- Denmark

- /

- Electrical

- /

- CPSE:VWS

Why Vestas (CPSE:VWS) Is Up 6.5% After Surge in Major European Wind Turbine Orders

Reviewed by Sasha Jovanovic

- Vestas Wind Systems recently announced a surge in firm wind turbine orders across Europe, including over 239 MW in Germany, 346 MW spanning Germany, Denmark, and the UK, and 94 MW in Italy, featuring its latest EnVentus platform technology and long-term service agreements.

- This rapid expansion in order intake underscores growing customer confidence in Vestas' advanced solutions and highlights robust momentum for renewable energy projects in key European markets.

- We’ll examine how these significant new European orders reinforce Vestas’ investment narrative and shed light on demand trends for wind energy.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Vestas Wind Systems Investment Narrative Recap

To own shares in Vestas Wind Systems, an investor needs to have conviction in the expansion of renewable energy and confidence that Vestas can capture growing demand, particularly in Europe and the US, amid tough competition and ongoing policy shifts. The recent surge in firm European orders demonstrates Vestas’ project execution capability and supports the bullish case, yet it does not significantly offset the biggest near-term risk: ongoing pressure on margins and earnings from challenging offshore ramp-up costs and volatile global policies.

The newly announced 346 MW of orders across Germany, Denmark, and the UK stands out, as these projects showcase long-term customer confidence through 20 to 30-year service agreements and highlight progress in core onshore markets. These positive signals reinforce the importance of stable order flow and project delivery as a leading catalyst for near-term sentiment, especially while management works to resolve offshore cost issues and restore profitability.

On the other hand, investors should not overlook the ongoing risk from intensifying price competition in Europe that could...

Read the full narrative on Vestas Wind Systems (it's free!)

Vestas Wind Systems is expected to reach €23.1 billion in revenue and €1.3 billion in earnings by 2028. This outlook assumes annual revenue growth of 7.6% and a €538 million increase in earnings from the current €762.0 million level.

Uncover how Vestas Wind Systems' forecasts yield a DKK140.61 fair value, a 5% upside to its current price.

Exploring Other Perspectives

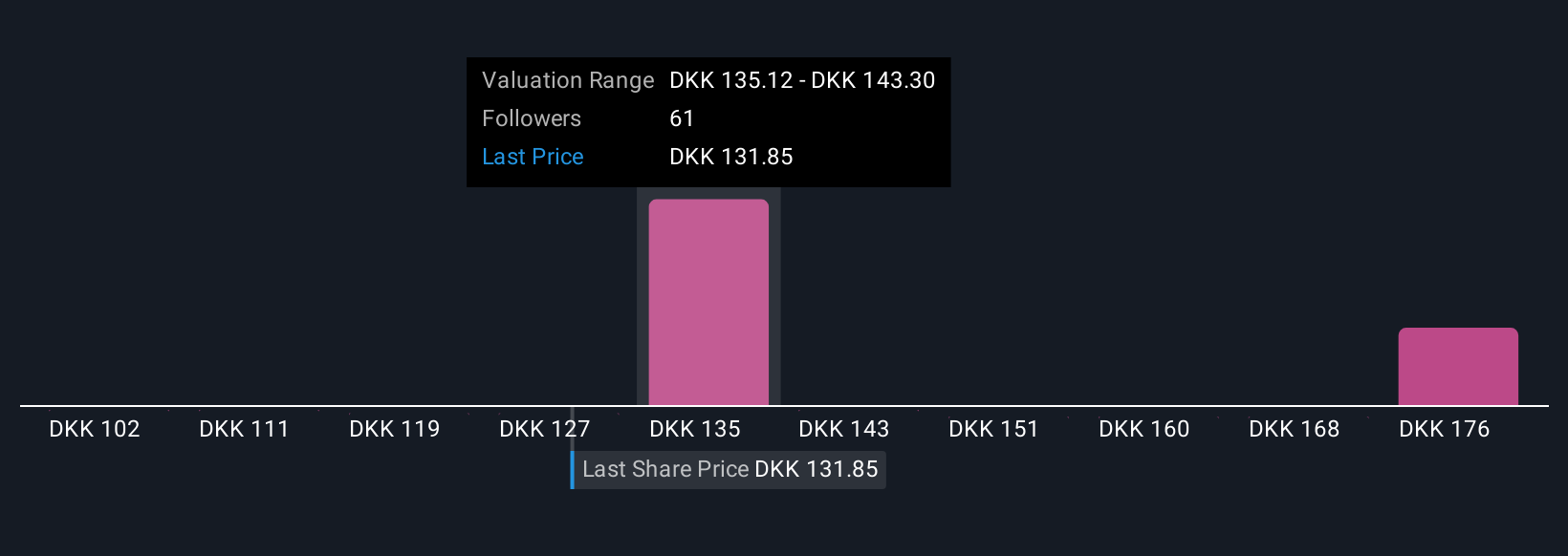

Simply Wall St Community members submitted 11 fair value estimates for Vestas ranging from DKK102.43 to DKK184.17 per share. While views differ, the recent uptick in European orders could shape company performance, especially as competition in Europe increases, explore more diverse analyses from the community for a broader view.

Explore 11 other fair value estimates on Vestas Wind Systems - why the stock might be worth as much as 38% more than the current price!

Build Your Own Vestas Wind Systems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Vestas Wind Systems research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Vestas Wind Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Vestas Wind Systems' overall financial health at a glance.

No Opportunity In Vestas Wind Systems?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:VWS

Vestas Wind Systems

Engages in the design, manufacture, installation, and services of wind turbines the United States, Denmark, and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives