The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that FLSmidth & Co. A/S (CPH:FLS) does use debt in its business. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for FLSmidth

What Is FLSmidth's Net Debt?

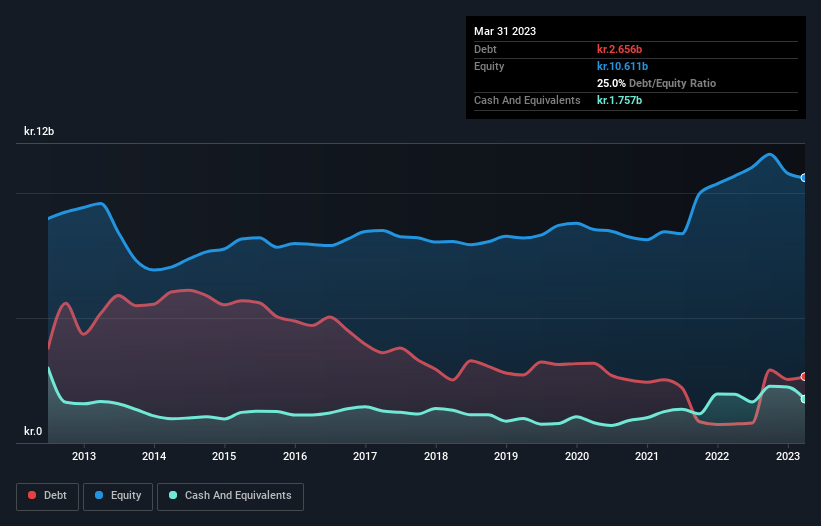

The image below, which you can click on for greater detail, shows that at March 2023 FLSmidth had debt of kr.2.66b, up from kr.761.0m in one year. On the flip side, it has kr.1.76b in cash leading to net debt of about kr.899.0m.

How Strong Is FLSmidth's Balance Sheet?

According to the last reported balance sheet, FLSmidth had liabilities of kr.13.9b due within 12 months, and liabilities of kr.5.15b due beyond 12 months. Offsetting these obligations, it had cash of kr.1.76b as well as receivables valued at kr.10.1b due within 12 months. So its liabilities total kr.7.23b more than the combination of its cash and short-term receivables.

While this might seem like a lot, it is not so bad since FLSmidth has a market capitalization of kr.16.8b, and so it could probably strengthen its balance sheet by raising capital if it needed to. But we definitely want to keep our eyes open to indications that its debt is bringing too much risk.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

With net debt sitting at just 0.65 times EBITDA, FLSmidth is arguably pretty conservatively geared. And it boasts interest cover of 8.3 times, which is more than adequate. Fortunately, FLSmidth grew its EBIT by 8.8% in the last year, making that debt load look even more manageable. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine FLSmidth's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we always check how much of that EBIT is translated into free cash flow. Over the last three years, FLSmidth actually produced more free cash flow than EBIT. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Our View

Happily, FLSmidth's impressive conversion of EBIT to free cash flow implies it has the upper hand on its debt. But truth be told we feel its level of total liabilities does undermine this impression a bit. When we consider the range of factors above, it looks like FLSmidth is pretty sensible with its use of debt. That means they are taking on a bit more risk, in the hope of boosting shareholder returns. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For example - FLSmidth has 2 warning signs we think you should be aware of.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CPSE:FLS

FLSmidth

Provides flowsheet technology and service solutions for the mining and cement industries in North America, South America, Europe, North and Sub-Saharan Africa, the Middle East, Central and South Asia, the Asia Pacific, and Australia.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives