Amid a backdrop of global economic uncertainty and mixed performance in major indices, Germany's DAX has experienced notable declines, reflecting broader market sentiment. Despite these challenges, opportunities remain for discerning investors who recognize the potential in under-the-radar small-cap stocks. In this article, we'll explore three hidden gems within Germany's market that demonstrate resilience and growth potential even in turbulent times.

Top 10 Undiscovered Gems With Strong Fundamentals In Germany

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mineralbrunnen Überkingen-Teinach GmbH KGaA | 19.44% | -1.40% | -8.94% | ★★★★★★ |

| EnviTec Biogas | 37.96% | 19.34% | 51.22% | ★★★★★★ |

| FRoSTA | 8.18% | 4.36% | 16.00% | ★★★★★★ |

| Südwestdeutsche Salzwerke | 0.66% | 4.03% | 11.36% | ★★★★★☆ |

| SIMONA | 17.90% | 10.89% | 9.64% | ★★★★★☆ |

| HOMAG Group | NA | -27.42% | 22.33% | ★★★★★☆ |

| Baader Bank | 91.28% | 12.42% | -8.00% | ★★★★★☆ |

| BAVARIA Industries Group | 3.19% | 0.18% | 28.18% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| BAUER | 78.29% | 2.30% | -38.28% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

HOMAG Group (DB:HG1)

Simply Wall St Value Rating: ★★★★★☆

Overview: HOMAG Group AG, along with its subsidiaries, manufactures and sells machines and solutions for the woodworking and timber construction industries worldwide, with a market cap of €580.46 million.

Operations: HOMAG Group generates revenue primarily from the sale of machines and solutions for woodworking and timber construction industries. The company's cost structure includes manufacturing expenses, R&D costs, and SG&A expenses. Gross profit margin is 23.45%.

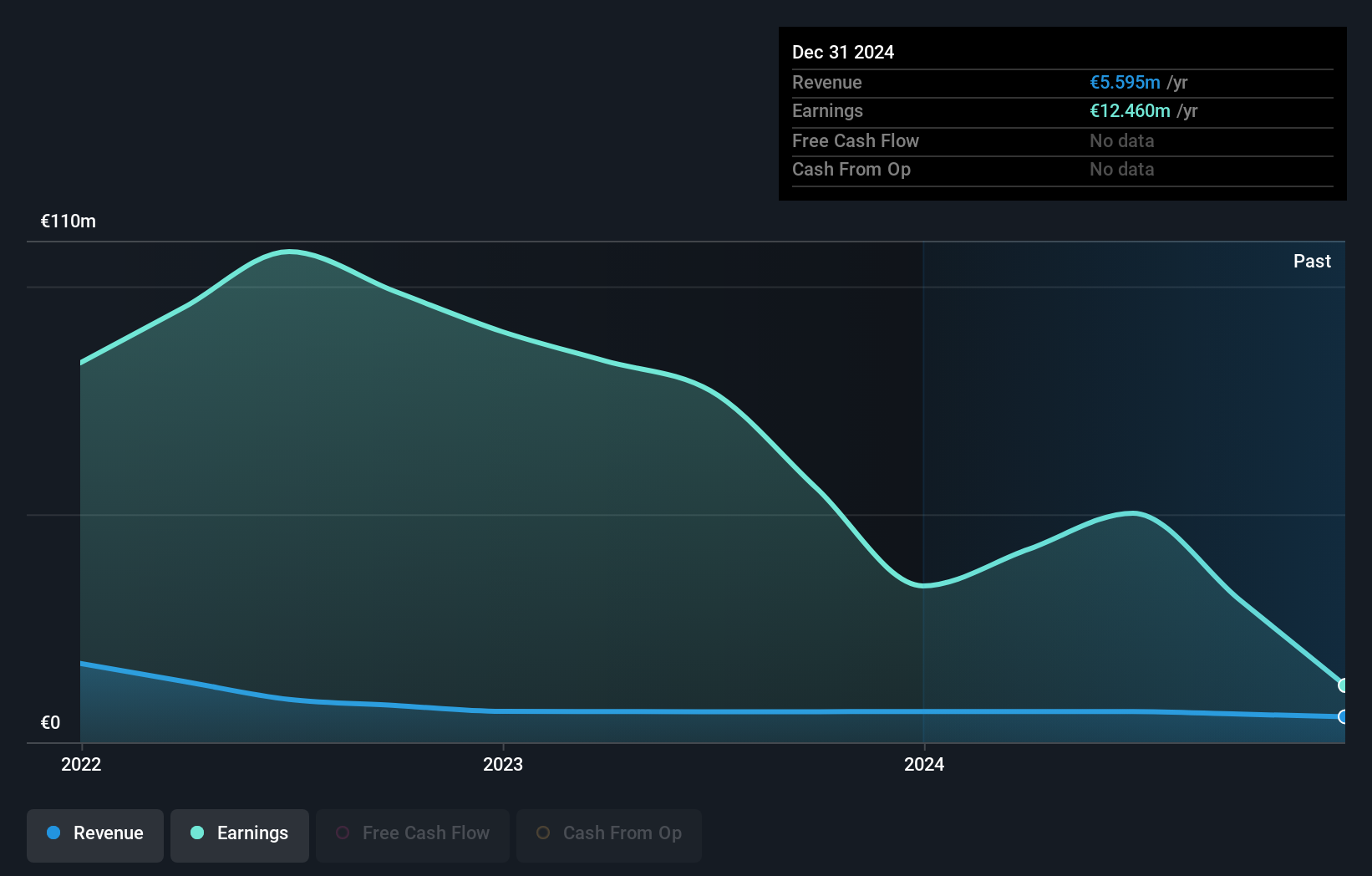

HOMAG Group, a notable player in the machinery sector, has faced challenges recently with earnings growth at -61.9%, significantly lagging behind the industry average of 5.6%. Despite this, HOMAG boasts high-quality past earnings and remains debt-free, which is a strong indicator of financial stability. The company repurchased shares last year, reflecting management's confidence in its long-term prospects. However, profit margins have dipped compared to the previous year, highlighting areas for potential improvement.

- Get an in-depth perspective on HOMAG Group's performance by reading our health report here.

Evaluate HOMAG Group's historical performance by accessing our past performance report.

EnviTec Biogas (XTRA:ETG)

Simply Wall St Value Rating: ★★★★★★

Overview: EnviTec Biogas AG manufactures and operates biogas and biomethane plants across multiple countries, including Germany, Italy, Great Britain, and the United States, with a market cap of €446.99 million.

Operations: EnviTec Biogas AG generates revenue primarily from three segments: Service (€48.58 million), Plant Engineering (€132.13 million), and Own Operation including Energy (€236.10 million). The company operates internationally across various countries, contributing to its diverse revenue streams.

