- Germany

- /

- Other Utilities

- /

- DB:WWG

0.3% earnings growth over 3 years has not materialized into gains for Gelsenwasser (FRA:WWG) shareholders over that period

If you love investing in stocks you're bound to buy some losers. But long term Gelsenwasser AG (FRA:WWG) shareholders have had a particularly rough ride in the last three year. Sadly for them, the share price is down 65% in that time. And the ride hasn't got any smoother in recent times over the last year, with the price 26% lower in that time.

With the stock having lost 3.8% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

Our free stock report includes 1 warning sign investors should be aware of before investing in Gelsenwasser. Read for free now.In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the unfortunate three years of share price decline, Gelsenwasser actually saw its earnings per share (EPS) improve by 0.8% per year. This is quite a puzzle, and suggests there might be something temporarily buoying the share price. Or else the company was over-hyped in the past, and so its growth has disappointed.

After considering the numbers, we'd posit that the the market had higher expectations of EPS growth, three years back. But it's possible a look at other metrics will be enlightening.

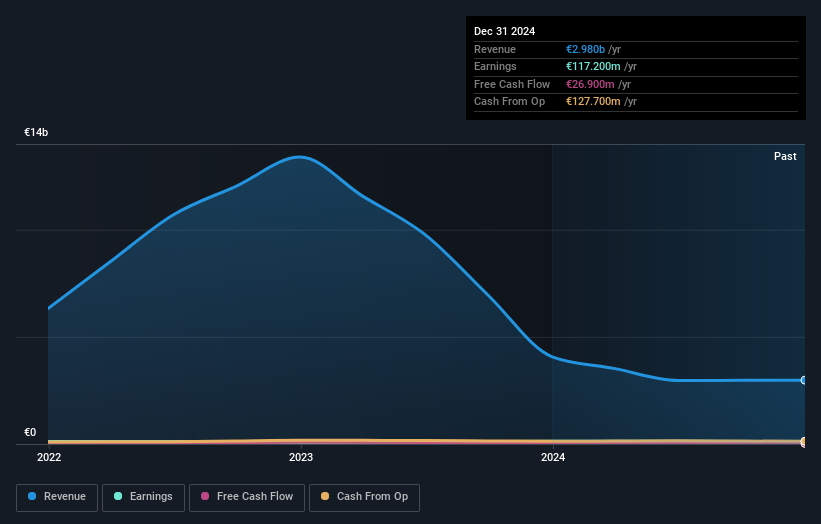

Given the healthiness of the dividend payments, we doubt that they've concerned the market. However, the weak share price might be related to the fact revenue has been disappearing at a rate of 38% each year, over three years. In that case, the current EPS might be viewed by some as difficult to sustain.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. This free interactive report on Gelsenwasser's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for Gelsenwasser the TSR over the last 3 years was -62%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

While the broader market gained around 9.7% in the last year, Gelsenwasser shareholders lost 23% (even including dividends). Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 9% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Gelsenwasser , and understanding them should be part of your investment process.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on German exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About DB:WWG

Gelsenwasser

Engages in the water, wastewater, gas supply, and electricity businesses in Germany, the Czech Republic, and Poland.

Mediocre balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives