- Germany

- /

- Renewable Energy

- /

- XTRA:RWE

RWE (XTRA:RWE): Assessing Valuation After a Strong Year-to-Date Share Price Rally

Reviewed by Simply Wall St

RWE (XTRA:RWE) has quietly turned into one of Europe’s stronger utility performers this year, with the stock up roughly 47% year to date and about 24% over the past 3 months.

See our latest analysis for RWE.

That surge in the share price this year looks less like a one off spike and more like momentum building, with investors warming to RWE’s renewables heavy shift and reassessing long term growth and risk.

If RWE’s run has you rethinking the utilities space, it might be a good moment to explore fast growing stocks with high insider ownership as a way to spot other under the radar opportunities.

With the shares already up sharply and trading only modestly below analyst targets, the real question now is whether RWE still offers upside from here or if the market has already priced in its future growth.

Most Popular Narrative Narrative: 9.5% Undervalued

With RWE last closing at €43.59 against a narrative fair value near €48, the story leans toward upside, hinging on renewables execution and financing.

Major policy tailwinds in core markets, including the U.K. retention of a single price zone, extension of CfD periods to 20 years, higher auction price caps, and the new U.S. "Big Beautiful Bill" with tax incentives, are expected to provide greater revenue visibility and de risk project cash flows, likely supporting higher recurring revenues and improved earnings quality over time.

Curious how steady but unspectacular growth, shifting profit margins, and a richer future earnings multiple can still justify a higher price tag for RWE? The narrative spells out the revenue runway, profit compression, and valuation reset that combine into this higher fair value, and the key assumptions might surprise you.

Result: Fair Value of $48.18 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weak wind conditions and tighter project financing could squeeze returns, disrupt RWE’s build out plans, and quickly challenge today’s upbeat valuation narrative.

Find out about the key risks to this RWE narrative.

Another View: Market Ratios Flash a Caution Signal

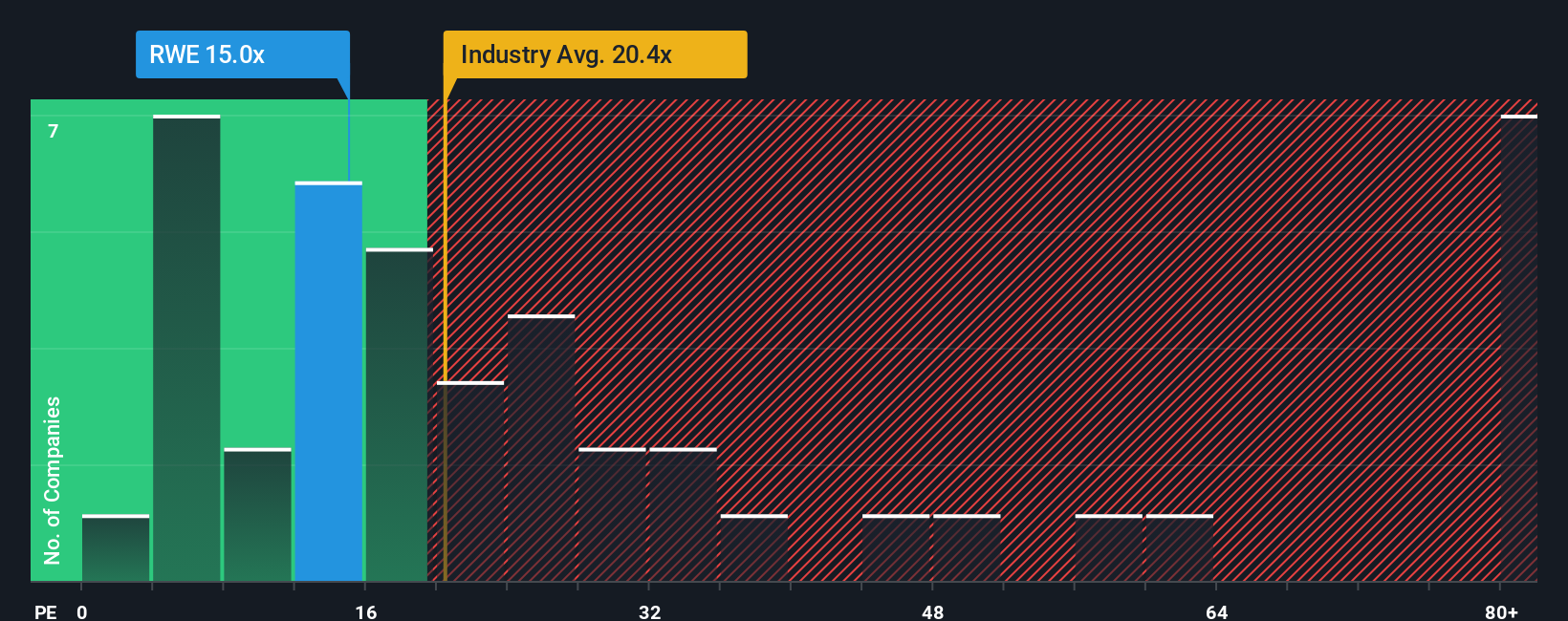

While the narrative fair value suggests RWE is about 9.5% undervalued, the market ratio lens is more cautious. RWE trades on 14.5x earnings, cheaper than the European renewables average of 19.8x and peers at 48.8x, yet still well above its own fair ratio of 9.1x.

That gap hints the share price could drift lower if sentiment cools or earnings disappoint, even if it still looks attractive versus sector benchmarks. Are investors being rewarded for that extra valuation risk, or paying up for a story that now needs flawless execution?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out RWE for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 907 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own RWE Narrative

If you see the story differently or prefer to dig into the numbers yourself, you can build a custom view in minutes: Do it your way.

A great starting point for your RWE research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing edge?

Do not stop at one strong idea. Use Simply Wall St screeners to uncover more opportunities that match your strategy and keep your portfolio moving forward.

- Capture potential multibaggers early by scanning these 3571 penny stocks with strong financials that already show real financial strength rather than pure speculation.

- Ride the next wave of innovation by targeting these 26 AI penny stocks at the forefront of automation, data, and intelligent software.

- Lock in mispriced opportunities by tracking these 907 undervalued stocks based on cash flows where market pessimism contrasts with solid cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:RWE

RWE

Generates and supplies electricity from renewable and conventional sources in Germany, the United Kingdom, rest of Europe, North America, and internationally.

Adequate balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026