- Denmark

- /

- Consumer Durables

- /

- CPSE:BO

If You Had Bought Bang & Olufsen (CPH:BO) Shares Three Years Ago You'd Have A Total Return Of Negative 47%

It is doubtless a positive to see that the Bang & Olufsen a/s (CPH:BO) share price has gained some 179% in the last three months. But that doesn't help the fact that the three year return is less impressive. Truth be told the share price declined 76% in three years and that return, Dear Reader, falls short of what you could have got from passive investing with an index fund.

See our latest analysis for Bang & Olufsen

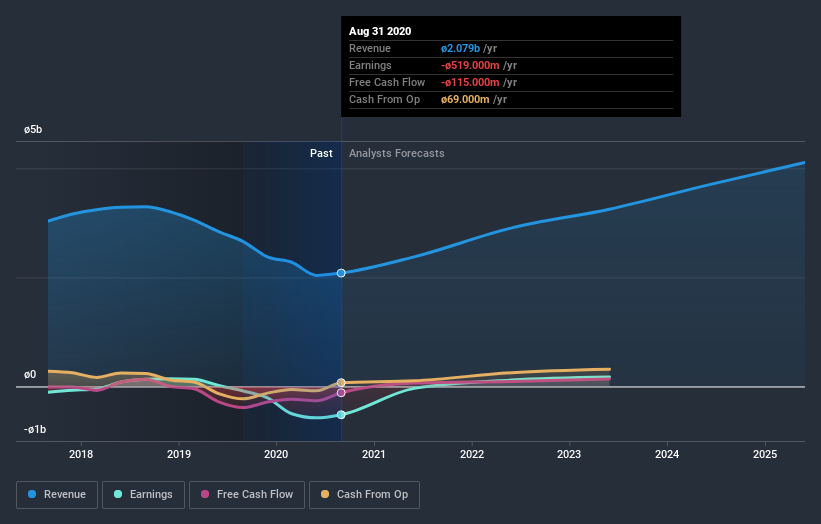

Bang & Olufsen isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over the last three years, Bang & Olufsen's revenue dropped 15% per year. That means its revenue trend is very weak compared to other loss making companies. And as you might expect the share price has been weak too, dropping at a rate of 21% per year. Never forget that loss making companies with falling revenue can and do cause losses for everyday investors. It's worth remembering that investors call buying a steeply falling share price 'catching a falling knife' because it is a dangerous pass time.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on Bang & Olufsen's balance sheet strength is a great place to start, if you want to investigate the stock further.

What about the Total Shareholder Return (TSR)?

We've already covered Bang & Olufsen's share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Bang & Olufsen's TSR of was a loss of 47% for the 3 years. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

It's nice to see that Bang & Olufsen shareholders have received a total shareholder return of 122% over the last year. That certainly beats the loss of about 1.5% per year over the last half decade. This makes us a little wary, but the business might have turned around its fortunes. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Like risks, for instance. Every company has them, and we've spotted 2 warning signs for Bang & Olufsen (of which 1 is significant!) you should know about.

We will like Bang & Olufsen better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on DK exchanges.

If you’re looking to trade Bang & Olufsen, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Bang & Olufsen might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About CPSE:BO

Bang & Olufsen

Designs, develops, markets, manufactures, and sells audio and video products in Europe, the Middle East, Africa, the Americas, and the Asia Pacific.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives