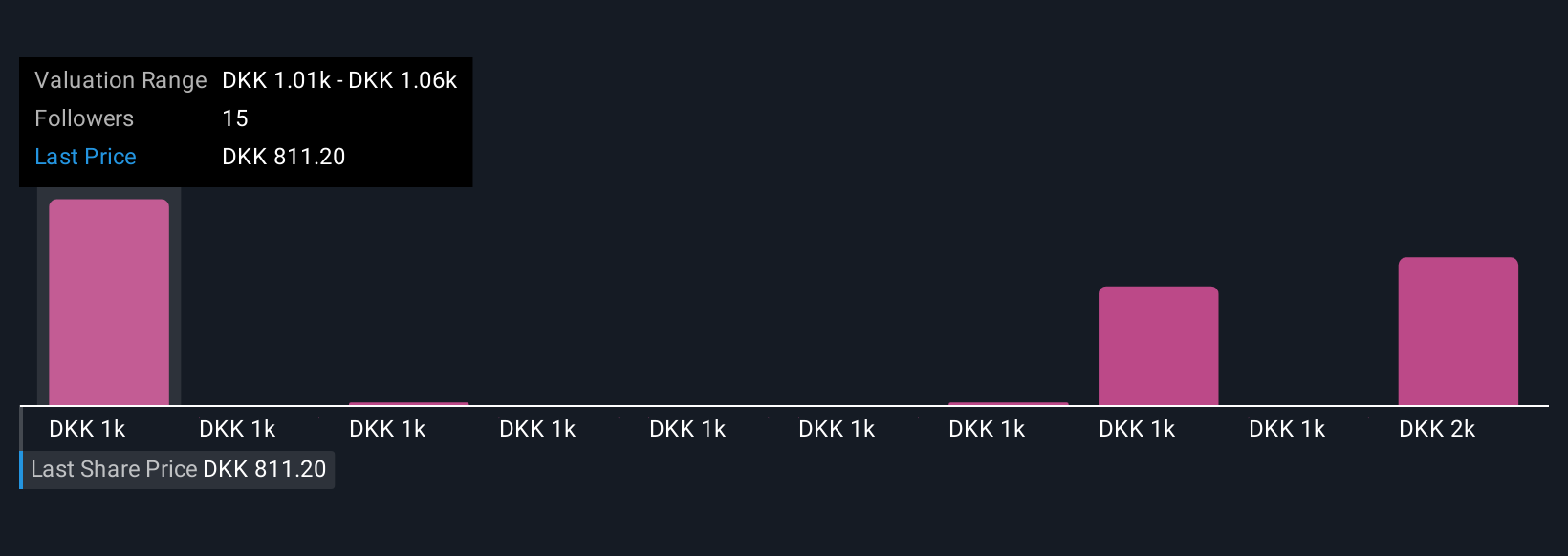

Seven members of the Simply Wall St Community have valued Pandora shares between DKK1,005 and DKK1,600, underlining a broad range of opinions. Against this backdrop, the business’s ability to expand beyond core charms and capture new jewelry market share remains a central factor many are watching.

Explore 7 other fair value estimates on Pandora - why the stock might be worth just DKK1005!

Build Your Own Pandora Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Pandora research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Pandora research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Pandora's overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:PNDORA

Pandora

Engages in the designing, manufacturing, and marketing of jewelry products.

Undervalued with reasonable growth potential and pays a dividend.

Market Insights

Community Narratives