As global markets navigate through geopolitical tensions and consumer spending concerns, investors are closely watching the impact of tariff news and economic data on major indices. Amidst this backdrop, dividend stocks continue to attract attention for their potential to provide steady income streams, making them a compelling consideration in times of market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Padma Oil (DSE:PADMAOIL) | 7.67% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.05% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.79% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.26% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.93% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.41% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.31% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.49% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.88% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.64% | ★★★★★★ |

Click here to see the full list of 2008 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

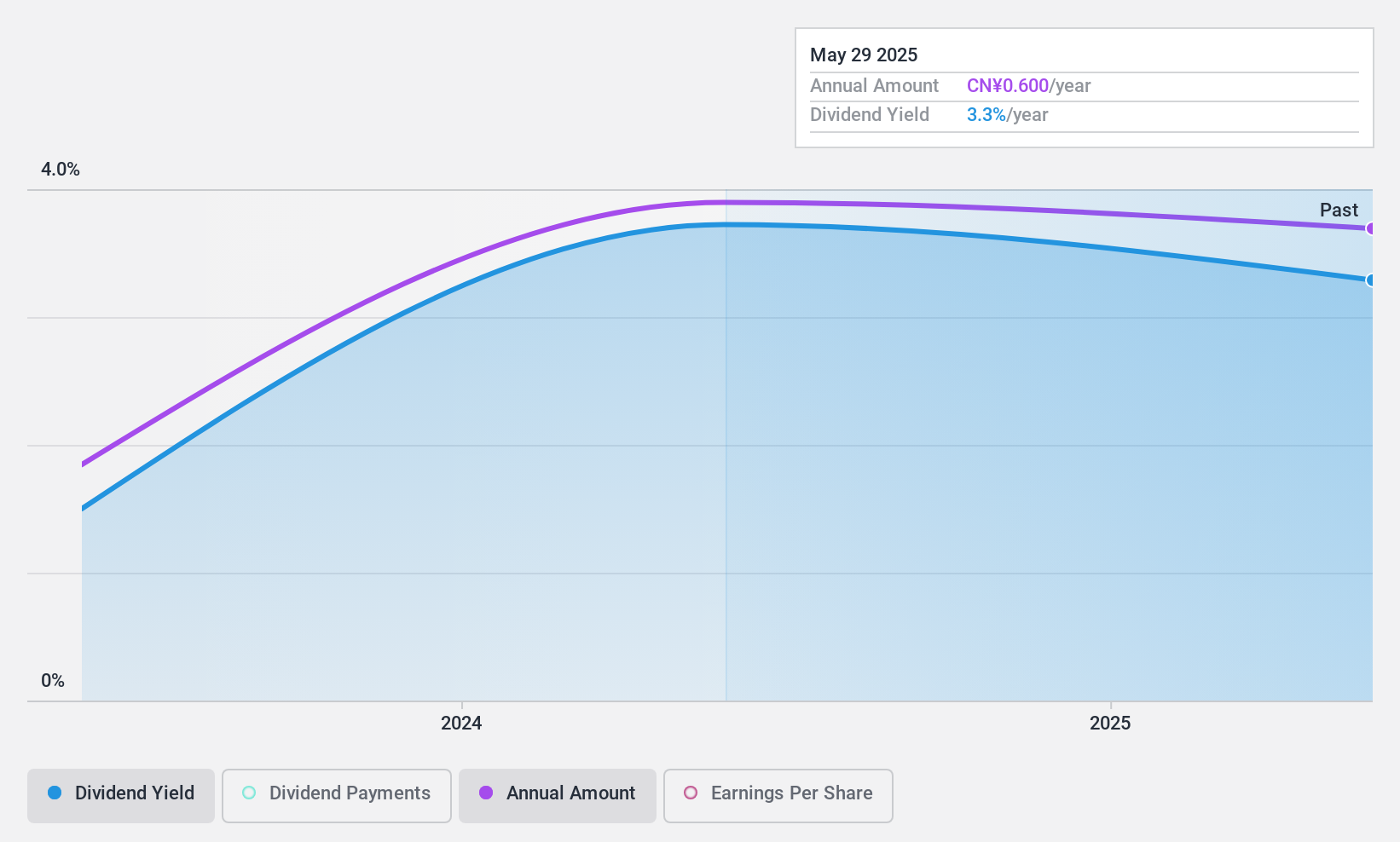

Beijing Jiaman DressLtd (SZSE:301276)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Beijing Jiaman Dress Co., Ltd. focuses on the R&D, design, production, and sale of children's clothing, apparel, and home textile products in China with a market cap of CN¥2.17 billion.

Operations: Beijing Jiaman Dress Co., Ltd. generates revenue through its operations in children's clothing, apparel, and home textile products within the Chinese market.

Dividend Yield: 3.8%

Beijing Jiaman Dress Ltd offers a compelling dividend profile, with its 3.79% yield ranking in the top 25% of CN market payers. Despite only two years of dividend history, payments have been stable and growing. The payout ratio of 52.4% ensures dividends are well-covered by earnings, while a cash payout ratio of 71.8% indicates sustainability from cash flows. Its P/E ratio of 13.8x suggests good value compared to the broader CN market average.

- Dive into the specifics of Beijing Jiaman DressLtd here with our thorough dividend report.

- Our valuation report unveils the possibility Beijing Jiaman DressLtd's shares may be trading at a discount.

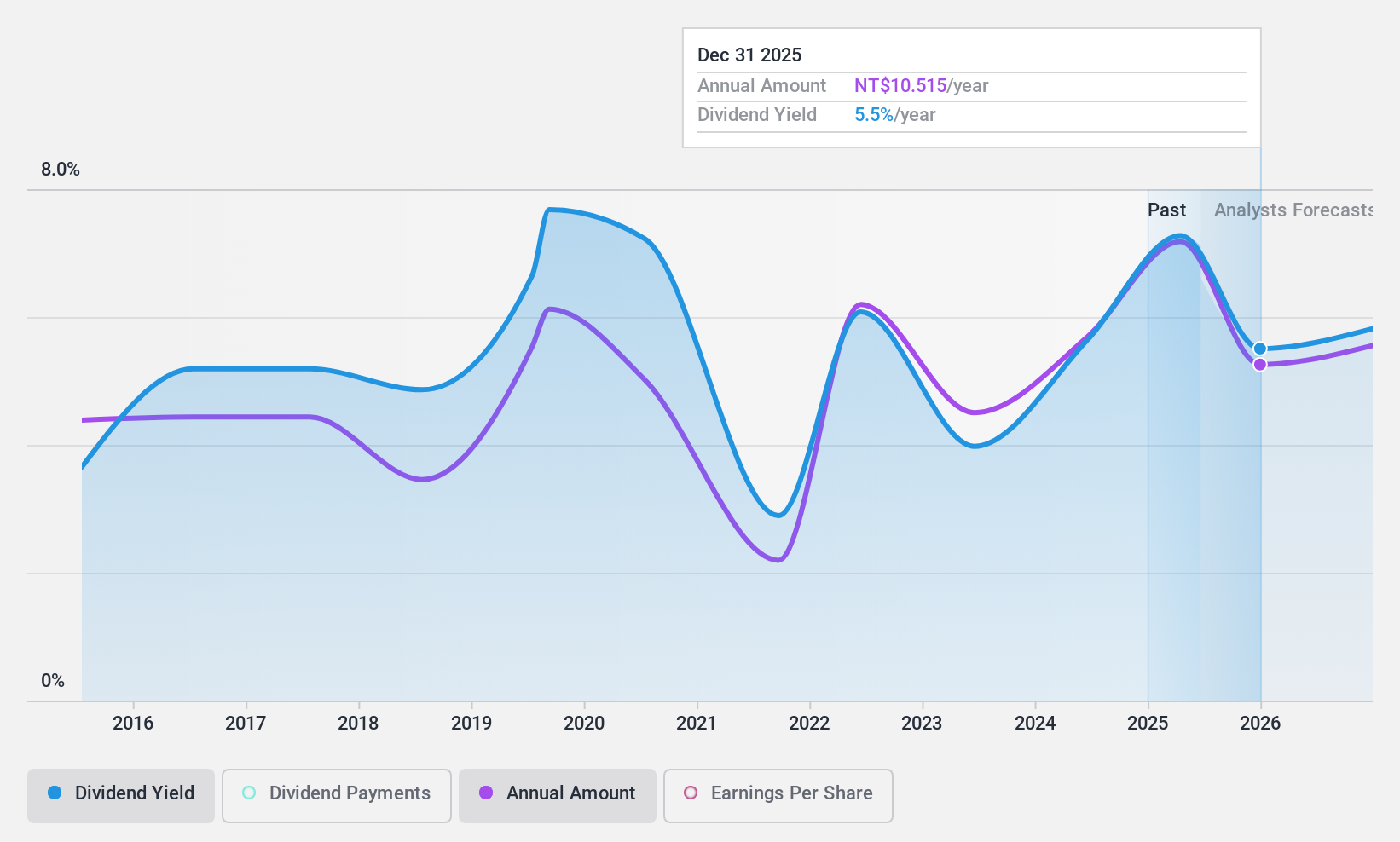

Formosa International Hotels (TWSE:2707)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Formosa International Hotels Corporation, along with its subsidiaries, operates tourist hotels in Taiwan and internationally, with a market cap of NT$25.03 billion.

Operations: Formosa International Hotels Corporation generates revenue through its Room Segment (NT$2.35 billion), Leasing Segment (NT$677.68 million), Catering Segment (NT$3.19 billion), and Technical Services and Management (NT$167.98 million).

Dividend Yield: 5.8%

Formosa International Hotels offers a dividend yield of 5.79%, placing it in the top 25% of TW market payers. While dividends have increased over the past decade, they are not well-covered by earnings, with a high payout ratio of 106.8%. However, a reasonable cash payout ratio of 66.9% supports sustainability from cash flows. Trading at 20.8% below estimated fair value suggests potential undervaluation, though dividend reliability has been volatile historically.

- Get an in-depth perspective on Formosa International Hotels' performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that Formosa International Hotels is priced lower than what may be justified by its financials.

Logwin (XTRA:TGHN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Logwin AG offers logistics and transport solutions across Germany, Austria, other European countries, Asia/Pacific, and internationally with a market cap of €679.49 million.

Operations: Logwin AG's revenue segments include Solutions with €275.78 million and Air + Ocean with €954.25 million.

Dividend Yield: 5.9%

Logwin's dividend yield of 5.93% ranks in the top 25% of German market payers, supported by a sustainable payout ratio of 57% from earnings and 59.4% from cash flows. Despite only seven years of dividend history, payments have been stable with minimal volatility. Recent guidance suggests revenue growth to EUR 1.3 billion–EUR 1.6 billion for 2024, though EBITA and net results are expected to decline compared to the previous year’s figures.

- Navigate through the intricacies of Logwin with our comprehensive dividend report here.

- Our expertly prepared valuation report Logwin implies its share price may be lower than expected.

Next Steps

- Dive into all 2008 of the Top Dividend Stocks we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:TGHN

Logwin

Provides logistics and transport solutions in Germany, Austria, other European countries, Asia/Pacific, and internationally.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026