- Denmark

- /

- Electrical

- /

- CPSE:VWS

Is Vestas a Bargain After Shares Jump 10% Amid Clean Energy Momentum in 2025?

Reviewed by Bailey Pemberton

If you are standing at a crossroads with your Vestas Wind Systems stock, wondering whether it is time to buy, sell, or simply hold, you are not alone. The recent journey of Vestas shares has been anything but boring, keeping both cautious and confident investors on their toes. Over the past month, the stock has surged 10.2%, and its year-to-date return stands impressively at 23.3%. These figures paint a picture of growing optimism around Vestas, despite a somewhat muted 1.5% gain over the past year and a challenging longer-term track record. It is clear some big market forces are shifting. Investors are adjusting their risk perception as renewable energy plays, like Vestas, regain some shine amidst global conversations about clean energy investments.

But is this latest rally built on solid ground? That is exactly where valuation comes into play. Vestas currently boasts a strong value score of 5 out of 6, indicating it is undervalued in nearly every metric seasoned analysts check for. While stock movements tell part of the story, these valuation checks help us get a much clearer picture of whether the market’s recent enthusiasm is truly justified.

Now, let’s break down what those six checks really mean and how they can help you decide what to do next with your investment. Keep an eye out for a smarter, more holistic way to measure value that I will reveal at the end of this piece.

Why Vestas Wind Systems is lagging behind its peers

Approach 1: Vestas Wind Systems Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) approach estimates what a company is worth by projecting its future cash flows and discounting them back to today’s value. This method relies on a multi-year forecast of Free Cash Flow (FCF), reflecting the company’s ability to generate actual cash profits for its shareholders.

For Vestas Wind Systems, the most recent trailing twelve-month Free Cash Flow stands at €1.23 Billion. Analyst estimates project these cash flows will generally rise over the next several years, reaching a forecast of €1.34 Billion by 2029. While analyst projections typically extend out five years, longer-term FCF numbers are extrapolated from these trends by third-party models to provide a full ten-year picture. The DCF model applied here is a two-stage Free Cash Flow to Equity approach, highlighting both near-term analyst insights and longer-range earnings potential.

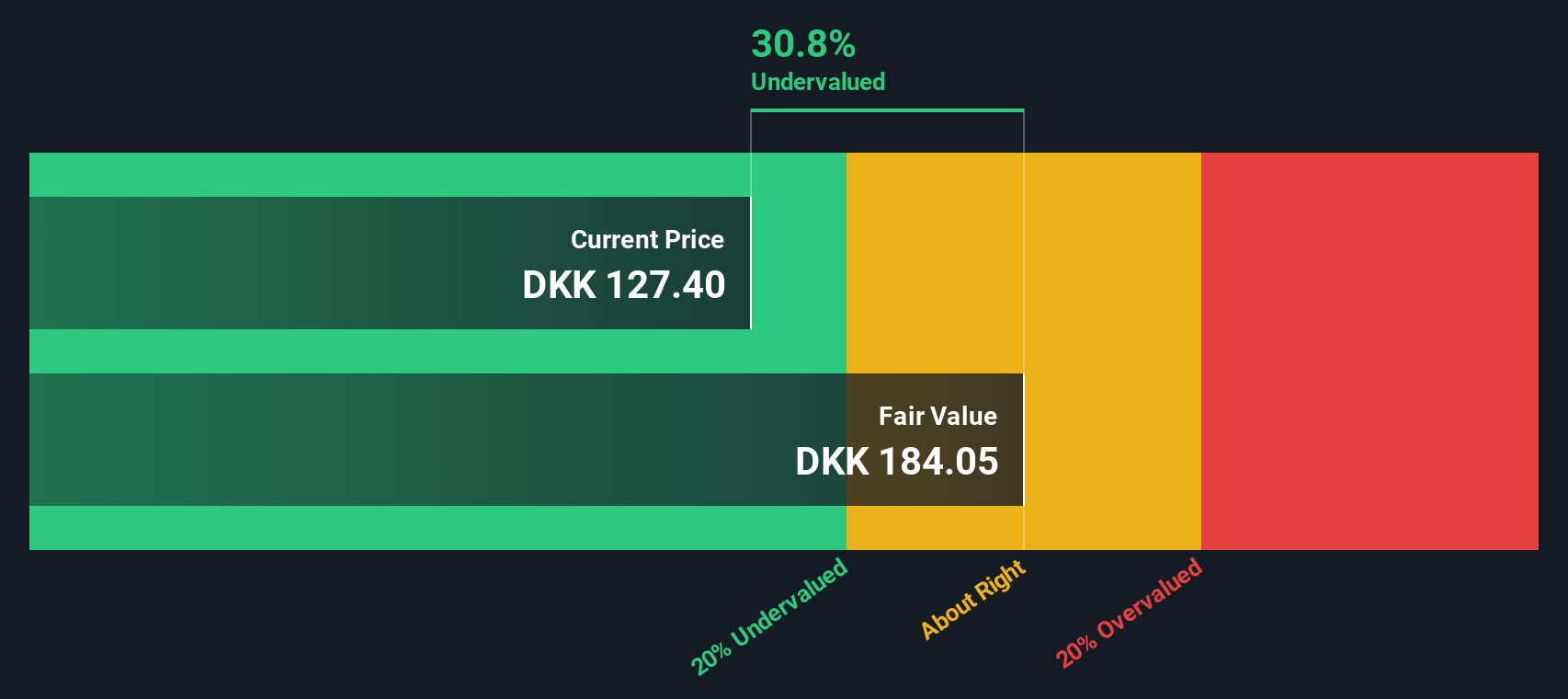

Based on this analysis, the model suggests an intrinsic fair value of €179.93 per share. This is 28.3% above the current share price, indicating the market is pricing Vestas Wind Systems considerably below what its cash flows suggest it is worth.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Vestas Wind Systems is undervalued by 28.3%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Vestas Wind Systems Price vs Earnings

The Price-to-Earnings (PE) ratio is a favorite tool of investors for valuing profitable companies like Vestas Wind Systems because it reveals how much the market is willing to pay today for a company's current earnings. It is especially effective in established businesses, where consistent earnings give a more reliable signal of value than sales or book value multiples.

What counts as a “normal” or “fair” PE ratio is shaped by how quickly investors expect earnings to grow and how much risk surrounds those expectations. Generally, higher growth or lower perceived risk commands a higher PE, while slower growth or greater uncertainty tends to lower the ratio.

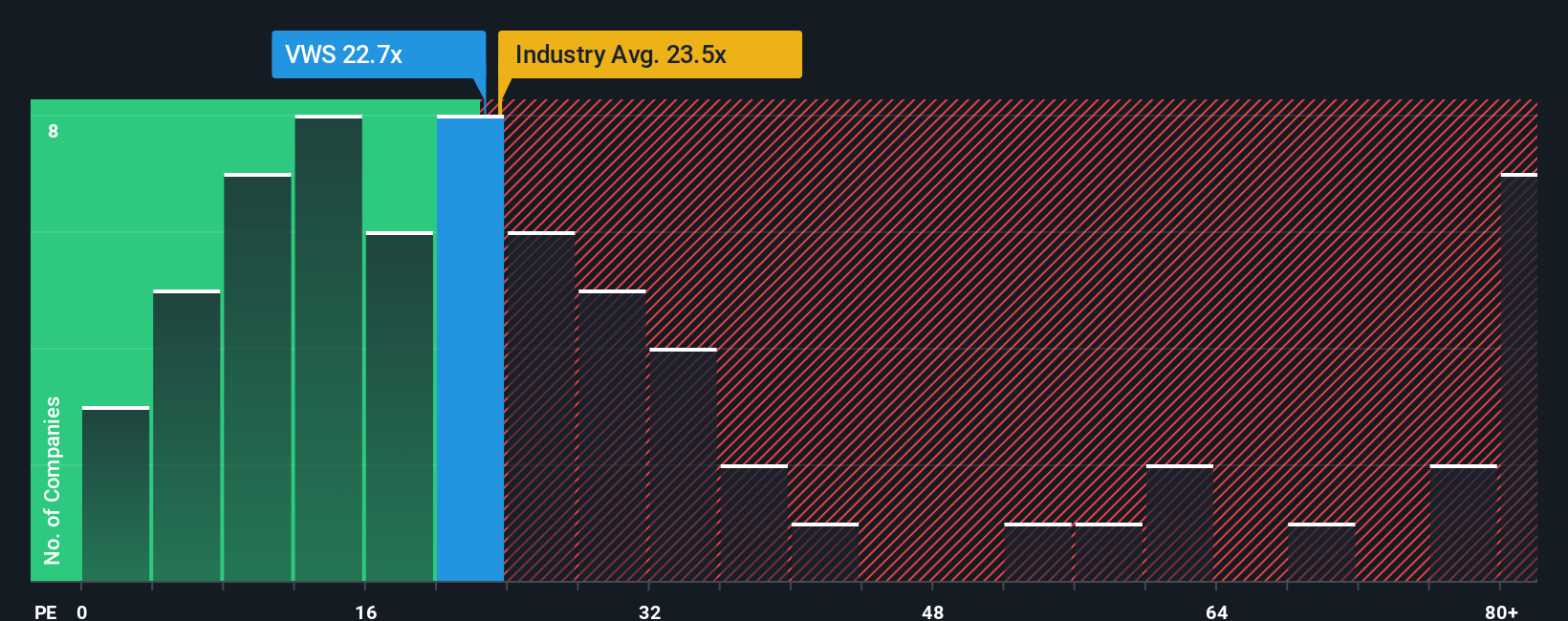

At the moment, Vestas trades at 22.7x earnings, which is notably below the Electrical industry’s average of 31.3x and also lower than similar peers, who trade on average at 36.0x. On paper, this suggests Vestas looks attractively priced compared to its sector and rivals. However, simple comparisons do not always paint the full picture. This is where Simply Wall St’s Fair Ratio comes in. The Fair Ratio is a proprietary benchmark that calculates a “deserved” PE multiple by weighing earnings growth, industry context, profit margins, company size, and risk. Unlike the broad brush of peer or sector averages, the Fair Ratio is tailored to Vestas’ unique characteristics and future prospects.

For Vestas, the Fair Ratio is set at 27.7x. With the current PE at 22.7x, there is a notable discount, indicating the market may be underappreciating the company’s growth potential and risk profile compared to what its fundamentals support.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Vestas Wind Systems Narrative

Earlier, we mentioned there is an even smarter way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple, dynamic way to bring your own story to the numbers behind a stock like Vestas. It connects your assumptions about future revenue, margins, and profits with real financial forecasts and an estimated fair value, making your investment decisions more personal and informed.

With Narratives, you see how your perspective stacks up: are you optimistic about policy support and offshore expansion or cautious about cost and competition? On Simply Wall St’s Community page, millions of investors use Narratives to translate their views into values, comparing fair value estimates directly with today’s share price to make confident buy or sell decisions. These Narratives update automatically as new news or earnings emerge, keeping your insights fresh and relevant.

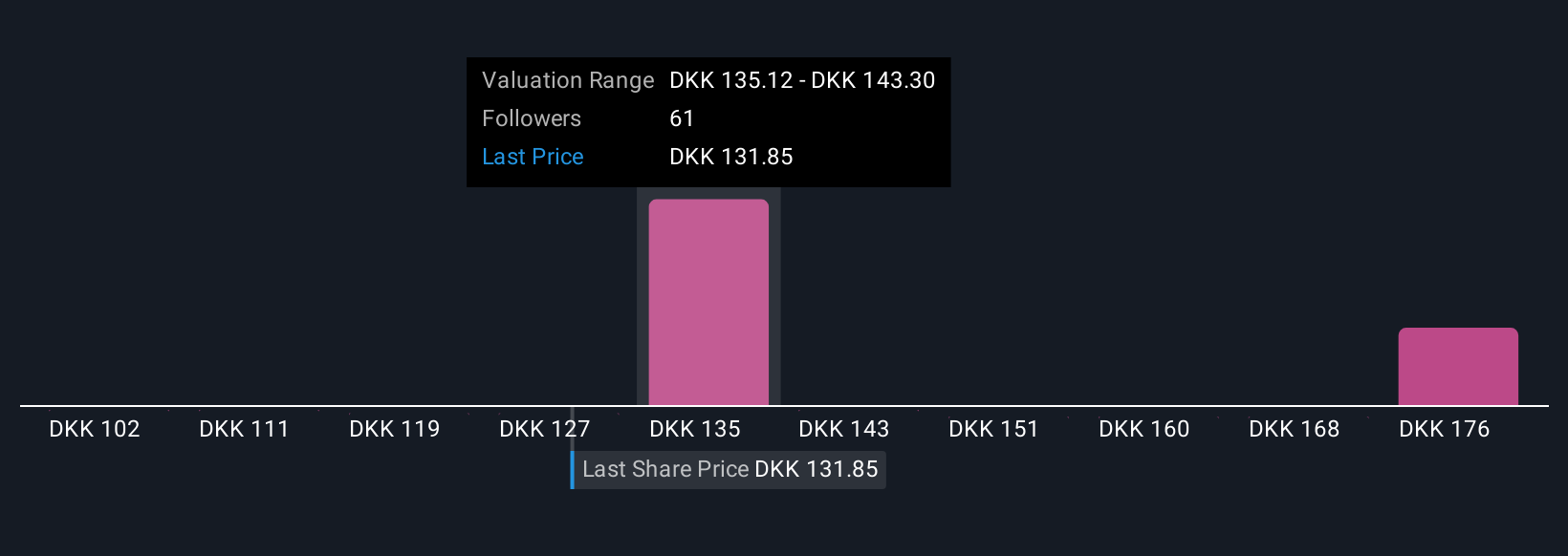

For example, some investors expect Vestas’s earnings to soar as governments push clean energy, which supports a higher price target (DKK195.99). Others are more conservative, emphasizing pressure from global competition and cost risks, estimating a much lower fair value (DKK60.00). Narratives make it easy for you to see exactly where your view fits and act with clarity.

Do you think there's more to the story for Vestas Wind Systems? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:VWS

Vestas Wind Systems

Engages in the design, manufacture, installation, and services of wind turbines the United States, Denmark, and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives