- Denmark

- /

- Electrical

- /

- CPSE:NKT

Could NKT's (CPSE:NKT) New Copenhagen HQ Reveal Its Evolving Approach to Modernization?

Reviewed by Sasha Jovanovic

- NKT has announced it will relocate its headquarters from Priorparken in Brøndby to a central location at Amerika Plads 29 in Copenhagen’s Nordhavn district, with the move set to take effect from January 2026.

- This relocation reflects NKT’s ongoing focus on business modernization, urban connectivity, and sustainable infrastructure, while maintaining essential service operations in Brøndby.

- We'll explore how NKT’s decision to establish its headquarters in central Copenhagen aligns with its growth and modernization strategy.

Find companies with promising cash flow potential yet trading below their fair value.

NKT Investment Narrative Recap

Investors in NKT are generally betting on long-term energy transition tailwinds, ongoing grid modernization in Europe, and the company’s ability to execute on capacity expansions and secure profitable contracts. The recent headquarters move to Copenhagen’s Nordhavn is largely symbolic of NKT’s modernization focus and is not expected to have a material near-term impact on the existing catalysts, such as its order backlog or project execution risks, nor does it significantly mitigate the financial and operational risks currently faced.

The announcement most relevant in the context of this relocation is NKT’s recent contract with Energinet for the HVDC power cable system to connect Bornholm Energy Island with Zealand’s grid, valued at approximately EUR 650 million. This contract demonstrates the company’s ongoing momentum in securing high-profile energy projects, a key driver of its long-term growth outlook, especially as new facilities and modernized headquarters support collaboration and market presence.

However, it is important for investors to remain mindful that despite these promising developments, NKT still faces pressure from concentrated backlog and potential delays in project conversion, which could...

Read the full narrative on NKT (it's free!)

NKT's narrative projects €4.4 billion revenue and €329.1 million earnings by 2028. This requires 7.6% yearly revenue growth and a €116.1 million earnings increase from €213.0 million currently.

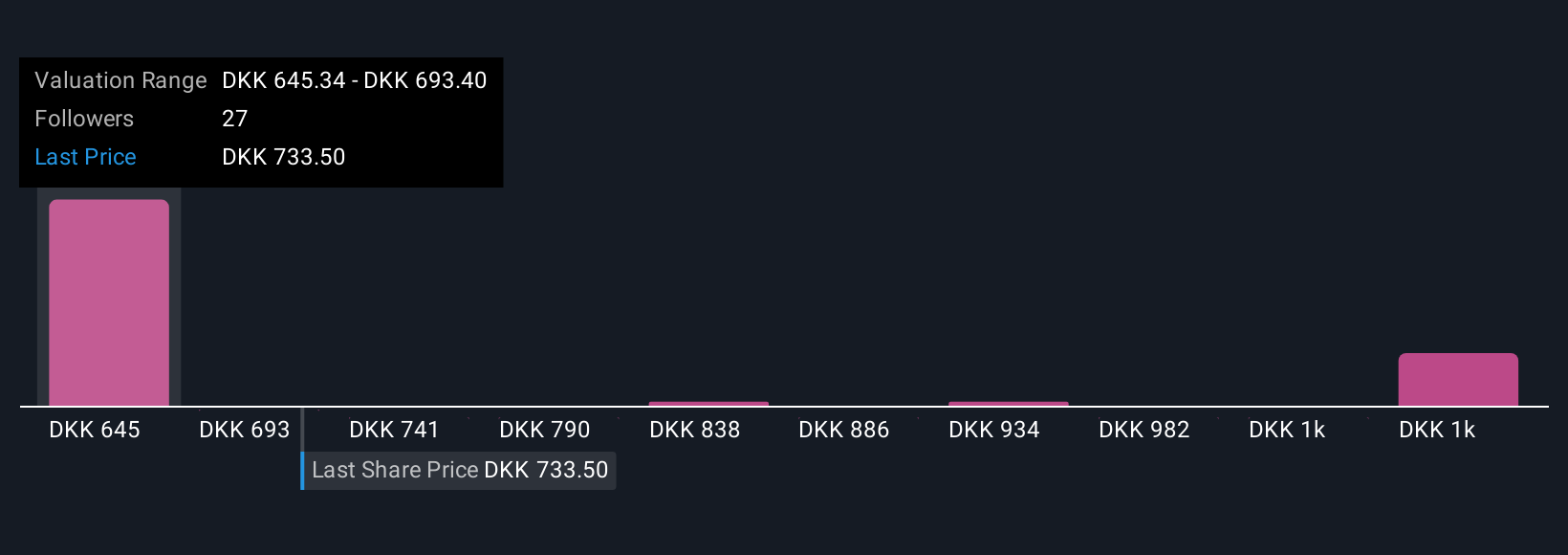

Uncover how NKT's forecasts yield a DKK645.34 fair value, a 10% downside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have provided eight unique fair value estimates ranging from DKK645 to DKK1,151. This diversity of views highlights how forecasts for NKT remain wide, even as the company’s earnings growth is supported by large energy infrastructure orders and ongoing capacity investment.

Explore 8 other fair value estimates on NKT - why the stock might be worth as much as 60% more than the current price!

Build Your Own NKT Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NKT research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free NKT research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NKT's overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NKT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:NKT

NKT

Designs, manufactures, and installs low, medium, and high voltage power cable solutions in Denmark.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives