As global markets navigate a choppy start to the year, influenced by resilient labor market data and inflation concerns, investors are seeking stability amidst uncertainty. In such an environment, dividend stocks can offer a reliable income stream and potential for capital appreciation.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.31% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.36% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.38% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.80% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.72% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.00% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.66% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.89% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.21% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.17% | ★★★★★★ |

Click here to see the full list of 2007 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

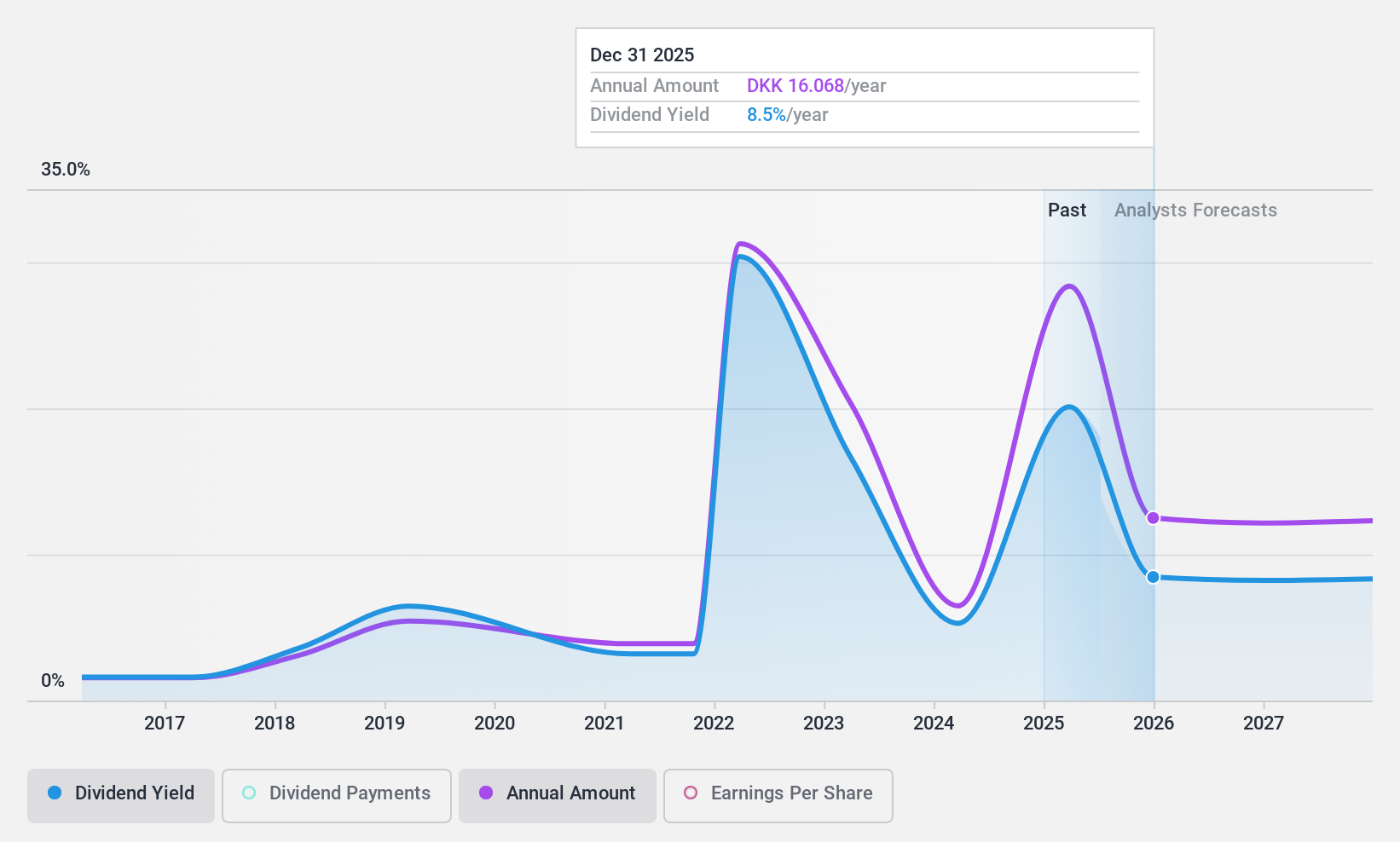

Føroya Banki (CPSE:FOBANK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Føroya Banki, with a market cap of DKK1.58 billion, offers personal and corporate banking services across the Faroe Islands, Denmark, and Greenland through its subsidiaries.

Operations: Føroya Banki generates its revenue from segments including DKK293.77 million in personal banking, DKK129.13 million in corporate banking, and DKK29.41 million from non-life insurance in the Faroe Islands, along with an additional DKK201.31 million from other banking services.

Dividend Yield: 5%

Bankivik, formerly Føroya Banki, offers a dividend yield slightly below the top 25% of Danish dividend payers. While its payout ratio is low at 24.4%, ensuring dividends are well-covered by earnings, its track record is marked by volatility and unreliability over the past decade. Despite recent profit growth and revised upward earnings guidance for 2024, concerns include high bad loans at 5.2% and a forecasted decline in earnings over the next three years.

- Delve into the full analysis dividend report here for a deeper understanding of Føroya Banki.

- Our valuation report here indicates Føroya Banki may be undervalued.

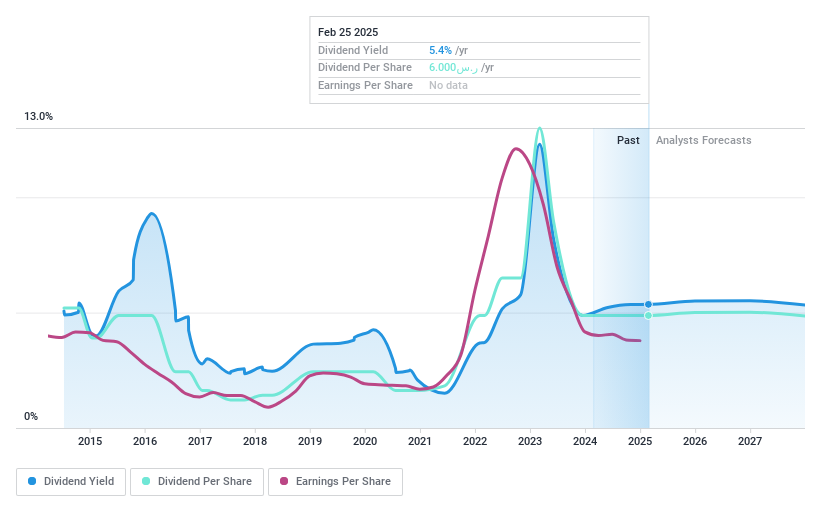

SABIC Agri-Nutrients (SASE:2020)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SABIC Agri-Nutrients Company operates in the production, conversion, manufacturing, marketing, and trade of agri-nutrients and chemical products across various international markets with a market cap of SAR52.36 billion.

Operations: SABIC Agri-Nutrients generates revenue primarily from Agri-Nutrients at SAR10.33 billion and Petrochemicals at SAR683.15 million.

Dividend Yield: 5.5%

SABIC Agri-Nutrients' recent earnings report shows a decline in net income despite increased sales, with third-quarter net income at SAR 826.52 million. The company trades at a favorable price-to-earnings ratio of 15.6x compared to the SA market average of 23.6x, indicating good relative value. However, its dividend track record is unstable and unreliable over the past decade, though current dividends are covered by earnings and cash flows with payout ratios of 85.2% and 67.4%, respectively.

- Click here to discover the nuances of SABIC Agri-Nutrients with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential undervaluation of SABIC Agri-Nutrients shares in the market.

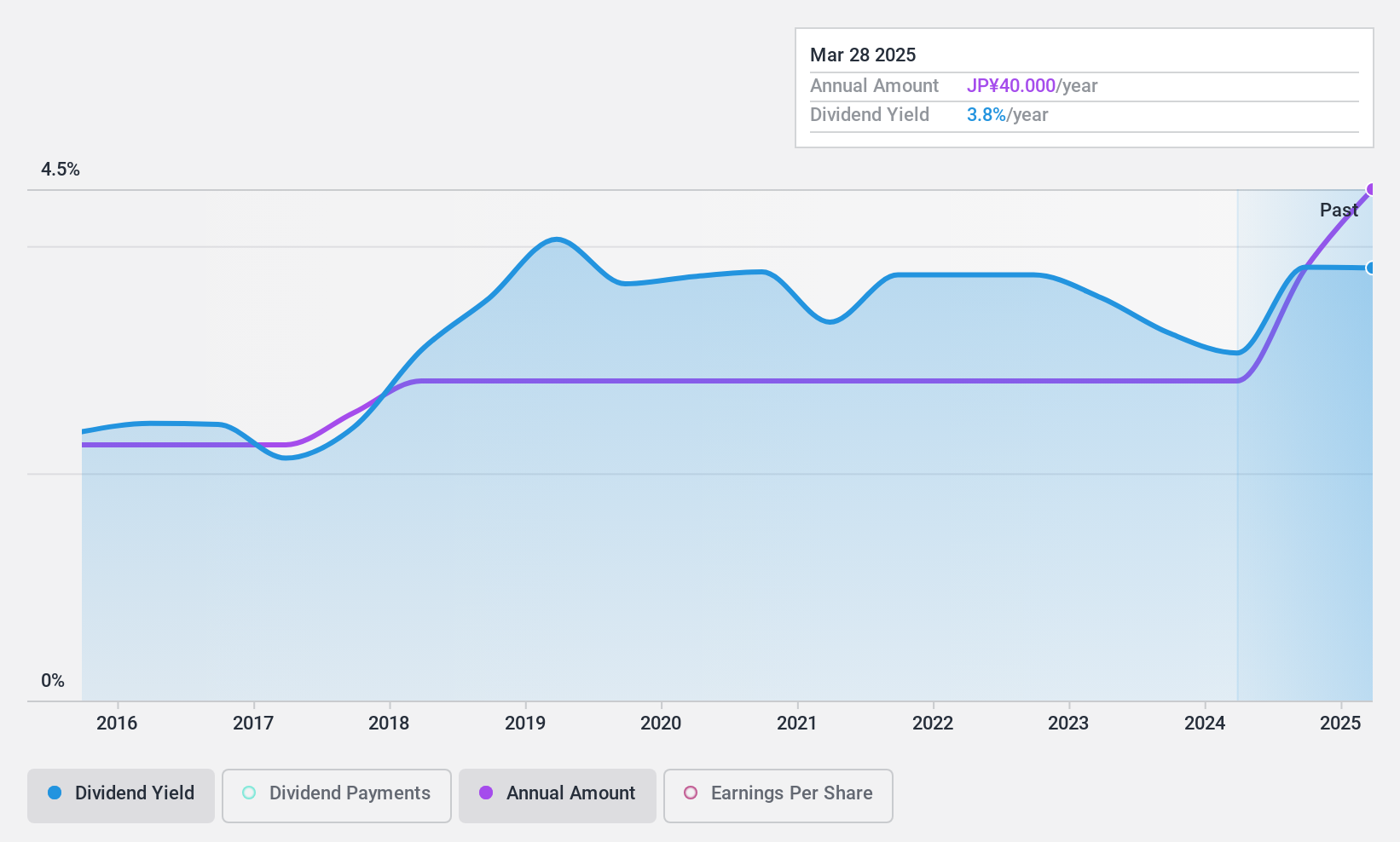

Kyodo Printing (TSE:7914)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Kyodo Printing Co., Ltd., along with its subsidiaries, operates in the printing industry in Japan and has a market capitalization of approximately ¥29.60 billion.

Operations: Kyodo Printing Co., Ltd.'s revenue is derived from its Information Security Division (¥31.07 billion), Information Communication Department (¥35.76 billion), and Life and Industrial Materials Division (¥32.56 billion).

Dividend Yield: 3.9%

Kyodo Printing's dividend profile is robust, with stable and growing dividends over the past decade. The dividend yield of 3.94% ranks in the top tier of Japan's market, supported by a sustainable payout ratio of 38% and cash flow coverage at 43.4%. Recent share buybacks totaling ¥866.83 million aim to enhance shareholder value further, following a program set to expire in May 2025. Earnings have consistently grown at 9.2% annually over five years, reinforcing financial stability for dividends.

- Navigate through the intricacies of Kyodo Printing with our comprehensive dividend report here.

- Our comprehensive valuation report raises the possibility that Kyodo Printing is priced higher than what may be justified by its financials.

Key Takeaways

- Get an in-depth perspective on all 2007 Top Dividend Stocks by using our screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:FOBANK

Føroya Banki

Provides personal and corporate banking services in the Faroe Islands and Greenland.

Good value with adequate balance sheet.

Market Insights

Community Narratives