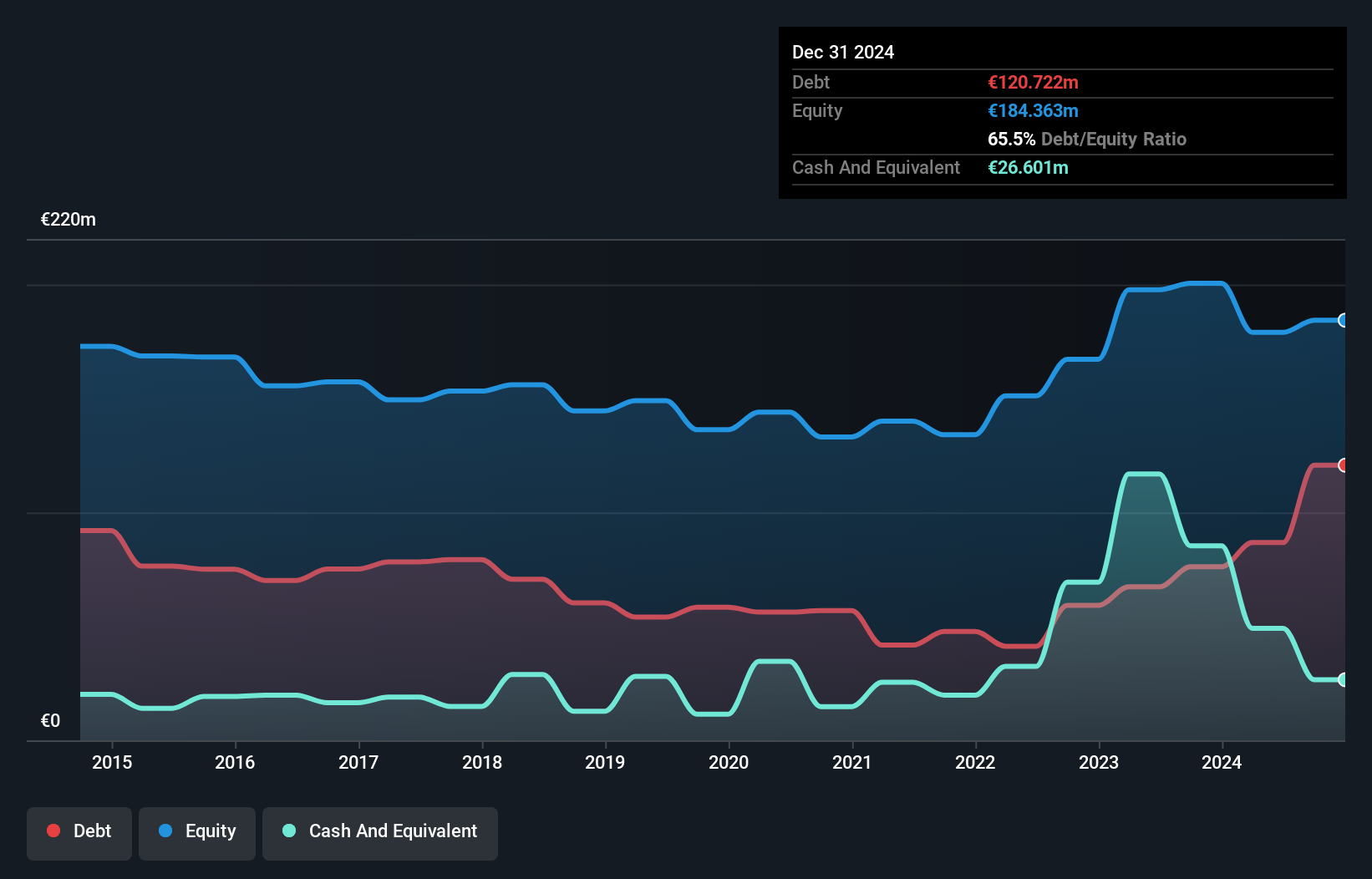

EnviTec Biogas, a small cap in Germany's renewable energy sector, reported impressive financials for 2023 with sales reaching €441.9 million and net income at €58.46 million. The company’s debt to equity ratio improved from 41.7% to 38% over five years, while its earnings grew by 27.6%, outpacing the Oil and Gas industry’s -24.9%. Additionally, EnviTec's interest payments are well covered by EBIT (419x), reflecting robust financial health and potential for continued growth in the biogas market.

- Click here to discover the nuances of EnviTec Biogas with our detailed analytical health report.

Review our historical performance report to gain insights into EnviTec Biogas''s past performance.

Logwin (XTRA:TGHN)

Simply Wall St Value Rating: ★★★★★★

Overview: Logwin AG offers logistics and transport solutions across Germany, Austria, other European countries, the Asia/Pacific region, and internationally, with a market cap of €760.11 million.

Operations: Logwin AG generates revenue primarily from its Air + Ocean segment (€954.25 million) and Solutions segment (€275.78 million). The company has a market cap of €760.11 million.

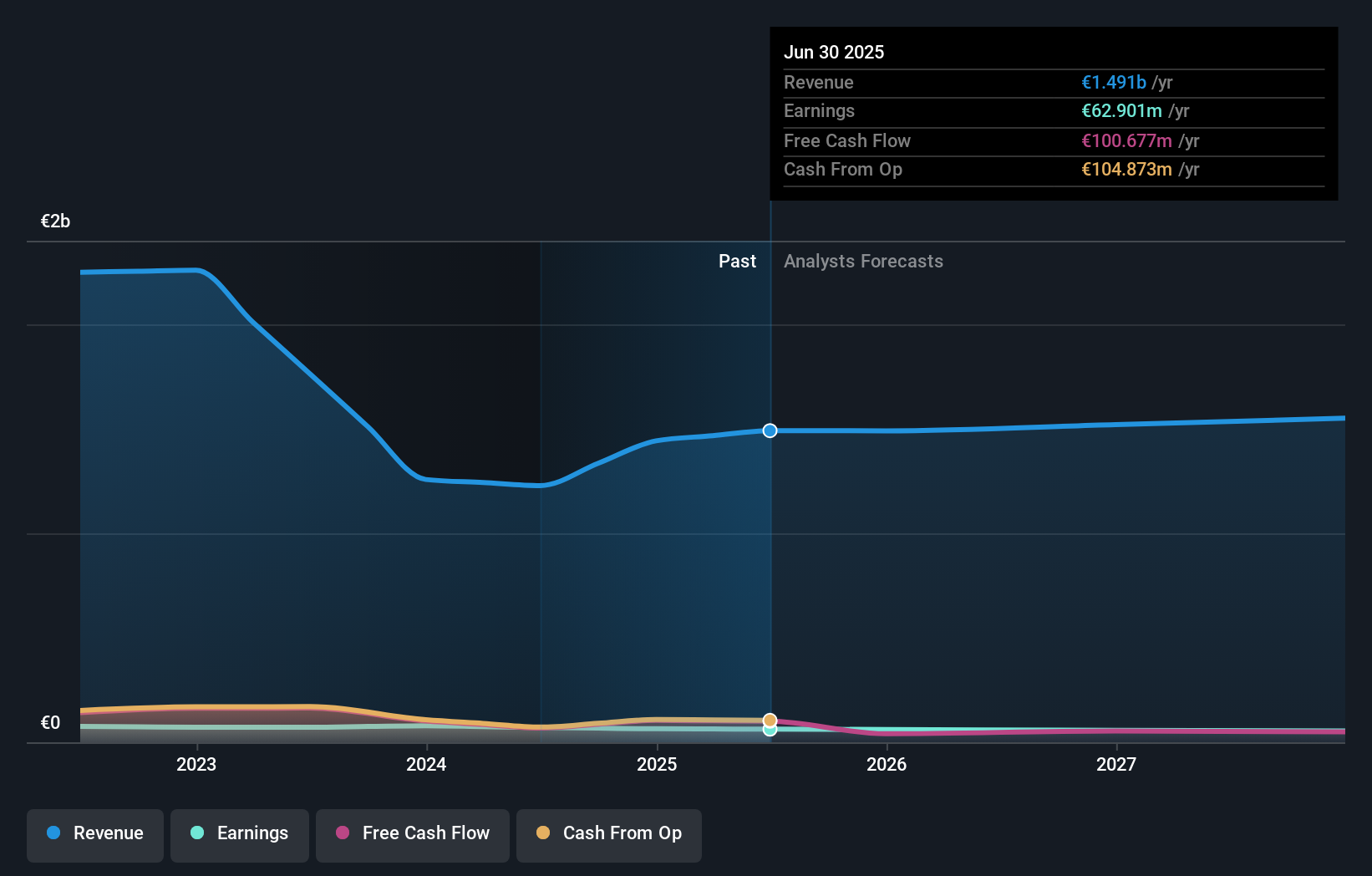

Logwin, a small cap logistics company, recently announced half-year earnings with sales of €643.5 million and net income at €31.86 million, compared to €672.97 million and €40.49 million respectively from the previous year. Basic earnings per share dropped to €11.07 from €14.06 last year. Despite these figures, Logwin trades at 28% below its estimated fair value and has reduced its debt-to-equity ratio from 0.04% to 0.03% over the past five years while maintaining more cash than total debt.

- Take a closer look at Logwin's potential here in our health report.

Gain insights into Logwin's historical performance by reviewing our past performance report.

Taking Advantage

- Take a closer look at our German Undiscovered Gems With Strong Fundamentals list of 40 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:TGHN

Logwin

Provides logistics and transport solutions in Germany, Austria, other European countries, Asia/Pacific, and internationally.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026