- Denmark

- /

- Consumer Durables

- /

- CPSE:HUSCO

HusCompagniet (CPH:HUSCO) Could Be A Buy For Its Upcoming Dividend

HusCompagniet A/S (CPH:HUSCO) stock is about to trade ex-dividend in three days. The ex-dividend date is one business day before a company's record date, which is the date on which the company determines which shareholders are entitled to receive a dividend. The ex-dividend date is an important date to be aware of as any purchase of the stock made on or after this date might mean a late settlement that doesn't show on the record date. Thus, you can purchase HusCompagniet's shares before the 11th of April in order to receive the dividend, which the company will pay on the 13th of April.

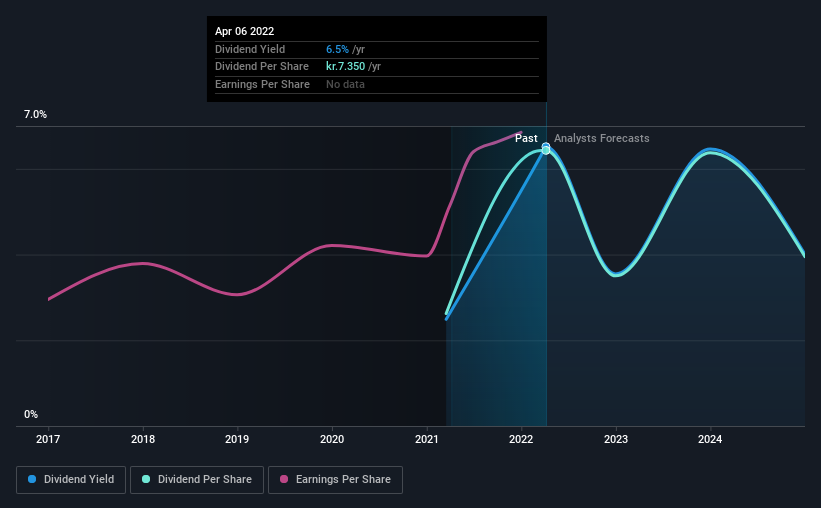

The company's next dividend payment will be kr.7.35 per share, on the back of last year when the company paid a total of kr.7.35 to shareholders. Last year's total dividend payments show that HusCompagniet has a trailing yield of 6.5% on the current share price of DKK112.8. If you buy this business for its dividend, you should have an idea of whether HusCompagniet's dividend is reliable and sustainable. So we need to investigate whether HusCompagniet can afford its dividend, and if the dividend could grow.

Check out our latest analysis for HusCompagniet

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. HusCompagniet paid out more than half (54%) of its earnings last year, which is a regular payout ratio for most companies. Yet cash flows are even more important than profits for assessing a dividend, so we need to see if the company generated enough cash to pay its distribution. Thankfully its dividend payments took up just 25% of the free cash flow it generated, which is a comfortable payout ratio.

It's positive to see that HusCompagniet's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Businesses with strong growth prospects usually make the best dividend payers, because it's easier to grow dividends when earnings per share are improving. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. That's why it's comforting to see HusCompagniet's earnings have been skyrocketing, up 20% per annum for the past five years. The current payout ratio suggests a good balance between rewarding shareholders with dividends, and reinvesting in growth. Earnings per share have been growing quickly and in combination with some reinvestment and a middling payout ratio, the stock may have decent dividend prospects going forwards.

Unfortunately HusCompagniet has only been paying a dividend for a year or so, so there's not much of a history to draw insight from.

To Sum It Up

Is HusCompagniet worth buying for its dividend? We like HusCompagniet's growing earnings per share and the fact that - while its payout ratio is around average - it paid out a lower percentage of its cash flow. HusCompagniet looks solid on this analysis overall, and we'd definitely consider investigating it more closely.

With that in mind, a critical part of thorough stock research is being aware of any risks that stock currently faces. To help with this, we've discovered 1 warning sign for HusCompagniet that you should be aware of before investing in their shares.

If you're in the market for strong dividend payers, we recommend checking our selection of top dividend stocks.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if HusCompagniet might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CPSE:HUSCO

HusCompagniet

Engages in the construction of single-family detached houses in Denmark and Sweden.

Undervalued with reasonable growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)