Sydbank (CPSE:SYDB) Valuation in Focus After Recent Share Price Momentum

Reviewed by Kshitija Bhandaru

See our latest analysis for Sydbank.

After a strong run this year, Sydbank’s latest 6.9% share price return over the past month adds to its momentum and signals that investor interest is building. Looking further out, the bank has delivered an impressive 68.2% total shareholder return over the past year. This underscores just how robust its performance has been in both the short and long term.

If Sydbank’s recent gains have you rethinking your portfolio, this could be a great moment to broaden your research and discover fast growing stocks with high insider ownership

With shares surging this year, the big question is whether Sydbank’s current price reflects all its future growth or if there is still value left for new investors to capture.

Price-to-Earnings of 11.2x: Is it justified?

Right now, Sydbank trades at a price-to-earnings (P/E) ratio of 11.2, putting it above both its peer average and the broader European Banks industry. At the most recent close of DKK523, that puts a spotlight on market expectations and how investors are weighing the bank’s future.

The price-to-earnings multiple reflects the price investors are willing to pay for each unit of current earnings. For a traditional sector like banking, this remains a key indicator of whether a stock is seen as a value play or priced for premium. Higher multiples can sometimes suggest confidence that future earnings will rise, or signal over-optimism.

Compared to its industry peers (average 9.8x) and closest rivals (peer average 9x), Sydbank’s current P/E looks stretched. Even relative to the estimated fair price-to-earnings ratio of 11.1x, the stock is trading slightly above justified levels. This may hint that the market has built in high expectations or is placing a premium on elements unique to Sydbank’s story.

Explore the SWS fair ratio for Sydbank

Result: Price-to-Earnings of 11.2x (OVERVALUED)

However, slower revenue and net income growth could dampen sentiment, especially if market expectations remain high and Sydbank fails to deliver stronger results.

Find out about the key risks to this Sydbank narrative.

Another View: Discounted Cash Flow Shows Deep Value

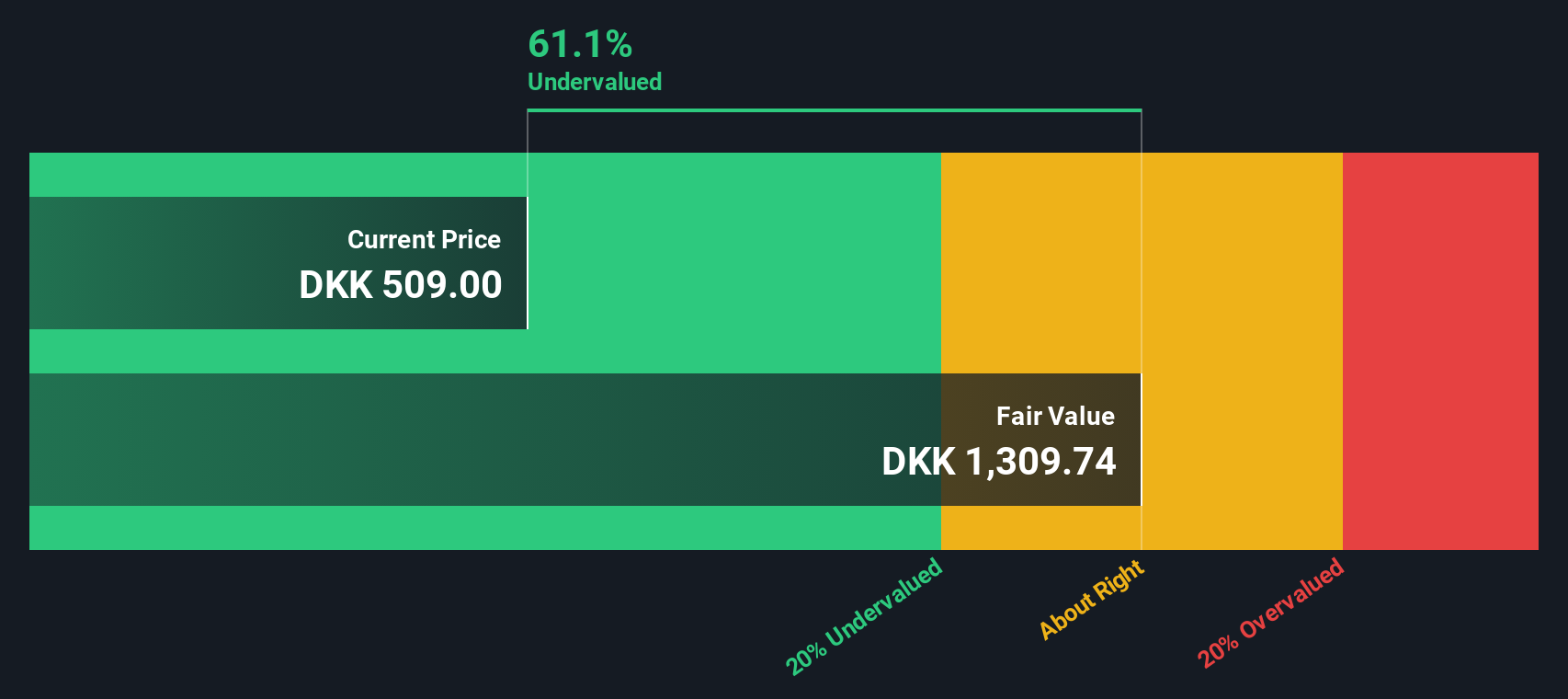

Switching from earnings multiples to our SWS DCF model reveals a clear contrast. The DCF approach estimates Sydbank's fair value at DKK1,335, so today's share price appears deeply undervalued by over 60%. Could the market be overlooking something important, or is caution warranted?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sydbank for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sydbank Narrative

If you want to dig deeper or challenge this perspective, you can dive into the numbers and craft your own view in just a few minutes. Do it your way.

A great starting point for your Sydbank research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let the next big opportunity pass you by when there are fast-moving trends and hidden gems waiting just beyond your current radar.

- Capitalize on the rising income stream from companies offering substantial yields by checking out these 19 dividend stocks with yields > 3%.

- Spot tomorrow’s industry changers among these 25 AI penny stocks, ideal for those who want a front-row seat to breakthroughs in artificial intelligence.

- Uncover stocks priced well below their intrinsic value through these 897 undervalued stocks based on cash flows, and seize the advantage before the crowd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:SYDB

Sydbank

Provides various banking products and services to corporate, private, retail, and institutional clients in Denmark and internationally.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives