- Turkey

- /

- Food and Staples Retail

- /

- IBSE:GRTHO

Undiscovered Gems Featuring 3 Promising Stocks with Potential

Reviewed by Simply Wall St

In the wake of recent market dynamics, including a notable rally in U.S. small-cap stocks like those in the Russell 2000 Index, investors are keenly observing how potential policy shifts and economic indicators might influence future growth trajectories. Amidst these developments, identifying promising stocks involves assessing factors such as earnings potential and resilience to regulatory changes, which can be crucial for uncovering hidden opportunities in today's evolving market landscape.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Parker Drilling | 46.25% | -0.33% | 53.04% | ★★★★★★ |

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Systex | 31.69% | 12.06% | -1.88% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

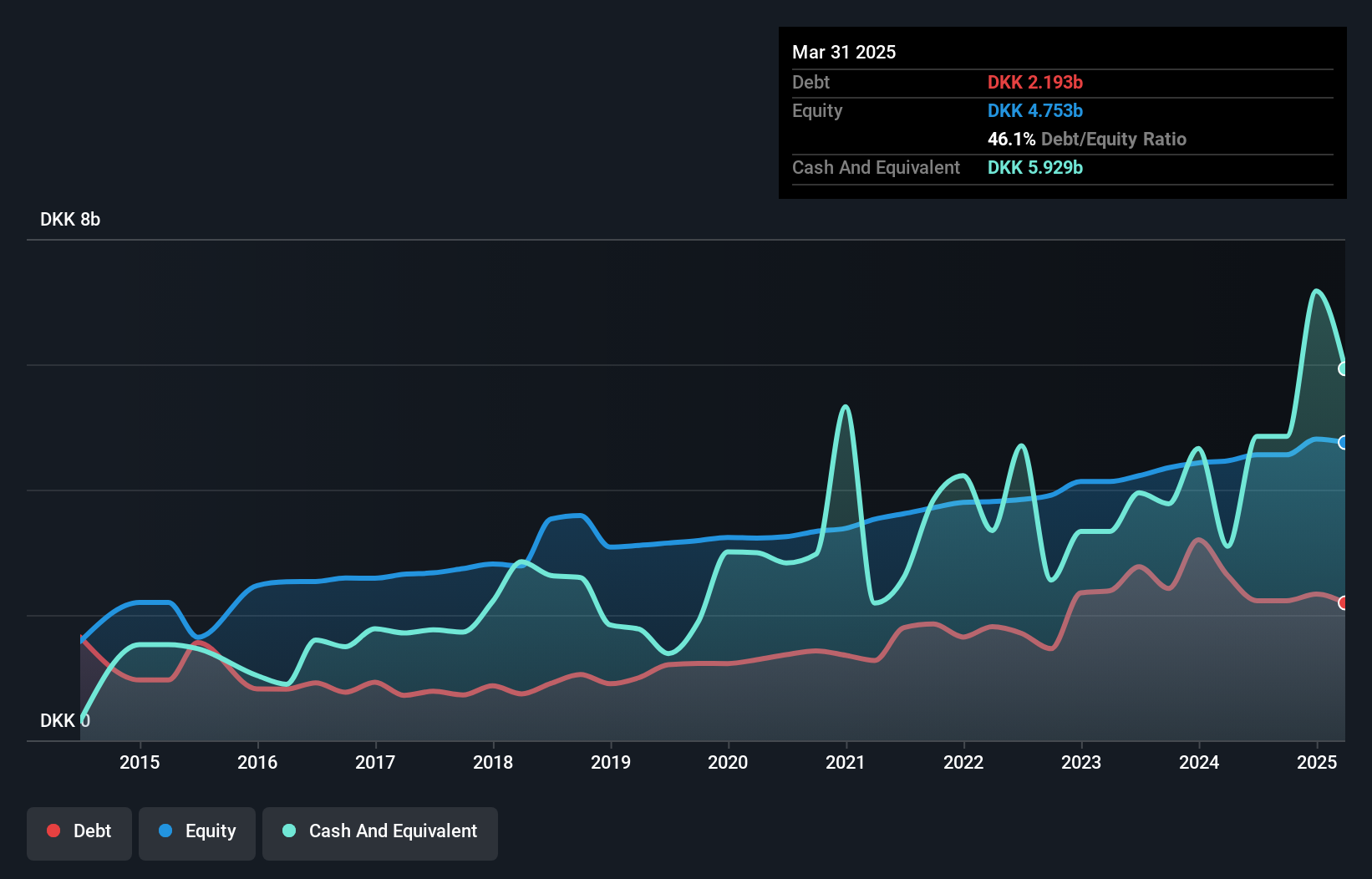

Sparekassen Sjælland-Fyn (CPSE:SPKSJF)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Sparekassen Sjælland-Fyn A/S is a savings bank offering financial products and services to both private and corporate customers, with a market capitalization of DKK3.59 billion.

Operations: The bank generates revenue primarily through interest income and fees from financial services provided to private and corporate clients. It has a market capitalization of DKK3.59 billion, reflecting its valuation in the financial market.

Sparekassen Sjælland-Fyn, a small financial entity, shows a mixed financial landscape with total assets at DKK31.8 billion and equity standing at DKK4.7 billion. The bank's liabilities are 88% funded by low-risk customer deposits, indicating stability in its funding structure. Over the past five years, earnings have increased annually by 22.4%, though recent growth of 24.4% lagged behind the industry average of 27.9%. Trading significantly below estimated fair value by 52.6%, it presents potential investment appeal despite forecasts suggesting an average earnings decline of 8% per year over the next three years.

- Take a closer look at Sparekassen Sjælland-Fyn's potential here in our health report.

Gain insights into Sparekassen Sjælland-Fyn's past trends and performance with our Past report.

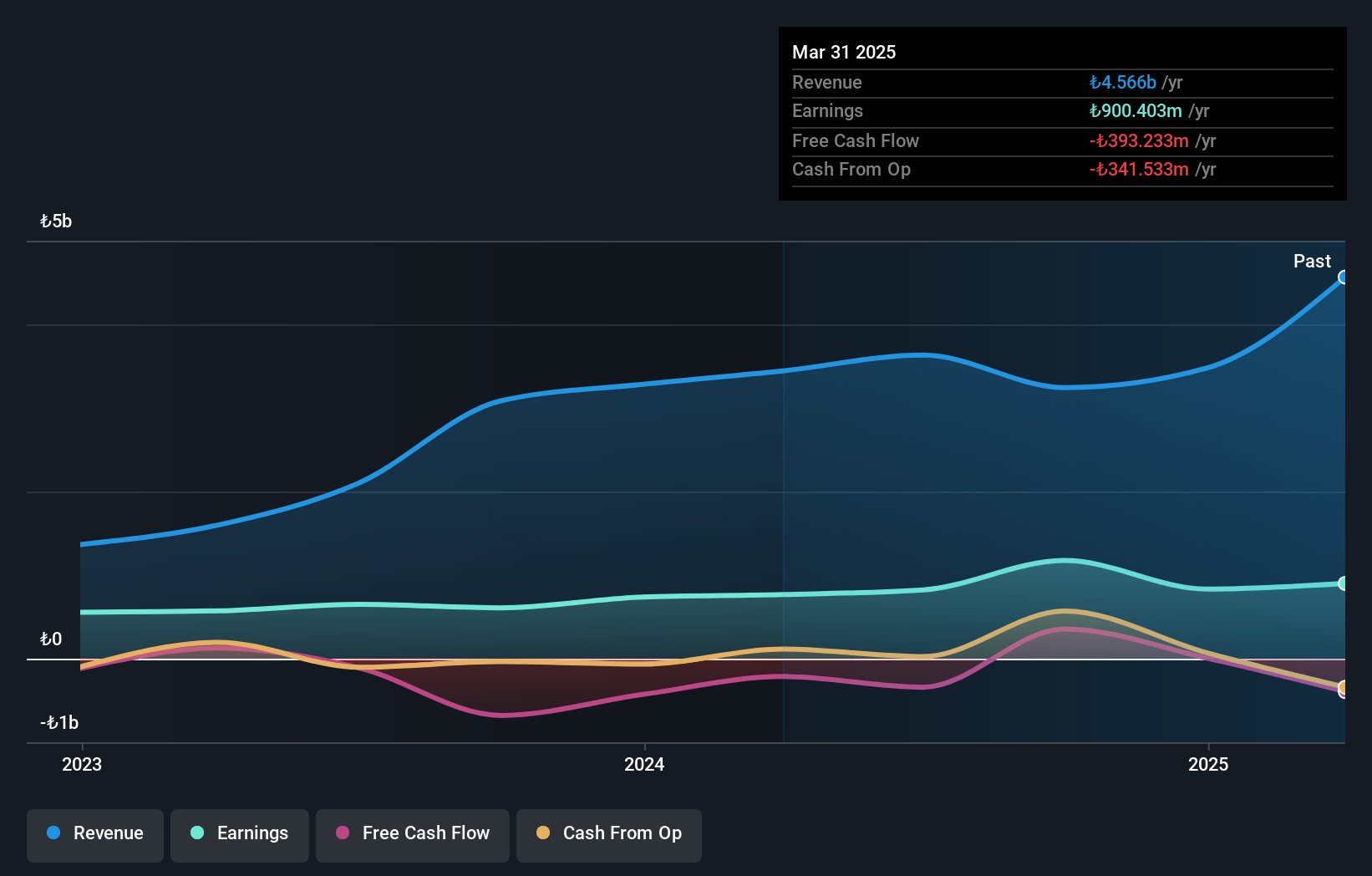

GRAINTURK Holding (IBSE:GRTHO)

Simply Wall St Value Rating: ★★★★★☆

Overview: Grainturk Tarim Anonim Sirketi engages in agricultural commodity trading on both national and international platforms, with a market cap of TRY14.88 billion.

Operations: Grainturk Tarim Anonim Sirketi generates revenue through agricultural commodity trading on national and international platforms. The company has a market capitalization of TRY14.88 billion.

GRAINTURK Holding, a small cap player in the consumer retailing sector, has shown impressive earnings growth of 35.5% over the past year, outpacing the industry average of 12.7%. Despite its volatility in share price recently, it reported a substantial net income increase to TRY 373.54 million for Q3 2024 from TRY 21.76 million a year prior. Sales figures reveal mixed results: Q3 sales dropped to TRY 763.91 million from TRY 1,152.62 million last year; however, nine-month net income rose to TRY 652.44 million compared to TRY 239.36 million previously, indicating strong profitability despite fluctuating revenues and high non-cash earnings levels contributing significantly to its financial performance.

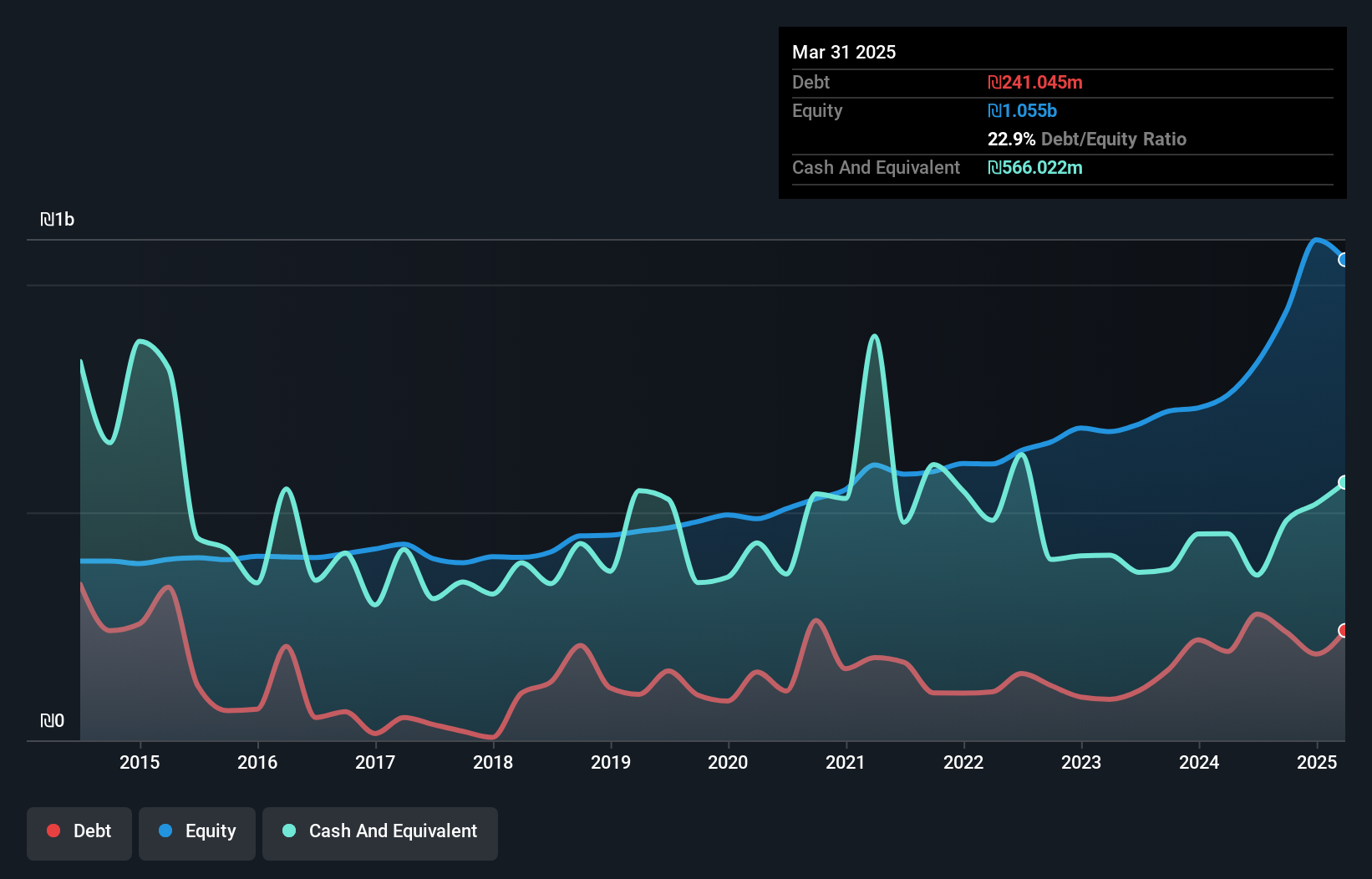

I.B.I. Investment House (TASE:IBI)

Simply Wall St Value Rating: ★★★★★☆

Overview: I.B.I Investment House Ltd. is a publicly owned holding investment firm with approximately ₪11 billion ($2.63 billion) in assets under management and a market cap of ₪1.85 billion.

Operations: I.B.I generates revenue primarily through its asset management services, leveraging approximately ₪11 billion in assets under management. The firm focuses on optimizing its cost structure to enhance profitability, reflected in a net profit margin of 15%.

I.B.I. Investment House, a notable player in the financial sector, has demonstrated high-quality earnings with a robust 19.4% annual growth over five years. Trading at 27.9% below its estimated fair value, it offers potential for investors seeking undervalued opportunities. Despite its profitability and strong cash position relative to debt, recent performance showed mixed results; second-quarter sales increased to ILS 616 million from ILS 483 million last year, but net income decreased to ILS 23 million from ILS 47 million. With EBIT covering interest payments by a substantial margin of 34.8 times, the company maintains solid financial health despite industry challenges.

- Get an in-depth perspective on I.B.I. Investment House's performance by reading our health report here.

Learn about I.B.I. Investment House's historical performance.

Taking Advantage

- Delve into our full catalog of 4666 Undiscovered Gems With Strong Fundamentals here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:GRTHO

GRAINTURK Holding

Grainturk Tarim Anonim Sirketi operates in the field of agricultural commodity trade on national and international platforms.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives